Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the question in the same format its shown... Part 1 and part 2... After completing her first year of operations, Penny Cassidy used

Please answer the question in the same format its shown... Part 1 and part 2...

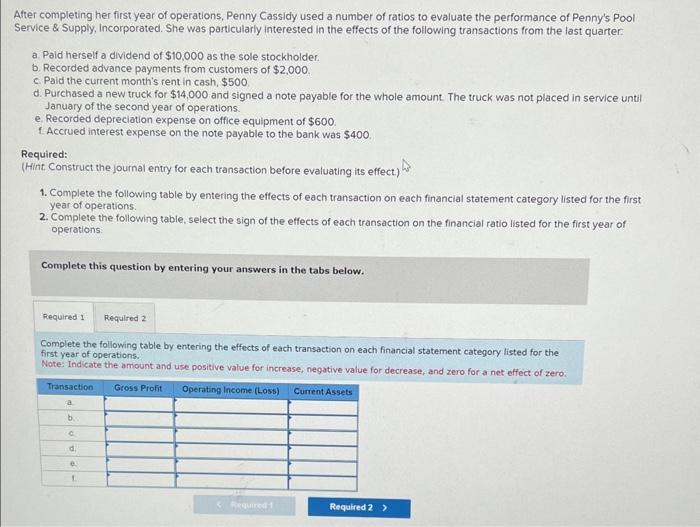

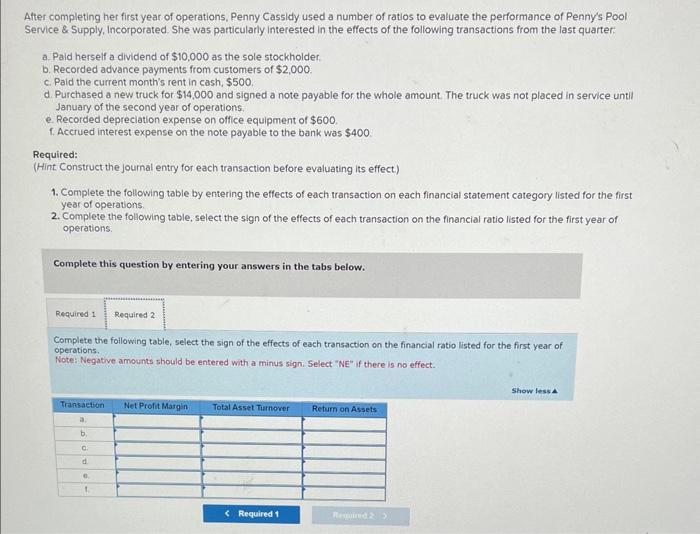

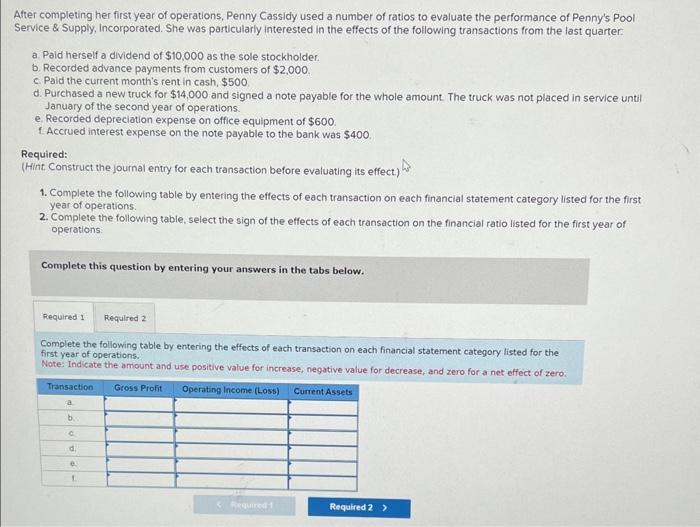

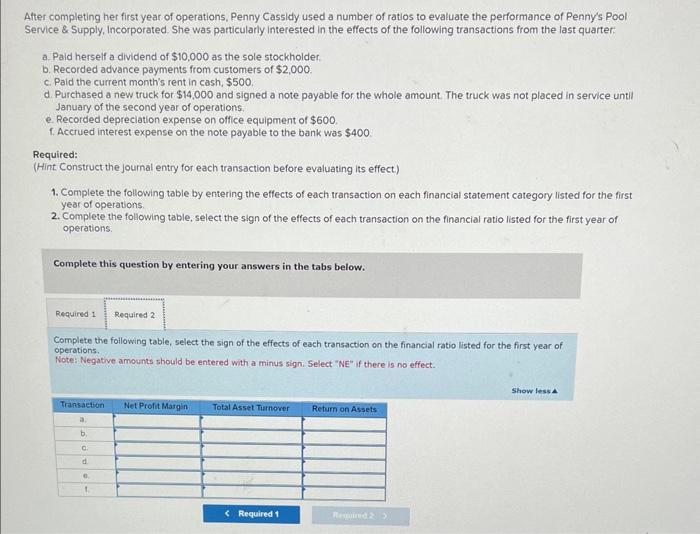

After completing her first year of operations, Penny Cassidy used a number of ratios to evaluate the performance of Penny's Pool Service \& Supply, Incorporated. She was particularly interested in the effects of the following transactions from the last quarter: a. Paid herself a dividend of $10,000 as the sole stockholder. b. Recorded advance payments from customers of $2,000. c. Paid the current month's rent in cash, $500. d. Purchased a new truck for $14,000 and signed a note payable for the whole amount. The truck was not placed in service until January of the second year of operations. e. Recorded depreciation expense on office equipment of $600. f. Accrued interest expense on the note payable to the bank was $400. Required: (Hint Construct the journal entry for each transaction before evaluating its effect.) 1. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. 2. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations: Complete this question by entering your answers in the tabs below. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. Note: Indicate the amount and use positive value for increase, negative value for decrease, and zero for a net effect of zero. After completing her first year of operations, Penny Cassidy used a number of ratios to evaluate the performance of Penny's Pool Service \& Supply, incorporated. She was particularly interested in the effects of the following transactions from the last quarter: a. Paid herself a dividend of $10,000 as the sole stockholder. b. Recorded advance payments from customers of $2,000. c. Paid the current month's rent in cash, $500. d. Purchased a new truck for $14,000 and signed a note payable for the whole amount. The truck was not placed in service until January of the second year of operations. e. Recorded depreciation expense on office equipment of $600. f. Accrued interest expense on the note payable to the bank was $400. Required: (Hint Construct the journal entry for each transaction before evaluating its effect) 1. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. 2. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations. Complete this question by entering your answers in the tabs below. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations. Note: Negative amounts should be entered with a minus sign. Select "NE" if there is no effect. After completing her first year of operations, Penny Cassidy used a number of ratios to evaluate the performance of Penny's Pool Service \& Supply, Incorporated. She was particularly interested in the effects of the following transactions from the last quarter: a. Paid herself a dividend of $10,000 as the sole stockholder. b. Recorded advance payments from customers of $2,000. c. Paid the current month's rent in cash, $500. d. Purchased a new truck for $14,000 and signed a note payable for the whole amount. The truck was not placed in service until January of the second year of operations. e. Recorded depreciation expense on office equipment of $600. f. Accrued interest expense on the note payable to the bank was $400. Required: (Hint Construct the journal entry for each transaction before evaluating its effect.) 1. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. 2. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations: Complete this question by entering your answers in the tabs below. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. Note: Indicate the amount and use positive value for increase, negative value for decrease, and zero for a net effect of zero. After completing her first year of operations, Penny Cassidy used a number of ratios to evaluate the performance of Penny's Pool Service \& Supply, incorporated. She was particularly interested in the effects of the following transactions from the last quarter: a. Paid herself a dividend of $10,000 as the sole stockholder. b. Recorded advance payments from customers of $2,000. c. Paid the current month's rent in cash, $500. d. Purchased a new truck for $14,000 and signed a note payable for the whole amount. The truck was not placed in service until January of the second year of operations. e. Recorded depreciation expense on office equipment of $600. f. Accrued interest expense on the note payable to the bank was $400. Required: (Hint Construct the journal entry for each transaction before evaluating its effect) 1. Complete the following table by entering the effects of each transaction on each financial statement category listed for the first year of operations. 2. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations. Complete this question by entering your answers in the tabs below. Complete the following table, select the sign of the effects of each transaction on the financial ratio listed for the first year of operations. Note: Negative amounts should be entered with a minus sign. Select "NE" if there is no effect

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started