Answered step by step

Verified Expert Solution

Question

1 Approved Answer

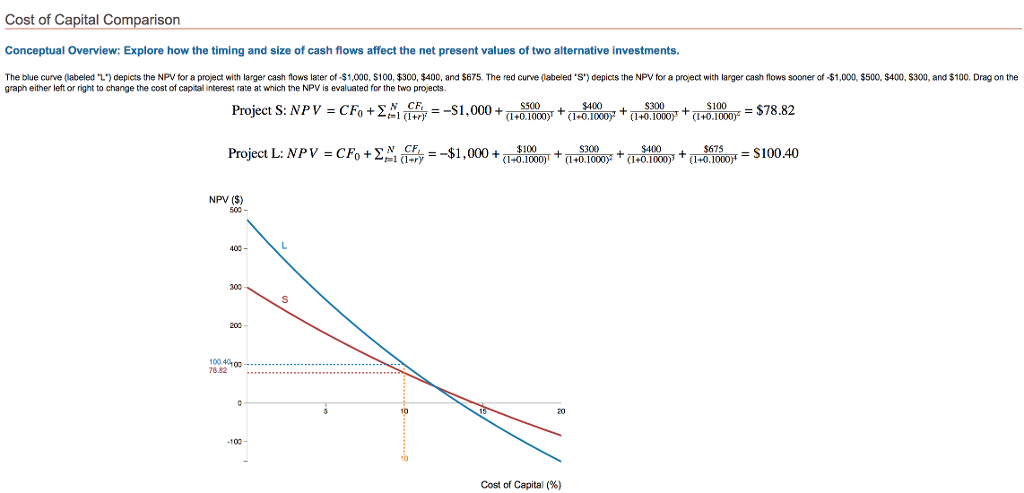

Please answer the questions # 5 - 8 in the second the image Cost of Capital Comparison Conceptual Overview: Explore how the timing and size

Please answer the questions # 5 - 8 in the second the image

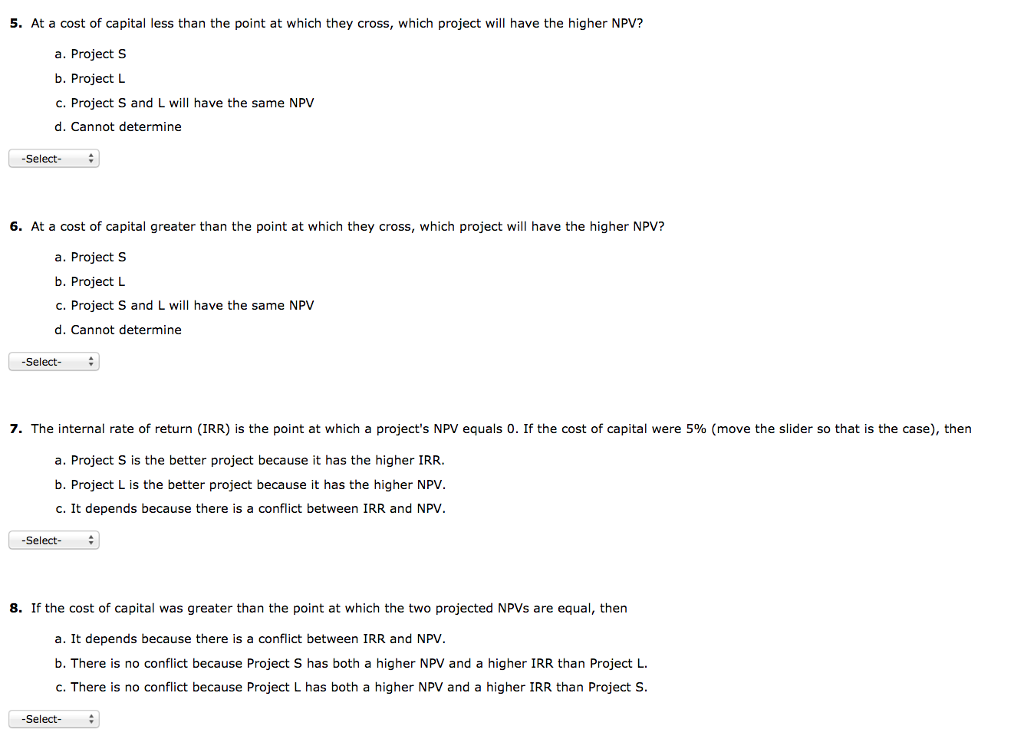

Cost of Capital Comparison Conceptual Overview: Explore how the timing and size of cash flows affect the net present values of two alternative investments. The blue curve (abeled L') depicts the NPV for a project with larger cash flows later of -$1,000, S100, $300, $400, and $675. The red curve (abeled S') depicts the NPV for a project with larger cash fows sooner of-$1,000, $500, $400, $300, and $100. Drag on the graph either left or right to change the cost of capital interest rate at which the NPV is evaluated for the two projects. S300 $100 Project S: NP V = CFO + 0.1000 (10.10000.1000)(I+0.1000 Project L: NPV-CF0 + =-$1,000 + (1-01000) + (1 300 jz + (1-040007 + (1 06 NPV (S) 500- 400- 300 10040100 78.82 -100 Cost of Capital (%) 5. At a cost of capital less than the point at which they cross, which project will have the higher NPV? a. Project S b. Project L c. Project S and L will have the same NPV d. Cannot determine Select 6. At a cost of capital greater than the point at which they cross, which project will have the higher NPV? a. Project S b. Project L c. Project S and L will have the same NPV d. Cannot determine Select 7. The internal rate of return (IRR) is the point at which a project's NPV equals o. If the cost of capital were 5% (move the slider so that She case) hen a. Project S is the better project because it has the higher IRR. b. Project L is the better project because it has the higher NPV. c. It depends because there is a conflict between IRR and NPV. Select 8. If the cost of capital was greater than the point at which the two projected NPVs are equal, thern a. It depends because there is a conflict between IRR and NPV b. There is no conflict because Project S has both a higher NPV and a higher IRR than Project L c. There is no conflict because Project L has both a higher NPV and a higher IRR than Project S. SelectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started