Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the questions 17.9, 17.10 and 17.11 with your detailed explanations, it's much appreciated! 7.9 An organisation restores its petty cash balance to $250

Please answer the questions 17.9, 17.10 and 17.11 with your detailed explanations, it's much appreciated!

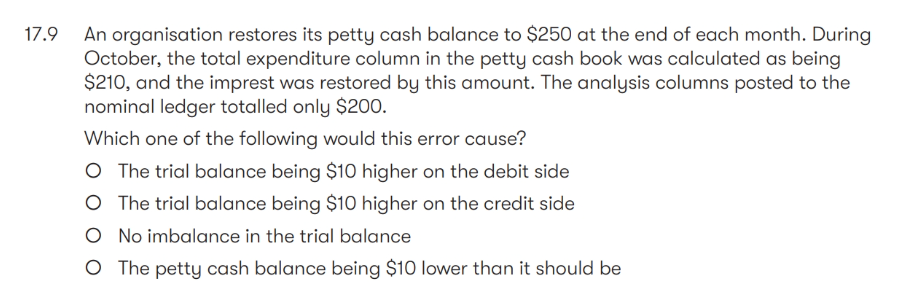

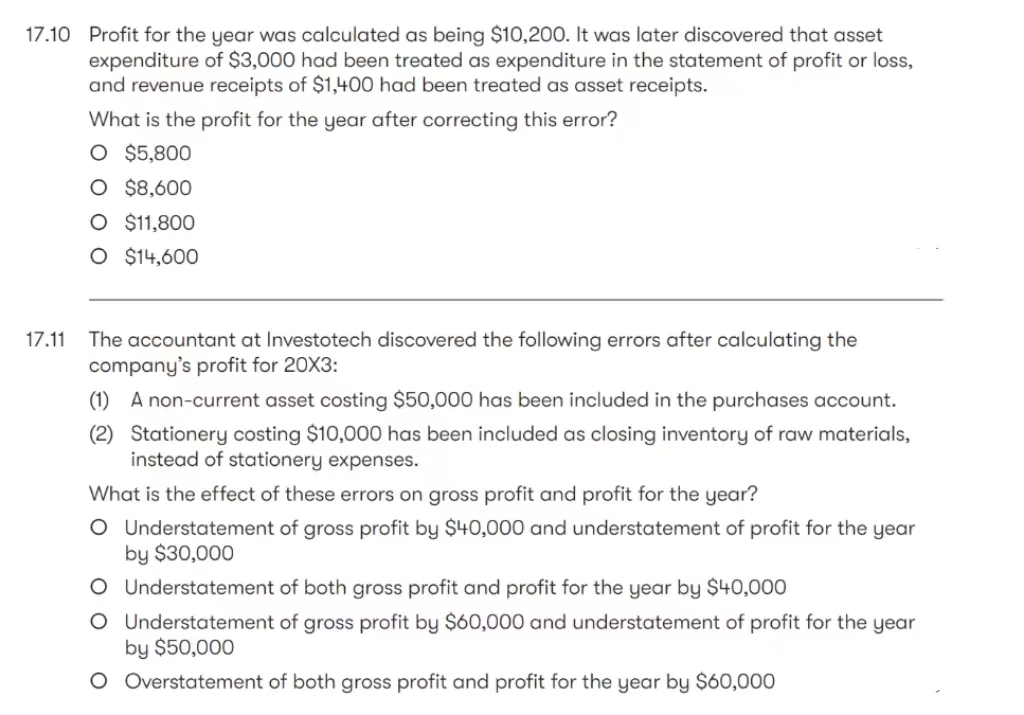

7.9 An organisation restores its petty cash balance to $250 at the end of each month. During October, the total expenditure column in the petty cash book was calculated as being $210, and the imprest was restored by this amount. The analysis columns posted to the nominal ledger totalled only \$200. Which one of the following would this error cause? The trial balance being $10 higher on the debit side The trial balance being $10 higher on the credit side No imbalance in the trial balance The petty cash balance being $10 lower than it should be 17.10 Profit for the year was calculated as being $10,200. It was later discovered that asset expenditure of $3,000 had been treated as expenditure in the statement of profit or loss, and revenue receipts of $1,400 had been treated as asset receipts. What is the profit for the year after correcting this error? $5,800$8,600$11,800$14,600 17.11 The accountant at Investotech discovered the following errors after calculating the company's profit for 20X3: (1) A non-current asset costing $50,000 has been included in the purchases account. (2) Stationery costing $10,000 has been included as closing inventory of raw materials, instead of stationery expenses. What is the effect of these errors on gross profit and profit for the year? Understatement of gross profit by $40,000 and understatement of profit for the year by $30,000 Understatement of both gross profit and profit for the year by $40,000 Understatement of gross profit by $60,000 and understatement of profit for the year by $50,000 Overstatement of both gross profit and profit for the year by $60,000

7.9 An organisation restores its petty cash balance to $250 at the end of each month. During October, the total expenditure column in the petty cash book was calculated as being $210, and the imprest was restored by this amount. The analysis columns posted to the nominal ledger totalled only \$200. Which one of the following would this error cause? The trial balance being $10 higher on the debit side The trial balance being $10 higher on the credit side No imbalance in the trial balance The petty cash balance being $10 lower than it should be 17.10 Profit for the year was calculated as being $10,200. It was later discovered that asset expenditure of $3,000 had been treated as expenditure in the statement of profit or loss, and revenue receipts of $1,400 had been treated as asset receipts. What is the profit for the year after correcting this error? $5,800$8,600$11,800$14,600 17.11 The accountant at Investotech discovered the following errors after calculating the company's profit for 20X3: (1) A non-current asset costing $50,000 has been included in the purchases account. (2) Stationery costing $10,000 has been included as closing inventory of raw materials, instead of stationery expenses. What is the effect of these errors on gross profit and profit for the year? Understatement of gross profit by $40,000 and understatement of profit for the year by $30,000 Understatement of both gross profit and profit for the year by $40,000 Understatement of gross profit by $60,000 and understatement of profit for the year by $50,000 Overstatement of both gross profit and profit for the year by $60,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started