Answered step by step

Verified Expert Solution

Question

1 Approved Answer

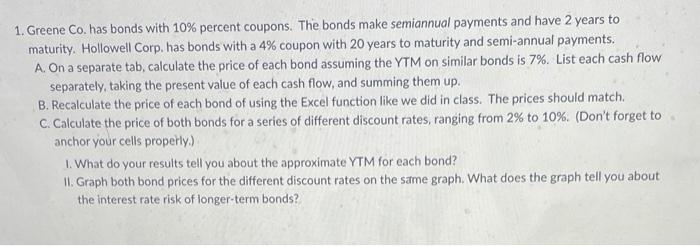

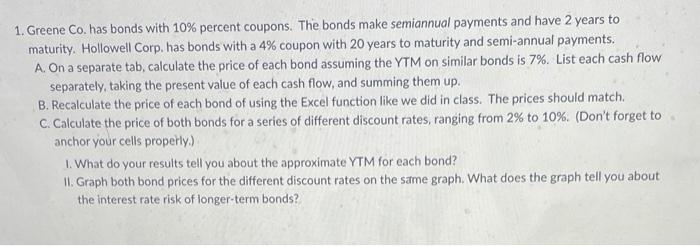

please answer the question with the detailed excel functions used to get answers. thanks 1. Greene Co. has bonds with 10% percent coupons. The bonds

please answer the question with the detailed excel functions used to get answers. thanks

1. Greene Co. has bonds with 10% percent coupons. The bonds make semiannual payments and have 2 years to maturity. Hollowell Corp. has bonds with a 4% coupon with 20 years to maturity and semi-annual payments. A. On a separate tab, calculate the price of each bond assuming the YTM on similar bonds is 7%. List each cash flow separately, taking the present value of each cash flow, and summing them up. B. Recalculate the price of each bond of using the Excel function like we did in class. The prices should match. C. Calculate the price of both bonds for a series of different discount rates, ranging from 2% to 10%. (Don't forget to anchor your cells properly.) 1. What do your results tell you about the approximate YTM for each bond? II. Graph both bond prices for the different discount rates on the same graph. What does the graph tell you about the interest rate risk of longer-term bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started