Answered step by step

Verified Expert Solution

Question

1 Approved Answer

****PLEASE ANSWER THE QUESTION BRIEFLY, THANK YOU ! Question 3 Bakul Holdings has decided to invest in a project in Spain. Considering that RM8 millions

****PLEASE ANSWER THE QUESTION BRIEFLY, THANK YOU !

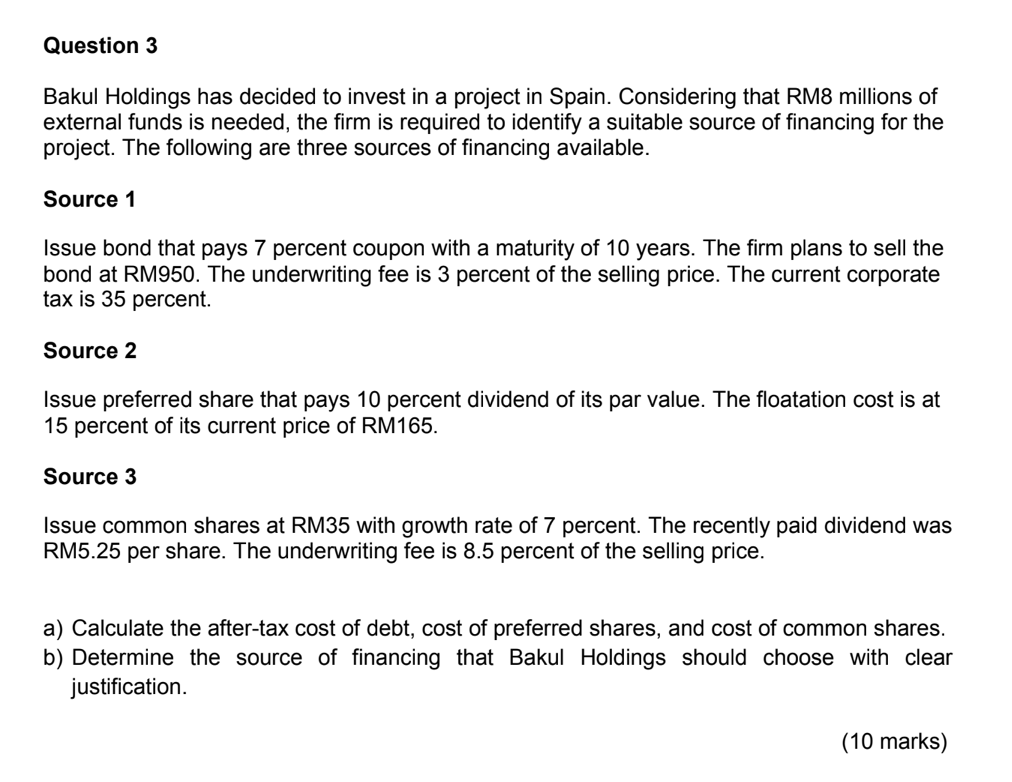

Question 3 Bakul Holdings has decided to invest in a project in Spain. Considering that RM8 millions of external funds is needed, the firm is required to identify a suitable source of financing for the project. The following are three sources of financing available. Source 1 Issue bond that pays 7 percent coupon with a maturity of 10 years. The firm plans to sell the bond at RM950. The underwriting fee is 3 percent of the selling price. The current corporate tax is 35 percent. Source 2 Issue preferred share that pays 10 percent dividend of its par value. The floatation cost is at 15 percent of its current price of RM165. Source 3 Issue common shares at RM35 with growth rate of 7 percent. The recently paid dividend was RM5.25 per share. The underwriting fee is 8.5 percent of the selling price. a) Calculate the after-tax cost of debt, cost of preferred shares, and cost of common shares. b) Determine the source of financing that Bakul Holdings should choose with clear justification. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started