Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the question woth details please answer the question woth details Suppose that Tenth-Fourth. (TF), a hypothetical technology company, and Great livestment Bank (GR),

please answer the question woth details

please answer the question woth details

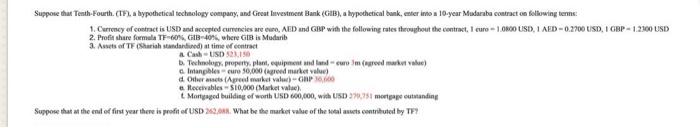

Suppose that Tenth-Fourth. (TF), a hypothetical technology company, and Great livestment Bank (GR), a hypothetical bank, terima 10-year Madaraba contract on following terms 1. Currency of contract is USD and accepted currencies are wo, AED and GBP with the following rates throughout the contrast, 1 euro = 1.0800 USD, 1 AED -0.2700 USD GBP - 12300 USD 2. Protid share formula TF-60% GB-40%, where GB is Mutarib 3. Ats of TF (Shariah standarded at time contract Cash-USD 150 Technology property, plant, quipment and alcom (predte) Intangibles cure 50,000 (red market value) d here (Apval)-GAP eleceivables $10,000 (Market value Mortgaged building of worth USD 600,000, with USD 3.751 mortape cutstanding Suppose that at the end of first year there is profit of USD 2001. What be the market value of the last contributed by TF? Suppose that Tenth-Fourth. (TF), a hypothetical technology company, and Great livestment Bank (GR), a hypothetical bank, terima 10-year Madaraba contract on following terms 1. Currency of contract is USD and accepted currencies are wo, AED and GBP with the following rates throughout the contrast, 1 euro = 1.0800 USD, 1 AED -0.2700 USD GBP - 12300 USD 2. Protid share formula TF-60% GB-40%, where GB is Mutarib 3. Ats of TF (Shariah standarded at time contract Cash-USD 150 Technology property, plant, quipment and alcom (predte) Intangibles cure 50,000 (red market value) d here (Apval)-GAP eleceivables $10,000 (Market value Mortgaged building of worth USD 600,000, with USD 3.751 mortape cutstanding Suppose that at the end of first year there is profit of USD 2001. What be the market value of the last contributed by TF Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started