Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the question on first pic A. Use the balance sheet and income statement to calculate JNI's earnings per share (EPS) for 2020: $5.51

please answer the question on first pic

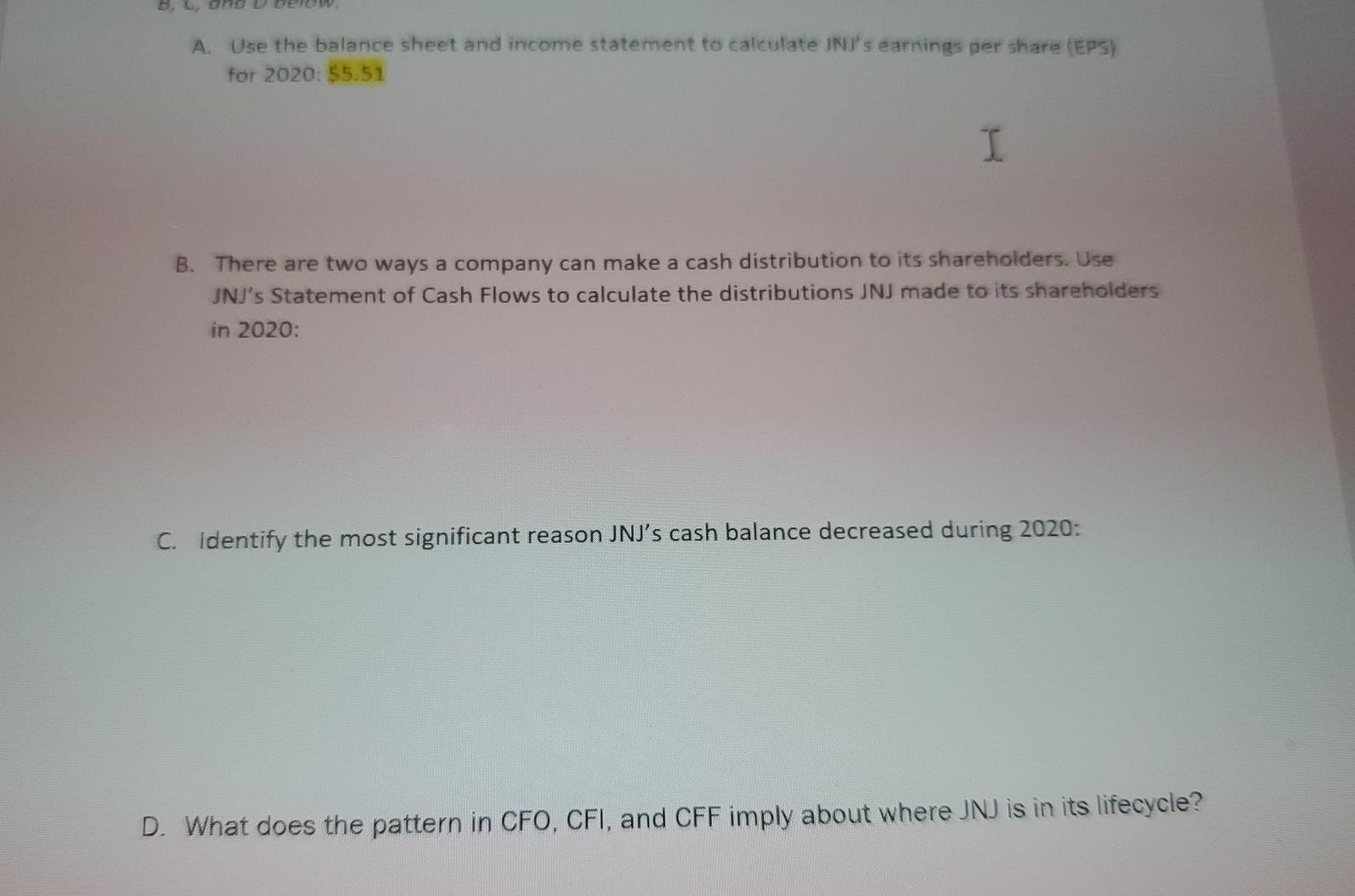

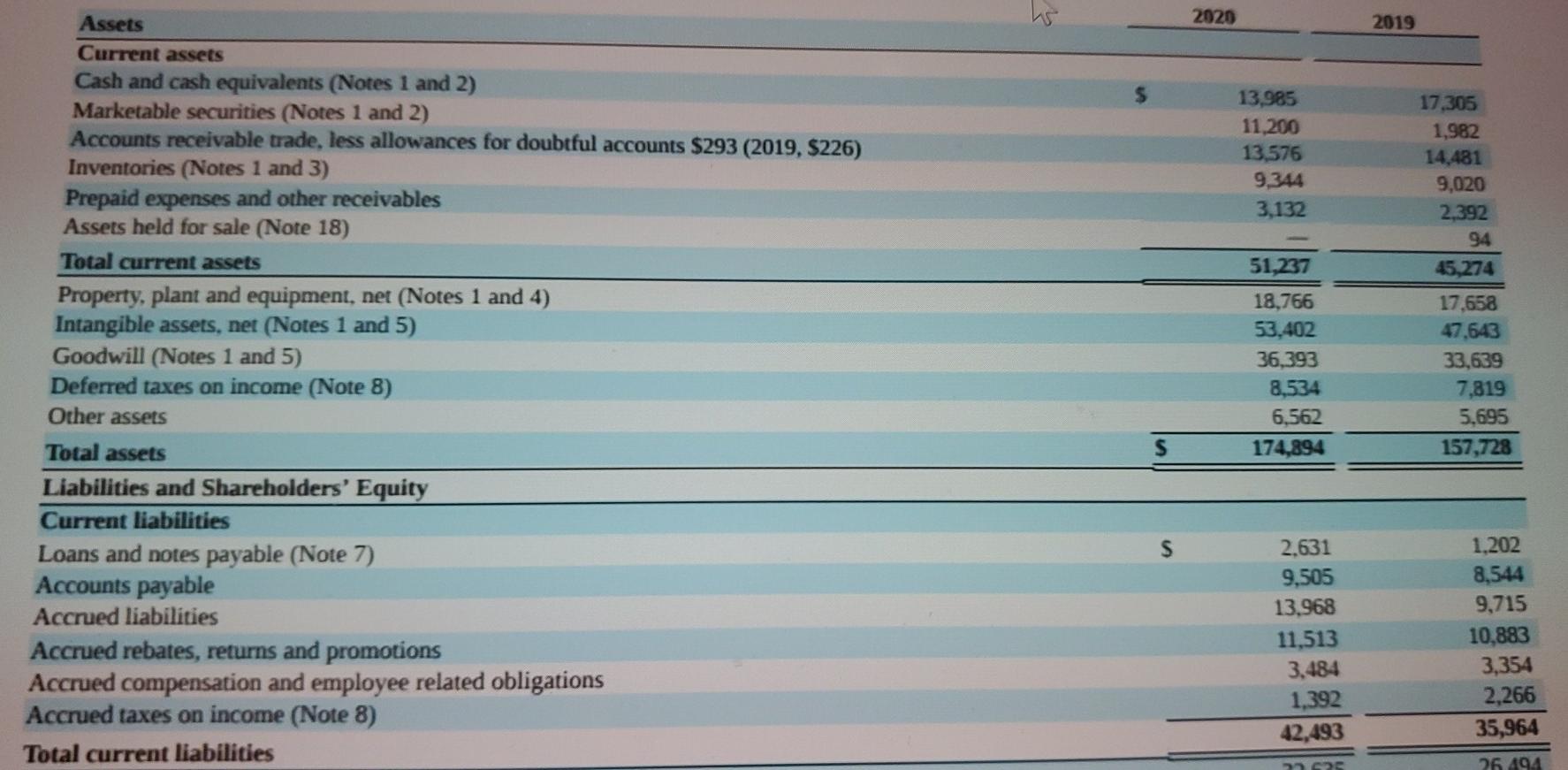

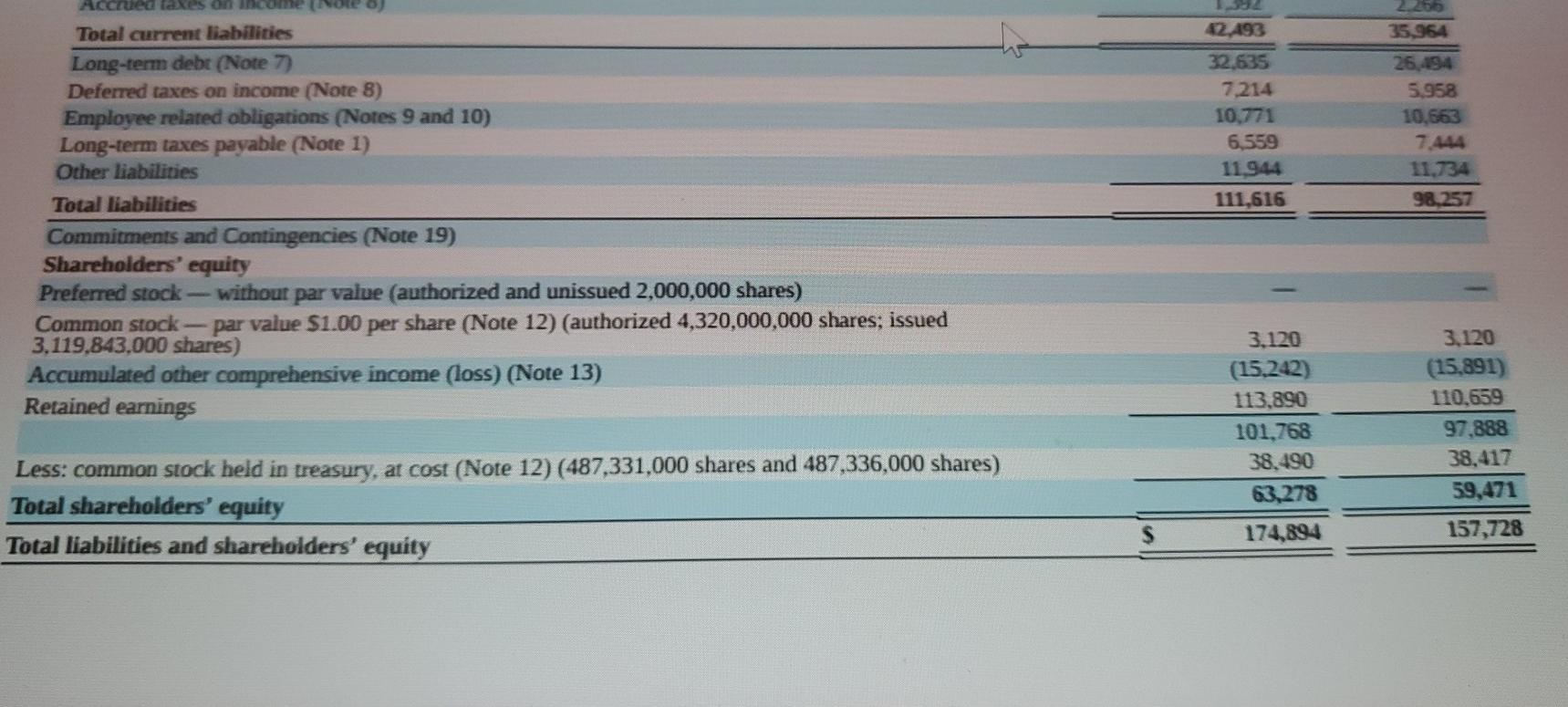

A. Use the balance sheet and income statement to calculate JNI's earnings per share (EPS) for 2020: $5.51 I B. There are two ways a company can make a cash distribution to its shareholders. Use JNI's Statement of Cash Flows to calculate the distributions JNJ made to its shareholders in 2020: C. Identify the most significant reason JNJ's cash balance decreased during 2020: D. What does the pattern in CFO, CFI, and CFF imply about where JNJ is in its lifecycle? 2020 2019 13,985 11,200 13,576 9,344 3.132 17.305 1,982 14,481 9,020 2.392 94 45,274 51,237 Assets Current assets Cash and cash equivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $293 (2019, $226) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 18) Total current assets Property, plant and equipment, net (Notes 1 and 4) Intangible assets, net (Notes 1 and 5) Goodwill (Notes 1 and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accrued liabilities Accrued rebates, returns and promotions Accrued compensation and employee related obligations Accrued taxes on income (Note 8) Total current liabilities 18,766 53.402 36,393 8,534 6,562 174,894 17,658 47.643 33,639 7,819 5.695 157,728 s 2.631 9,505 13,968 11,513 3,484 1.392 42,493 1.202 8,544 9,715 10,883 3,354 2,266 35,964 26.494 12.493 32,635 7,214 10,771 6,559 11.944 111,616 35,964 26,194 5.958 10.663 7.444 11,734 98,257 Accrued taxes on income to Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-term taxes payable (Note 1) Other liabilities Total liabilities Commitments and Contingencies (Note 19) Shareholders' equity Preferred stock without par value (authorized and unissued 2,000,000 shares) Common stock - par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3.119.843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earnings 3.120 (15.242) 113.890 101.768 38.490 63,278 3.120 (15,891) 110.659 97.888 38,417 59,471 Less: common stock held in treasury, at cost (Note 12) (487,331,000 shares and 487,336,000 shares) Total shareholders' equity Total liabilities and shareholders' equity 174,894 157,728 A. Use the balance sheet and income statement to calculate JNI's earnings per share (EPS) for 2020: $5.51 I B. There are two ways a company can make a cash distribution to its shareholders. Use JNI's Statement of Cash Flows to calculate the distributions JNJ made to its shareholders in 2020: C. Identify the most significant reason JNJ's cash balance decreased during 2020: D. What does the pattern in CFO, CFI, and CFF imply about where JNJ is in its lifecycle? 2020 2019 13,985 11,200 13,576 9,344 3.132 17.305 1,982 14,481 9,020 2.392 94 45,274 51,237 Assets Current assets Cash and cash equivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) Accounts receivable trade, less allowances for doubtful accounts $293 (2019, $226) Inventories (Notes 1 and 3) Prepaid expenses and other receivables Assets held for sale (Note 18) Total current assets Property, plant and equipment, net (Notes 1 and 4) Intangible assets, net (Notes 1 and 5) Goodwill (Notes 1 and 5) Deferred taxes on income (Note 8) Other assets Total assets Liabilities and Shareholders' Equity Current liabilities Loans and notes payable (Note 7) Accounts payable Accrued liabilities Accrued rebates, returns and promotions Accrued compensation and employee related obligations Accrued taxes on income (Note 8) Total current liabilities 18,766 53.402 36,393 8,534 6,562 174,894 17,658 47.643 33,639 7,819 5.695 157,728 s 2.631 9,505 13,968 11,513 3,484 1.392 42,493 1.202 8,544 9,715 10,883 3,354 2,266 35,964 26.494 12.493 32,635 7,214 10,771 6,559 11.944 111,616 35,964 26,194 5.958 10.663 7.444 11,734 98,257 Accrued taxes on income to Total current liabilities Long-term debt (Note 7) Deferred taxes on income (Note 8) Employee related obligations (Notes 9 and 10) Long-term taxes payable (Note 1) Other liabilities Total liabilities Commitments and Contingencies (Note 19) Shareholders' equity Preferred stock without par value (authorized and unissued 2,000,000 shares) Common stock - par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3.119.843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earnings 3.120 (15.242) 113.890 101.768 38.490 63,278 3.120 (15,891) 110.659 97.888 38,417 59,471 Less: common stock held in treasury, at cost (Note 12) (487,331,000 shares and 487,336,000 shares) Total shareholders' equity Total liabilities and shareholders' equity 174,894 157,728Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started