Please answer the question completely, (5 questions) , thank you

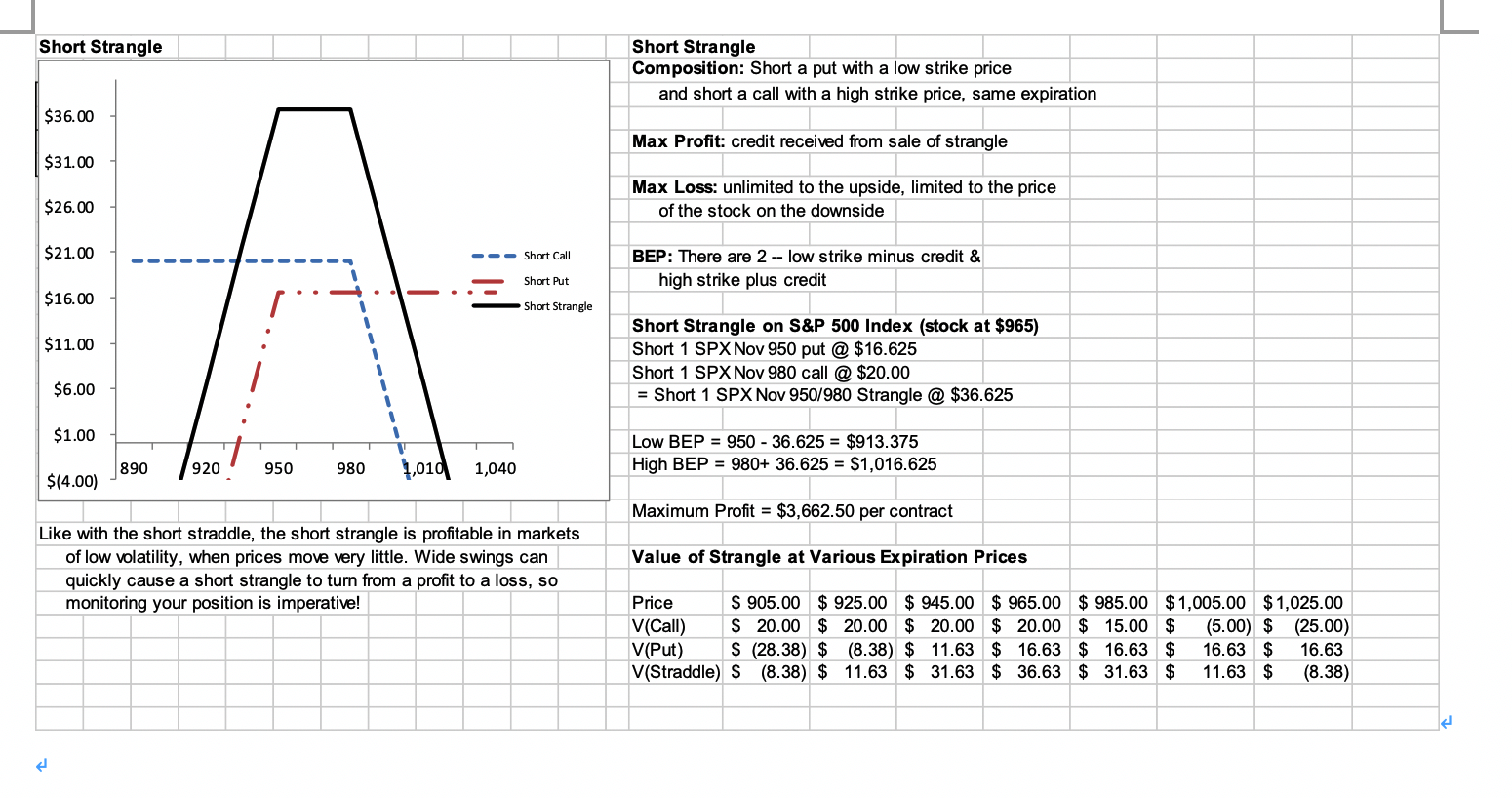

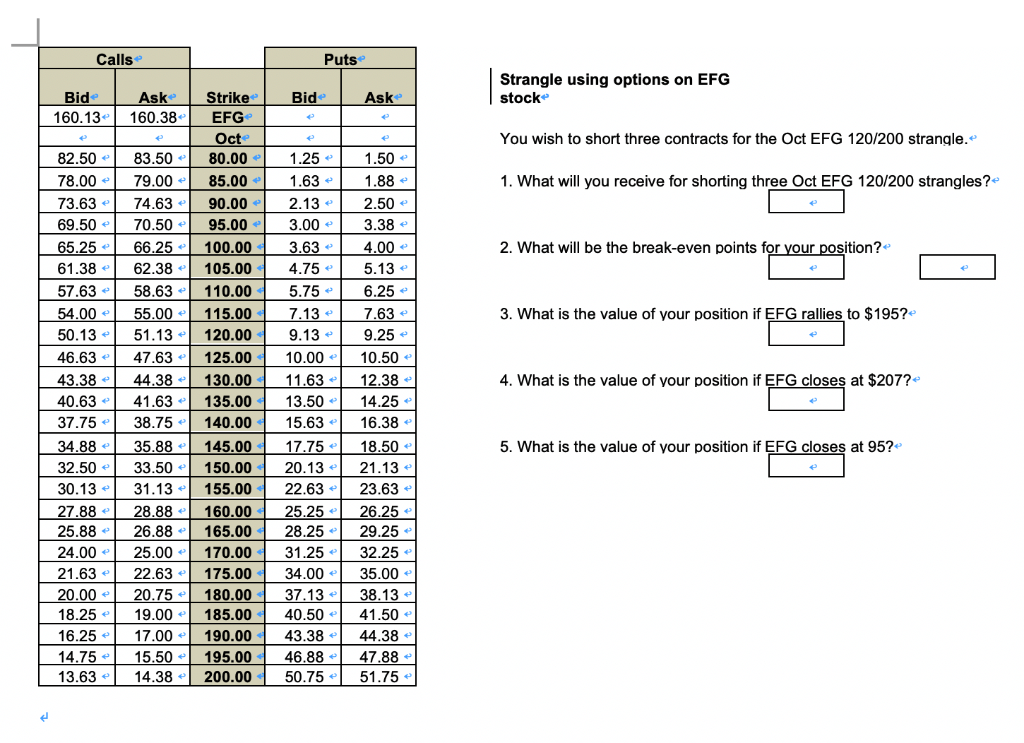

Short Strangle Short Strangle Composition: Short a put with a low strike price and short a call with a high strike price, same expiration $36.00 Max Profit: credit received from sale of strangle $31.00 $26.00 Max Loss: unlimited to the upside, limited to the price of the stock on the downside $21.00 Short Call BEP: There are 2 -- low strike minus credit & high strike plus credit .. - ..- Short Put $16.00 Short Strangle $11.00 Short Strangle on S&P 500 Index (stock at $965) Short 1 SPX Nov 950 put @ $16.625 Short 1 SPX Nov 980 call @ $20.00 = Short 1 SPX Nov 950/980 Strangle @ $36.625 $6.00 $1.00 LOW BEP = 950 - 36.625 = $913.375 High BEP = 980+ 36.625 = $1,016.625 $(4.00) 189 890 9 20' 950 980 1,010 1,040 Maximum Profit = $3,662.50 per contract Value of Strangle at Various Expiration Prices Like with the short straddle, the short strangle is profitable in markets of low volatility, when prices move very little. Wide swings can quickly cause a short strangle to turn from a profit to a loss, so monitoring your position is imperative! Price $ 905.00 $ 925.00 $ 945.00 $ 965.00 $ 985.00 $1,005.00 $1,025.00 V(Call) $ 20.00 $ 20.00 $ 20.00 $ 20.00 $ 15.00 $ (5.00) $ (25.00) V(Put) $ (28.38) $ (8.38) $ 11.63 $ 16.63 $ 16.63 $ 16.63 $ 16.63 V(Straddle) $ (8.38) $ 11.63 $ 31.63 $ 36.63 $ 31.63 $ 11.63 $ (8.38) Calls Puts Strangle using options on EFG stock Bide Ask Bid 160.13 Aske 160.38 You wish to short three contracts for the Oct EFG 120/200 strangle. 1. What will you receive for shorting three Oct EFG 120/200 strangles? 2. What will be the break-even points for your position? 3. What is the value of your position if EFG rallies to $195? Strike EFG Oct 80.00 85.00 90.00 95.00 100.00 105.00 110.00 115.00 120.00 125.00 130.00 135.00 140.00 145.00 150.00 155.00 160.00 165.00 170.00 175.00 180.00 185.00 190.00 195.00 200.00 82.50 83.50 78.00 79.00 73.63 74.63 - 69.50 70.50 65.25 | 66.25 61.38 | 62.38 57.63 58.63 54.00 55.00 50.13 51.13 - 46.63 47.63 43.38 | 44.38 - 40.63 41.63 37.75 38.75 - 34.88 35.88 32.50 33.50 30.13 - 31.13 27.88 1 28.88 25.88 26.88 24.00 25.00 21.63 | 22.63 20.00 - 20.75 - 18.25 | 19.00 16.25 17.00 - 14.75 | 15.50 - 13.63 14.38 - 4. What is the value of your position if EFG closes at $207? 1.25 1.50 1.631 1.88 2.13 | 2.50 3.00 3.38 3.63 | 4.00 4.75 - 5.13 5.75 6 .25 7.13 7.63 e 9.13 9.25 10.00 10.50 11.63 12.38 13.50 14.25 15.63 16.38 17.75 18.50 20.13 21.13 | 22.63 23.63 25.25 | 26.25 28.25 29.25 31.25 32.25 34.00 35.00 37.13 - 38.13 - 40.50 41.50 43.38 44.38 46.88 47.88 - 50.75 51.75 5. What is the value of your position if EFG closes at 95? Short Strangle Short Strangle Composition: Short a put with a low strike price and short a call with a high strike price, same expiration $36.00 Max Profit: credit received from sale of strangle $31.00 $26.00 Max Loss: unlimited to the upside, limited to the price of the stock on the downside $21.00 Short Call BEP: There are 2 -- low strike minus credit & high strike plus credit .. - ..- Short Put $16.00 Short Strangle $11.00 Short Strangle on S&P 500 Index (stock at $965) Short 1 SPX Nov 950 put @ $16.625 Short 1 SPX Nov 980 call @ $20.00 = Short 1 SPX Nov 950/980 Strangle @ $36.625 $6.00 $1.00 LOW BEP = 950 - 36.625 = $913.375 High BEP = 980+ 36.625 = $1,016.625 $(4.00) 189 890 9 20' 950 980 1,010 1,040 Maximum Profit = $3,662.50 per contract Value of Strangle at Various Expiration Prices Like with the short straddle, the short strangle is profitable in markets of low volatility, when prices move very little. Wide swings can quickly cause a short strangle to turn from a profit to a loss, so monitoring your position is imperative! Price $ 905.00 $ 925.00 $ 945.00 $ 965.00 $ 985.00 $1,005.00 $1,025.00 V(Call) $ 20.00 $ 20.00 $ 20.00 $ 20.00 $ 15.00 $ (5.00) $ (25.00) V(Put) $ (28.38) $ (8.38) $ 11.63 $ 16.63 $ 16.63 $ 16.63 $ 16.63 V(Straddle) $ (8.38) $ 11.63 $ 31.63 $ 36.63 $ 31.63 $ 11.63 $ (8.38) Calls Puts Strangle using options on EFG stock Bide Ask Bid 160.13 Aske 160.38 You wish to short three contracts for the Oct EFG 120/200 strangle. 1. What will you receive for shorting three Oct EFG 120/200 strangles? 2. What will be the break-even points for your position? 3. What is the value of your position if EFG rallies to $195? Strike EFG Oct 80.00 85.00 90.00 95.00 100.00 105.00 110.00 115.00 120.00 125.00 130.00 135.00 140.00 145.00 150.00 155.00 160.00 165.00 170.00 175.00 180.00 185.00 190.00 195.00 200.00 82.50 83.50 78.00 79.00 73.63 74.63 - 69.50 70.50 65.25 | 66.25 61.38 | 62.38 57.63 58.63 54.00 55.00 50.13 51.13 - 46.63 47.63 43.38 | 44.38 - 40.63 41.63 37.75 38.75 - 34.88 35.88 32.50 33.50 30.13 - 31.13 27.88 1 28.88 25.88 26.88 24.00 25.00 21.63 | 22.63 20.00 - 20.75 - 18.25 | 19.00 16.25 17.00 - 14.75 | 15.50 - 13.63 14.38 - 4. What is the value of your position if EFG closes at $207? 1.25 1.50 1.631 1.88 2.13 | 2.50 3.00 3.38 3.63 | 4.00 4.75 - 5.13 5.75 6 .25 7.13 7.63 e 9.13 9.25 10.00 10.50 11.63 12.38 13.50 14.25 15.63 16.38 17.75 18.50 20.13 21.13 | 22.63 23.63 25.25 | 26.25 28.25 29.25 31.25 32.25 34.00 35.00 37.13 - 38.13 - 40.50 41.50 43.38 44.38 46.88 47.88 - 50.75 51.75 5. What is the value of your position if EFG closes at 95