Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the questions above. Thank you kindly! 2017 1. 3.5pts A firm has 20 million common shares issued. It pays $2.00 dividend annually. The

Please answer the questions above. Thank you kindly!

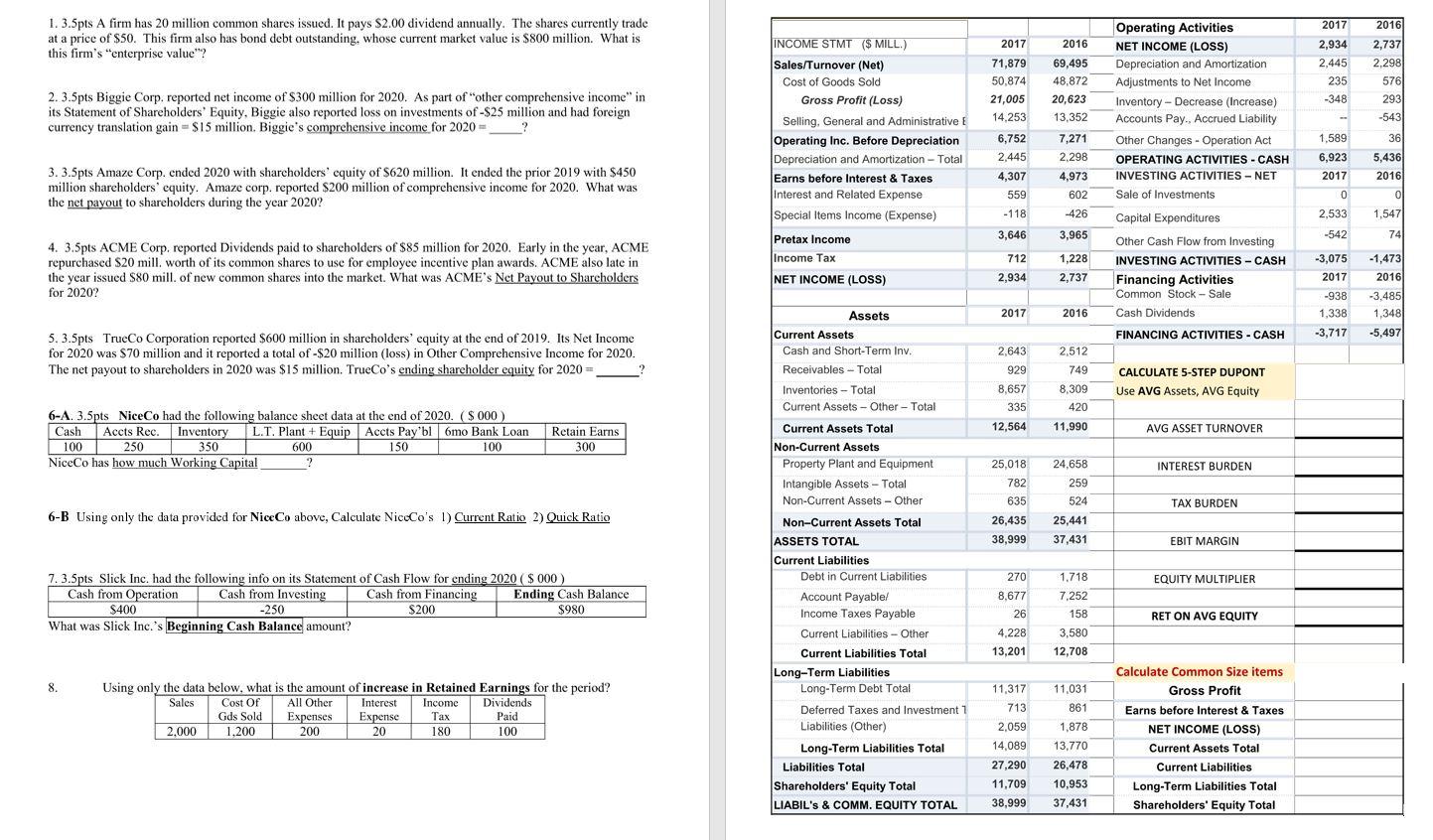

2017 1. 3.5pts A firm has 20 million common shares issued. It pays $2.00 dividend annually. The shares currently trade at a price of $50. This firm also has bond debt outstanding, whose current market value is $800 million. What is this firm's "enterprise value"? 2017 71,879 50,874 21,005 14.253 2016 69,495 48,872 20,623 13,352 2,934 2,445 235 -348 2016 2,737 2,298 576 293 -543 2.3.5pts Biggie Corp. reported net income of $300 million for 2020. As part of other comprehensive income" in its Statement of Shareholders' Equity, Biggie also reported loss on investments of -$25 million and had foreign currency translation gain = $15 million. Biggie's comprehensive income for 2020 = 36 INCOME STMT ($ MILL.) Sales/Turnover (Net) Cost of Goods Sold Gross Profit (Loss) Selling, General and Administrative Operating Inc. Before Depreciation Depreciation and Amortization - Total Earns before Interest & Taxes & Interest and Related Expense Special Items Income (Expense) Pretax Income Income Tax NET INCOME (LOSS) 6,752 2.445 1.589 6,923 5,436 7,271 2.298 4,973 602 3.3.5pts Amaze Corp. cnded 2020 with shareholders' equity of S620 million. It ended the prior 2019 with $450 million shareholders' equity. Amaze corp. reported $200 million of comprehensive income for 2020. What was the net payout to shareholders during the year 2020? 2017 Operating Activities NET INCOME (LOSS) Depreciation and Amortization Adjustments to Net Income Inventory - Decrease (Increase) Accounts Pay. Accrued Liability Other Changes - Operation Act OPERATING ACTIVITIES - CASH INVESTING ACTIVITIES - NET Sale of Investments Capital Expenditures Other Cash Flow from Investing INVESTING ACTIVITIES - CASH Financing Activities Common Stock - Sale Cash Dividends FINANCING ACTIVITIES - CASH 2016 4,307 559 0 ol - 118 -426 2,533 1,547 3,646 3,965 -542 741 712 1,228 4. 3.5pts ACME Corp. reported Dividends paid to shareholders of $85 million for 2020. Early in the year, ACME repurchased $20 mill. worth of its common shares to use for employee incentive plan awards. ACME also late in the year issued S80 mill. of new common shares into the market. What was ACME's Net Payout to Shareholders for 2020? 2,934 2,737 -3,075 2017 -938 1,338 -3,717 -1,4730 2016 -3,485 1,348 -5,497 2017 2016 5.3.5pts TrueCo Corporation reported $600 million in shareholders' equity at the end of 2019. Its Net Income for 2020 was $70 million and it reported a total of $20 million (loss) in Other Comprehensive Income for 2020. The net payout to shareholders in 2020 was $15 million. TrueCo's ending shareholder equity for 2020 = Assets Current Assets Cash and Short-Term Inv. Receivables - Total Inventories - Total Current Assets - Other - Total 2,512 749 2,643 929 8,657 335 12,564 CALCULATE 5-STEP DUPONT 5- Use AVG Assets, AVG Equity 8,309 420 11,990 AVG ASSET TURNOVER 6-A. 3.5pts NiceCo had the following balance sheet data at the end of 2020. ($ 000) Cash Accts Rec. Inventory L.T. Plant + Equip Accts Pay'bl Omo Bank Loan 100 250 350 600 150 100 NiceCo has how much Working Capital Retain Earns 300 24,658 INTEREST BURDEN 259 25,018 782 635 26,435 38,999 524 TAX BURDEN 6-B Using only the data provided for NiceCo above, Calculate NicoCo's 1) Current Ratio 2) Quick Ratio 25,441 37,431 EBIT MARGIN EQUITY MULTIPLIER 7.3.5pts Slick Inc. had the following info on its Statement of Cash Flow for ending 2020 ($ 000) Cash from Operation Cash from Investing Cash from Financing Ending Cash Balance $400 -250 $200 $ $980 What was Slick Inc.'s Beginning Cash Balance amount? Current Assets Total Non-Current Assets Property Plant and Equipment Intangible Assets - Total Non-Current Assets - Other Non-Current Assets Total ASSETS TOTAL Current Liabilities Debt in Current Liabilities Account Payable/ Income Taxes Payable Current Liabilities - Other Current Liabilities Total Long-Term Liabilities Long-Term Debt Total Deferred Taxes and Investment 1 Liabilities (Other) Long-Term Liabilities Total Liabilities Total Shareholders' Equity Total LIABIL'S & COMM. EQUITY TOTAL 270 8,677 26 4.228 13,201 1.718 7,252 158 RET ON AVG EQUITY 3,580 12,708 8. 11,031 Income Using only the data below, what is the amount of increase in Retained Earnings for the period? Sales Cost Of All Other Interest Dividends Gds Sold Expenses Expense Tax Paid 2.000 1,200 200 20 180 100 861 11,317 713 2.059 14,089 27,290 11,709 38,999 1,878 13,770 26,478 10,953 37,431 Calculate Common Size items Gross Profit Earns before Interest & Taxes NET INCOME (LOSS) Current Assets Total Current Liabilities Long-Term Liabilities Total Shareholders' Equity TotalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started