Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER THE QUESTION OWN . PLEASE DO NOT COPY AND PASTE FROM ANOTHER CHEGG QUESTION. IF CAN HELP ME TO ALL THE QUESTIONS. THANK

PLEASE ANSWER THE QUESTION OWN . PLEASE DO NOT COPY AND PASTE FROM ANOTHER CHEGG QUESTION. IF CAN HELP ME TO ALL THE QUESTIONS. THANK YOU .

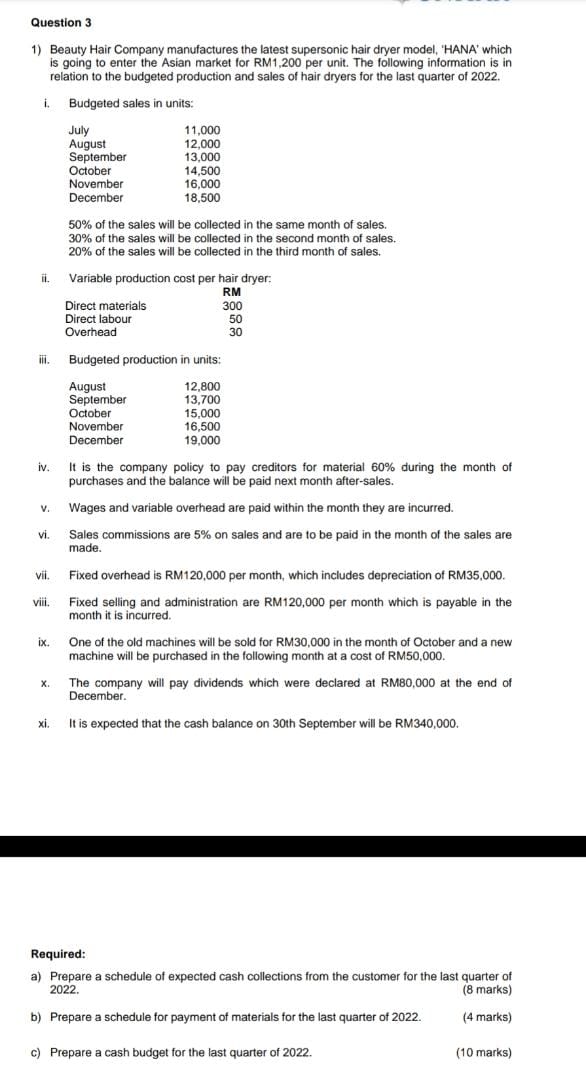

1) Beauty Hair Company manufactures the latest supersonic hair dryer model, 'HANA' which is going to enter the Asian market for RM1,200 per unit. The following information is in relation to the budgeted production and sales of hair dryers for the last quarter of 2022. i. Budgeted sales in units: 50% of the sales will be collected in the same month of sales. 30% of the sales will be collected in the second month of sales. 20% of the sales will be collected in the third month of sales. i. iii. Budgeted production in units: iv. It is the company policy to pay creditors for material 60% during the month of purchases and the balance will be paid next month after-sales. v. Wages and variable overhead are paid within the month they are incurred. vi. Sales commissions are 5% on sales and are to be paid in the month of the sales are made. vii. Fixed overhead is RM120,000 per month, which includes depreciation of RM35,000. viii. Fixed selling and administration are RM120,000 per month which is payable in the month it is incurred. ix. One of the old machines will be sold for RM30,000 in the month of October and a new machine will be purchased in the following month at a cost of RM50,000. x. The company will pay dividends which were declared at RM80,000 at the end of December. xi. It is expected that the cash balance on 30 th September will be RM340,000. Required: a) Prepare a schedule of expected cash collections from the customer for the last quarter of 2022. (8 marks) b) Prepare a schedule for payment of materials for the last quarter of 2022. (4 marks) c) Prepare a cash budget for the last quarter of 2022. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started