Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the questions 26.3, 26.4 and 26.5with your detailed explanations, it's much appreciated! A sole trader fixes his prices to achieve a gross profit

Please answer the questions 26.3, 26.4 and 26.5with your detailed explanations, it's much appreciated!

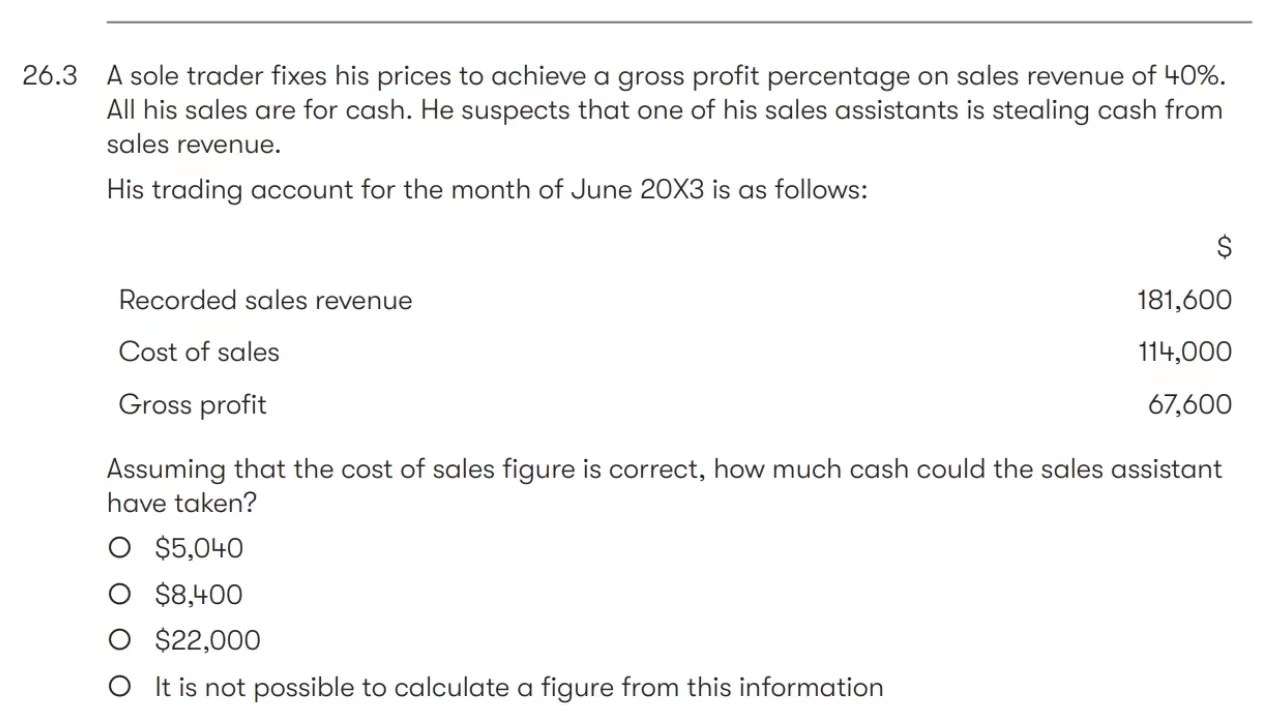

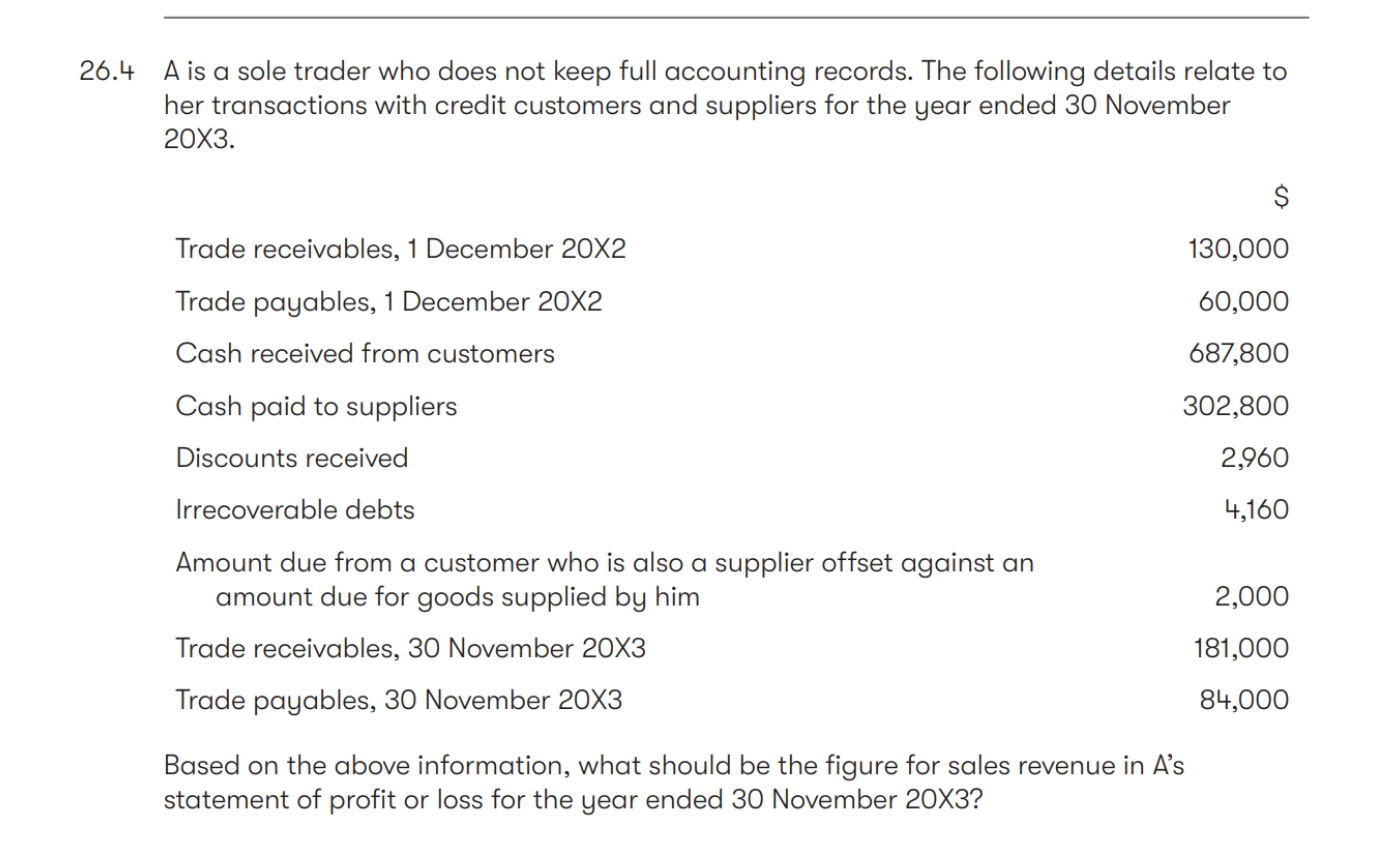

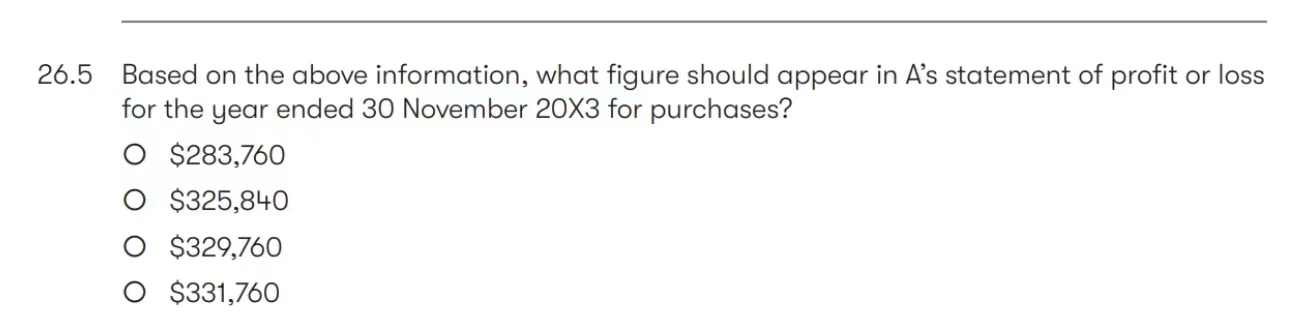

A sole trader fixes his prices to achieve a gross profit percentage on sales revenue of 40%. All his sales are for cash. He suspects that one of his sales assistants is stealing cash from sales revenue. His trading account for the month of June 203 is as follows: Recorded sales revenue Cost of sales Gross profit $181,600114,00067,600 Assuming that the cost of sales figure is correct, how much cash could the sales assistant have taken? $5,040$8,400$22,000 It is not possible to calculate a figure from this information + A is a sole trader who does not keep full accounting records. The following details relate to her transactions with credit customers and suppliers for the year ended 30 November 203. $ .5 Based on the above information, what figure should appear in A's statement of profit or loss for the year ended 30 November 20X3 for purchases? $283,760$325,840$329,760$331,760

A sole trader fixes his prices to achieve a gross profit percentage on sales revenue of 40%. All his sales are for cash. He suspects that one of his sales assistants is stealing cash from sales revenue. His trading account for the month of June 203 is as follows: Recorded sales revenue Cost of sales Gross profit $181,600114,00067,600 Assuming that the cost of sales figure is correct, how much cash could the sales assistant have taken? $5,040$8,400$22,000 It is not possible to calculate a figure from this information + A is a sole trader who does not keep full accounting records. The following details relate to her transactions with credit customers and suppliers for the year ended 30 November 203. $ .5 Based on the above information, what figure should appear in A's statement of profit or loss for the year ended 30 November 20X3 for purchases? $283,760$325,840$329,760$331,760 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started