please answer the question is the picture at the bottom

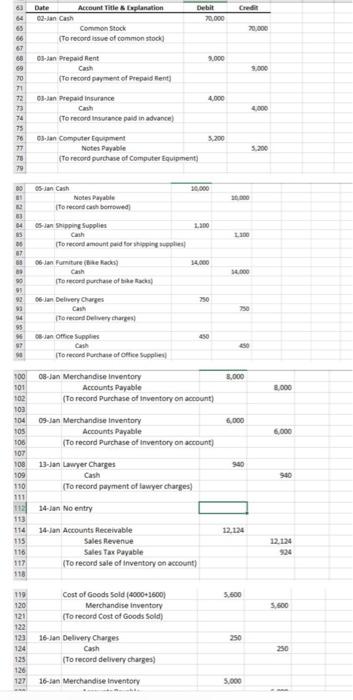

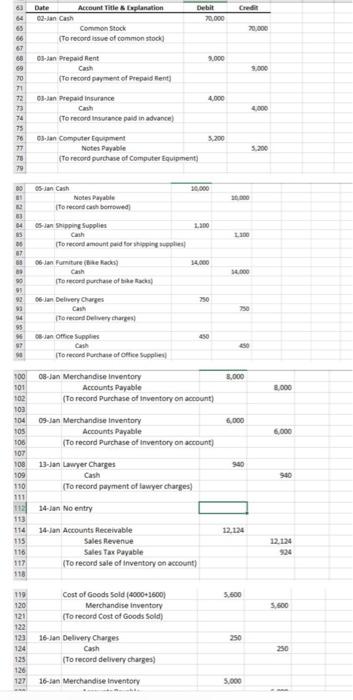

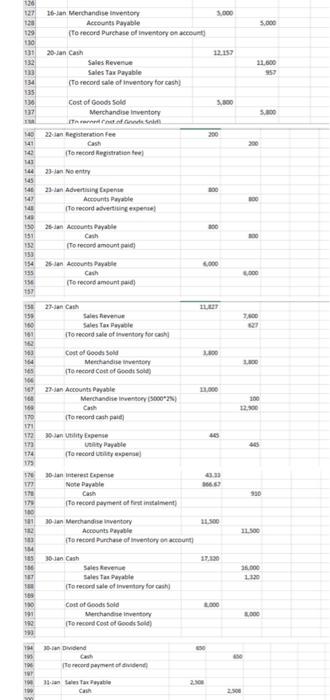

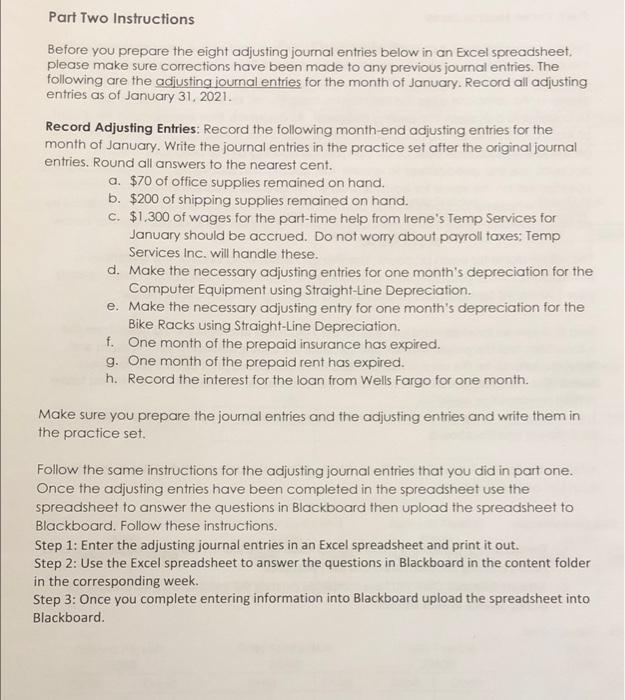

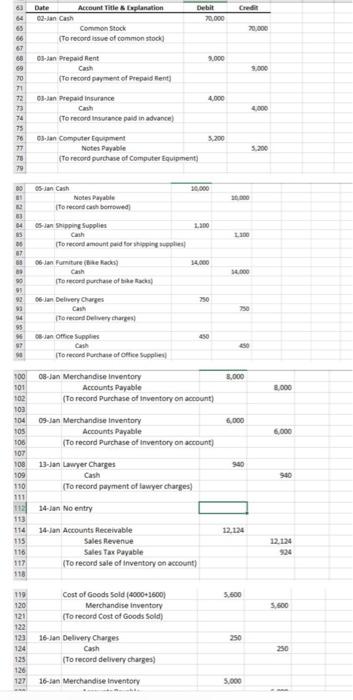

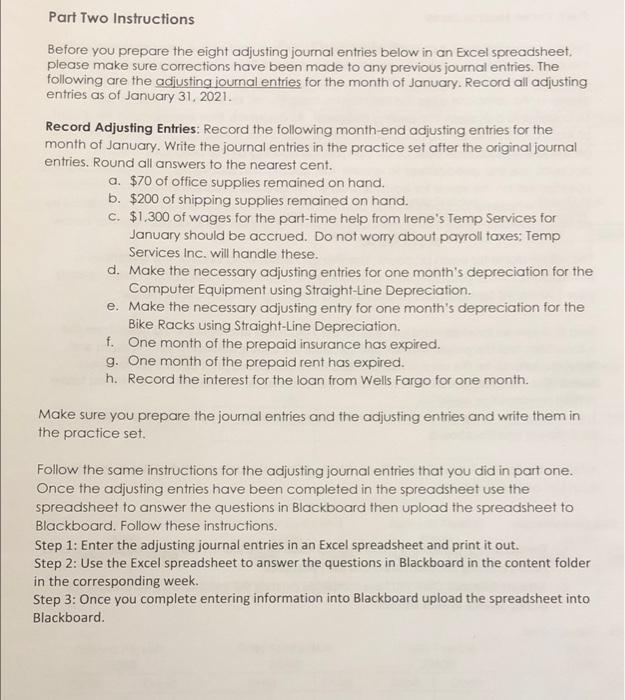

Credit Debit 70.000 Date Account Title & Laplanation 02-Jan Cash Common Stock To record issue of common stock 65 86 20,000 9.00 03-an Prepaid Rent Cash To record payment of Prepaid fent 69 70 9.00 4.000 72 03-Jan Prepaid Insurance 73 Cash 74 To record Instance paid in advance) 75 76 03-an Computer Equipment 77 Notes Payable To record purchase of Computer Equipment 79 5.200 5.200 30.000 0006 lan Cash 11 Notes Payable To record cachorrowed) 33 14 s-lan Shipping Supplies 2.300 L300 14.000 14.000 05 To record amount paid for shippie 07 06 Jan Furniture idea Cash To record purchase of his 926 Jan Delivery Charges Cam Torecard Delivery charges 95 08 Jan Office Supplies Cash To record Purchase of Office Supplies 750 450 so 3,000 3.000 08-Jan Merchandise Inventory Accounts Payable (To record Purchase of Inventory on account) 09 Jan Merchandise Inventory Accounts Payable To record Purchase of inventory on account) 6,000 6.000 940 100 101 102 109 104 105 106 107 108 109 110 111 114 113 114 115 116 117 510 940 13-Jan Lawyer Charges Cash (To record payment of lawyer charges) 14-an No entry 12.124 12.124 14-Jan Accounts Receivable Sales Revenue Sales Tax Payable (To record sale of Inventory on account) 5.600 Cost of Goods Sold (40001600) Merchandise inventory (To record Cost of Goods Sold) 5.600 119 120 121 122 123 124 125 126 127 250 16-Jan Delivery Charges Cash (To record delivery charges) 230 16-an Merchandise Inventory 5.000 5.000 11.500 950 3.00 300 00 100 00 120 127 16-an Merchandise inventory 5.000 120 Accounts Payable 129 To record Purchase of Inventory on account 110 131 20-an Cash 132 Sales Revenue 133 Sales Tax Payable 134 (To record sale of Inventory for cash 135 136 Cost of Goods Sold 5.00 137 Merchandise Inventory TACOS 140 22-Jan Registration Fee 200 141 Cash 143 To record Registration 144 23-ian Not 145 46 23-dan Advertising pense Accounts Payable 140 To record dvertising 140 150 26-an Accounts Payable 300 Cash 12 To record amount 153 154 26 an Accounts Payable 6.000 155 Cash 156 (To record amount 157 156 27-an Cath 155 Sales Revenue 100 Sales Towel 161 to record sale of triventory for cash 100 Cost of Goods 164 Merchandise To record Cost of Goods 104 1027-Jan Accounts Payable 100 16 Merchandiser N Cash 170 to record cash 171 172 3-Jan Ulty Expense 172 ity Payable 134 (Te record typer 175 5700-an terpente Note Payable Casa 17 To record payment of trendement) 100 10 Jan Merchandise entry 11.500 12 Accounts Payable To record Purchase of Inventory on account 14 18 Jan Cash 12.10 Sales Revenue Sales Tax Payable To record sale of inventory for 16 100 Cost of Goods Sold .600 191 Merchandise 192 Torced cost of Goods Sold 193 7,800 , EE E, 12.900 930 11.500 3.000 1120 3.000 794 Dividend 3 TO Tu record payment of 3 Sexy Car 10 2.300 Part Two Instructions Before you prepare the eight adjusting journal entries below in an Excel spreadsheet. please make sure corrections have been made to any previous journal entries. The following are the adjusting journal entries for the month of January. Record all adjusting entries as of January 31, 2021. Record Adjusting Entries: Record the following month-end adjusting entries for the month of January. Write the journal entries in the practice set after the original journal entries. Round all answers to the nearest cent. a. $70 of office supplies remained on hand. b. $200 of shipping supplies remained on hand. C. $1.300 of wages for the part-time help from Irene's Temp Services for January should be accrued. Do not worry about payroll taxes: Temp Services Inc. will handle these. d. Make the necessary adjusting entries for one month's depreciation for the Computer Equipment using Straight-Line Depreciation. e. Make the necessary adjusting entry for one month's depreciation for the Bike Racks using Straight-Line Depreciation. f. One month of the prepaid insurance has expired. g. One month of the prepaid rent has expired. h. Record the interest for the loan from Wells Fargo for one month. Make sure you prepare the journal entries and the adjusting entries and write them in the practice set. Follow the same instructions for the adjusting journal entries that you did in part one. Once the adjusting entries have been completed in the spreadsheet use the spreadsheet to answer the questions in Blackboard then upload the spreadsheet to Blackboard. Follow these instructions. Step 1: Enter the adjusting journal entries in an Excel spreadsheet and print it out. Step 2: Use the Excel spreadsheet to answer the questions in Blackboard in the content folder in the corresponding week. Step 3: Once you complete entering information into Blackboard upload the spreadsheet into Blackboard