Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question in the picture above... I am uploading this for the second time... Please please show all calculations... It's for 20 marks...

Please answer the question in the picture above... I am uploading this for the second time... Please please show all calculations... It's for 20 marks... This is my last question for the month please.

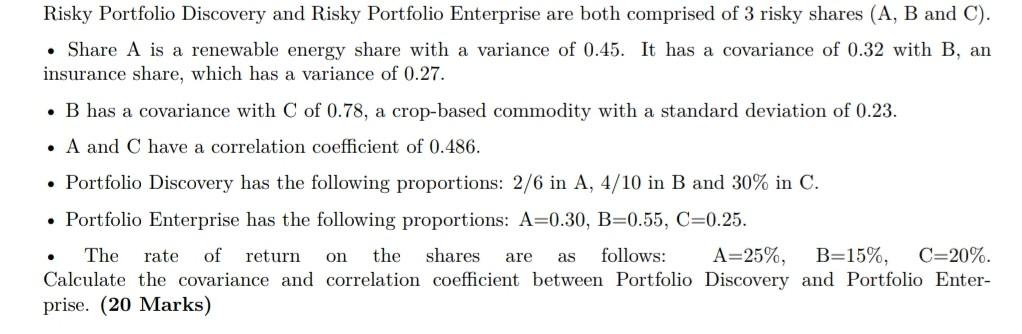

Risky Portfolio Discovery and Risky Portfolio Enterprise are both comprised of 3 risky shares (A, B and C). Share A is a renewable energy share with a variance of 0.45. It has a covariance of 0.32 with B, an insurance share, which has a variance of 0.27. B has a covariance with C of 0.78, a crop-based commodity with a standard deviation of 0.23. A and C have a correlation coefficient of 0.486. Portfolio Discovery has the following proportions: 2/6 in A, 4/10 in B and 30% in C. Portfolio Enterprise has the following proportions: A=0.30, B=0.55, C=0.25. on are as The rate of return the shares follows: A=25%, B=15%, C=20%. Calculate the covariance and correlation coefficient between Portfolio Discovery and Portfolio Enter- prise. (20 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started