Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the questions according to the marks appointed per question and sub question. this is a banking and finance question so please answer it

please answer the questions according to the marks appointed per question and sub question. this is a banking and finance question so please answer it accordingly.

see the marks for the questions

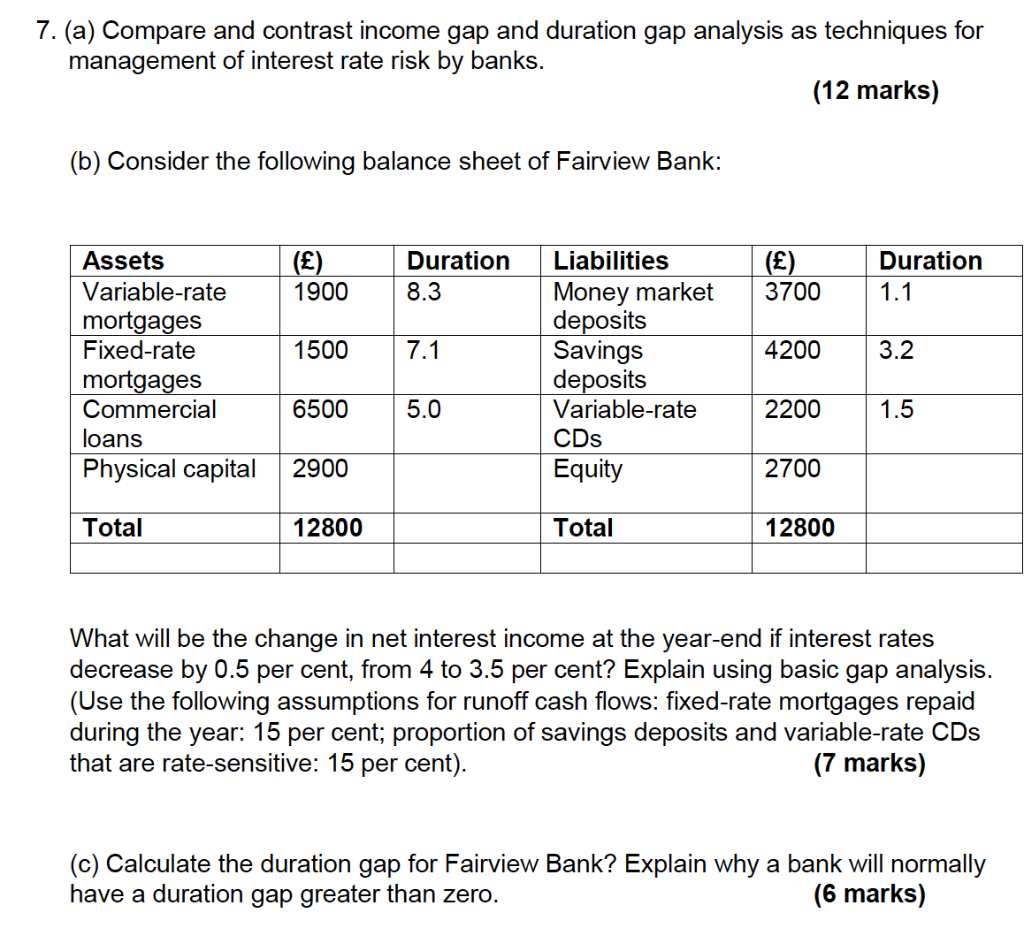

7. (a) Compare and contrast income gap and duration gap analysis as techniques for management of interest rate risk by banks. (12 marks) (b) Consider the following balance sheet of Fairview Bank: () 1900 Duration 8.3 () 3700 Duration 1.1 1500 7.1 4200 3.2 Assets Variable-rate mortgages Fixed-rate mortgages Commercial loans Physical capital Liabilities Money market deposits Savings deposits Variable-rate CDs Equity 6500 5.0 2200 1.5 2900 2700 Total 12800 Total 12800 What will be the change in net interest income at the year-end if interest rates decrease by 0.5 per cent, from 4 to 3.5 per cent? Explain using basic gap analysis. (Use the following assumptions for runoff cash flows: fixed-rate mortgages repaid during the year: 15 per cent; proportion of savings deposits and variable-rate CDs that are rate-sensitive: 15 per cent). (7 marks) (c) Calculate the duration gap for Fairview Bank? Explain why a bank will normally have a duration gap greater than zero. (6 marks) 7. (a) Compare and contrast income gap and duration gap analysis as techniques for management of interest rate risk by banks. (12 marks) (b) Consider the following balance sheet of Fairview Bank: () 1900 Duration 8.3 () 3700 Duration 1.1 1500 7.1 4200 3.2 Assets Variable-rate mortgages Fixed-rate mortgages Commercial loans Physical capital Liabilities Money market deposits Savings deposits Variable-rate CDs Equity 6500 5.0 2200 1.5 2900 2700 Total 12800 Total 12800 What will be the change in net interest income at the year-end if interest rates decrease by 0.5 per cent, from 4 to 3.5 per cent? Explain using basic gap analysis. (Use the following assumptions for runoff cash flows: fixed-rate mortgages repaid during the year: 15 per cent; proportion of savings deposits and variable-rate CDs that are rate-sensitive: 15 per cent). (7 marks) (c) Calculate the duration gap for Fairview Bank? Explain why a bank will normally have a duration gap greater than zero. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started