Please answer the questions below with details in step!!

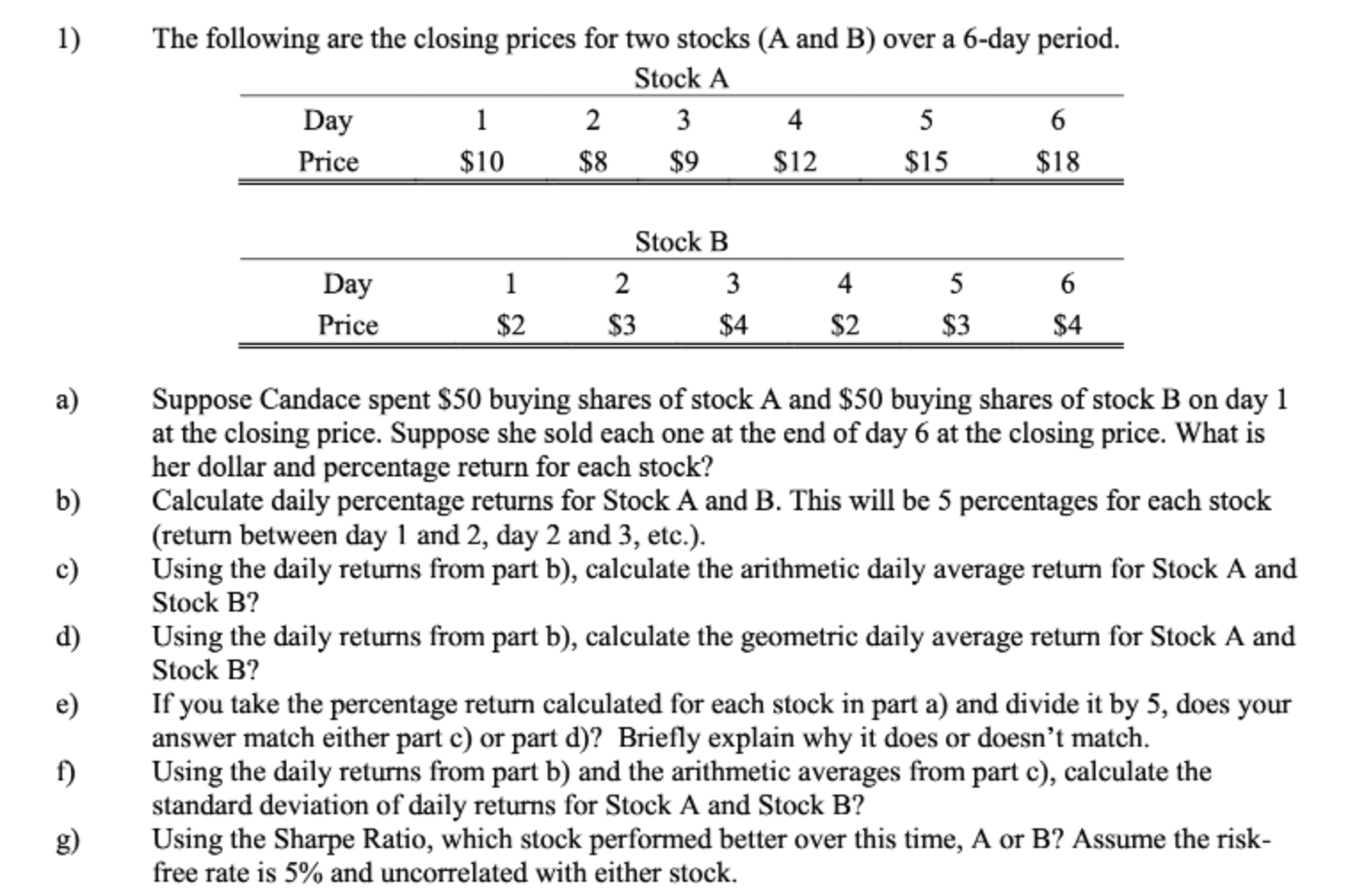

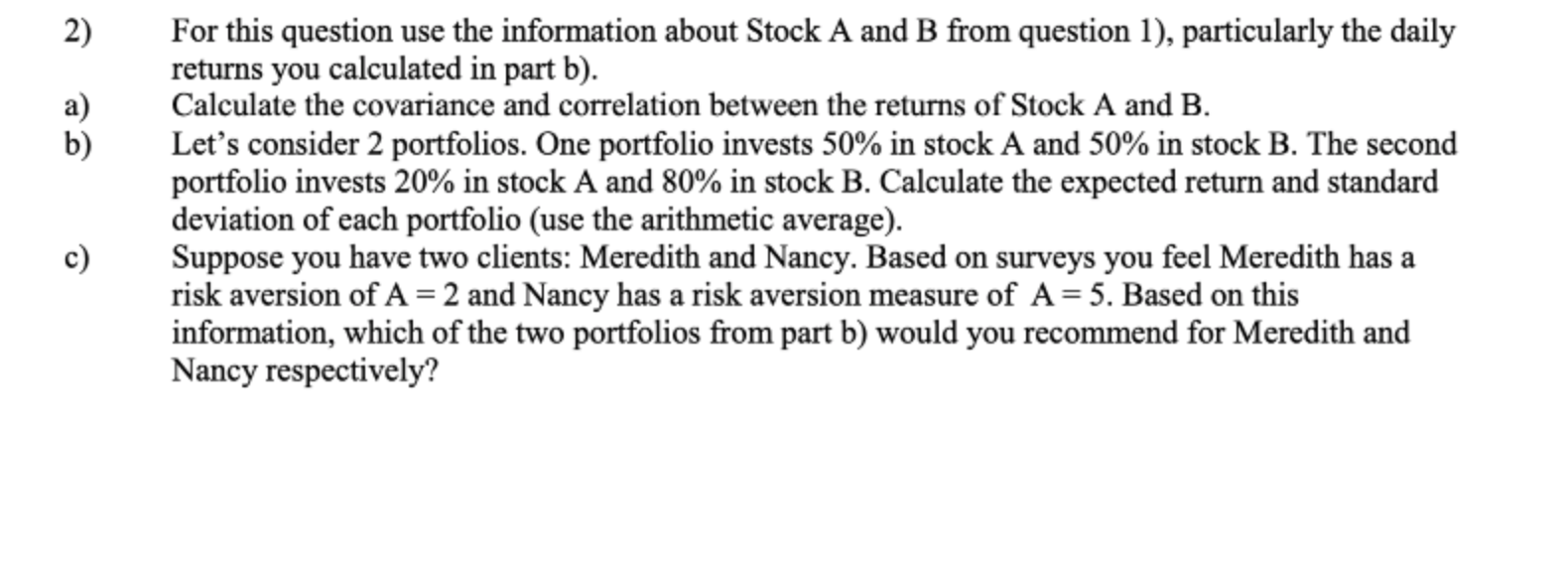

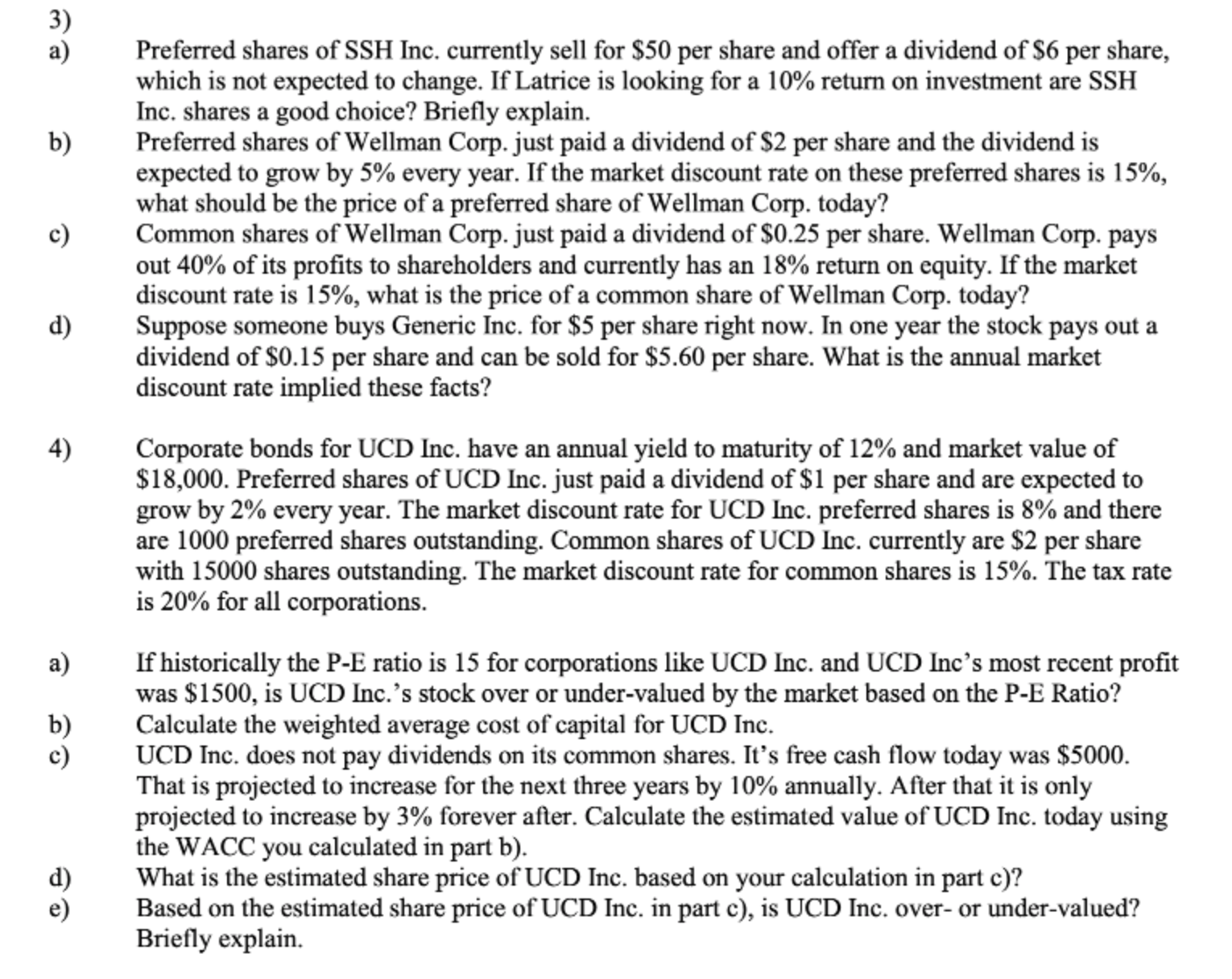

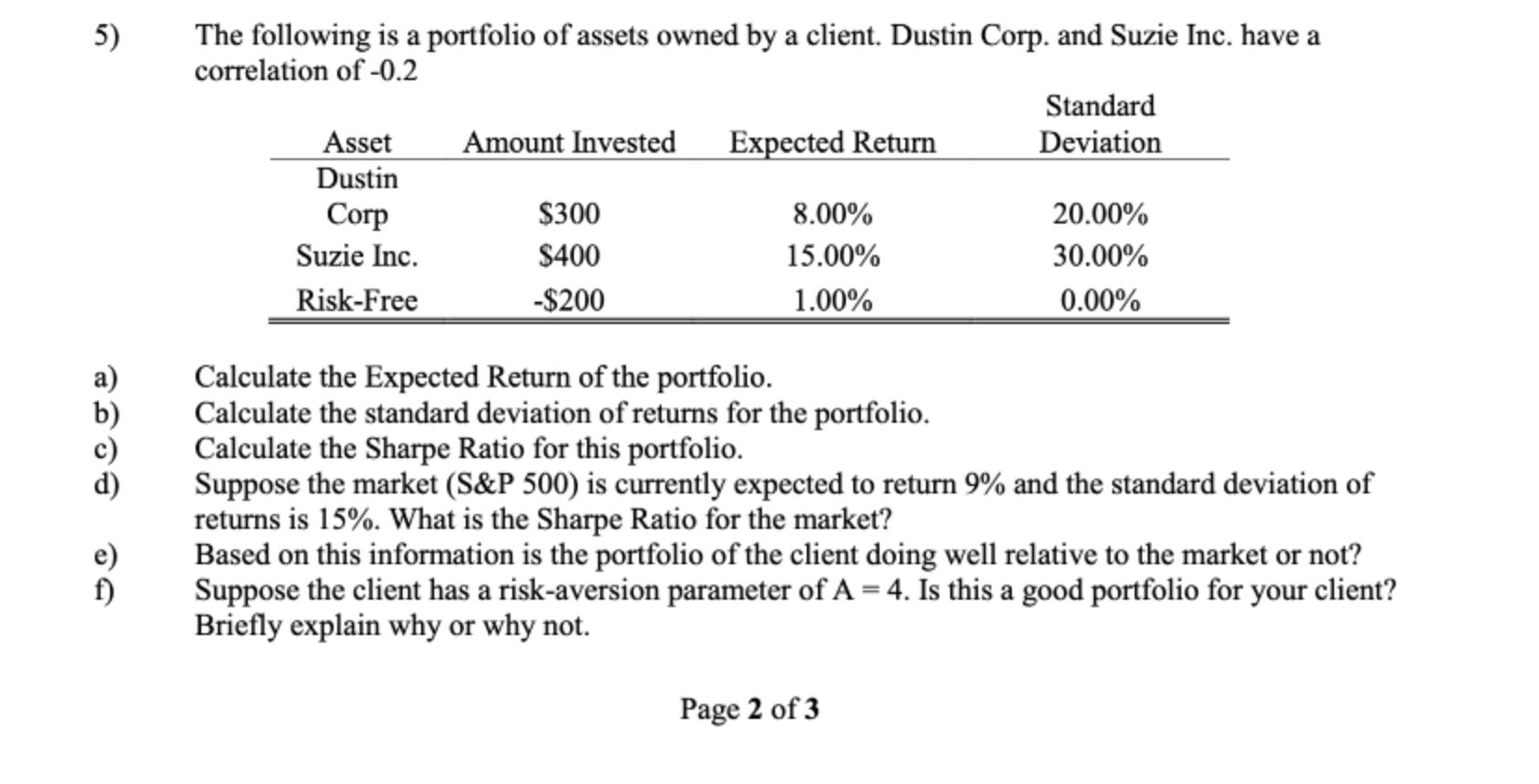

1) s) The following are the closing prices for two stocks (A and B) over a 6-day period. Stock A Day 1 2 3 4 5 6 Price $10 $8 $9 $12 SIS $18 Stock B Day 1 2 3 4 5 6 Price $2 $3 $4 $2 $3 $4 Suppose Candace spent $50 buying shares of stock A and $50 buying shares of stock B on day l at the closing price. Suppose she sold each one at the end of day 6 at the closing price. What is her dollar and percentage return for each stock? Calculate daily percentage returns for StockAand B. This will be 5 percentages for each stock (retum between day l and 2, day 2 and 3, etc). Using the daily returns from part b), calculate the arithmetic daily average return for Stock A and Stock B? Using the daily returns from part b), calculate the geometric daily average return for Stock A and Stock B? If you take the percentage return calculated for each stock in part a) and divide it by 5, does your answer match either part c) or part (1)? Briefly explain why it does or doesn't match. Using the daily returns from part b) and the arithmetic averages from part c), calculate the standard deviation of daily returns for Stock A and Stock B? Using the Sharpe Ratio, which stock performed better over this time, A or B? Assume the risk- free rate is 5% and uncorrelated with either stock. 2) b) For this question use the information about Stock A and B from question I). particularly the daily returns you calculated in part b). Calculate the covariance and correlation between the returns of Stock A and B. Let's consider 2 portfolios. One portfolio invests 50% in stock A and 50% in stock B. The second portfolio invests 20% in stock A and 80% in stock B. Calculate the expected return and standard deviation of each portfolio (use the arithmetic average). Suppose you have two clients: Meredith and Nancy. Based on surveys you feel Meredith has a risk aversion of A = 2 and Nancy has a risk aversion measure of A = 5. Based on this information, which of the two portfolios from part b) would you recommend for Meredith and Nancy respectively? d) 4) Preferred shares of SSH Inc. currently sell for $50 per share and offer a dividend of $6 per share, which is not expected to change. If Lattice is looking for a 10% return on investment are SSH Inc. shares a good choice? Briey explain. Preferred shares of Wellman Corp. just paid a dividend of $2 per share and the dividend is expected to grow by 5% every year. If the market discount rate on these preferred shares is 15%, what should be the price of a preferred share of Wellman Corp. today? Common shares ofWellman Corp. just paid a dividend of $0.25 per share. Wellman Corp. pays out 40% of its prots to shareholders and currently has an 18% return on equity. If the market discount rate is 15%, what is the price of a common share of Wellman Corp. today? Suppose someone buys Generic Inc. for $5 per share right now. In one year the stock pays out a dividend of$0.15 per share and can be sold for $5.60 per share. What is the annual market discount rate implied these facts? Corporate bonds for UCD Inc. have an annual yield to maturity of 12% and market value of $18,000. Preferred shares of UCD Inc. just paid a dividend of $1 per share and are expected to grow by 2% every year. The market discount rate for UCD Inc. preferred shares is 8% and there are 1000 preferred shares outstanding. Common shares of UCD Inc. currently are $2 per share with 15000 shares outstanding. The market discount rate for common shares is 15%. The tax rate is 20% for all corporations. If historically the P43 ratio is 15 for corporations like UCD Inc. and UCD Inc's most recent prot was $1500, is UCD Inc.'s stock over or under-valued by the market based on the P-E Ratio? Calculate the weighted average cost of capital for UCD Inc. UCD Inc. does not pay dividends on its common shares. It's free cash ow today was $5000. That is projected to increase for the next three years by 10% annually. After that it is only projected to increase by 3% forever after. Calculate the estimated value of UCD Inc. today using the WACC you calculated in part b). What is the estimated share price of UCD Inc. based on your calculation in part c)? Based on the estimated share price of UCD Inc. in part c), is UCD Inc. over- or under-valued? Briey explain. 5) The following is a portfolio of assets owned by a client. Dustin Corp. and Suzie Inc. have a correlation of -0.2 Asset Amount Invested Dustin Corp 3300 Suzie Inc. $400 Risk-Free -$200 Ex Return 8.00% 15.00% 1.00% Calculate the Expected Return of the portfolio. Calculate the standard deviation of returns for the portfolio. Calculate the Sharpe Ratio for this portfolio. Suppose the market (S&P 500) is currently expected to return 9% and the standard deviation of returns is 15%. What is the Sharpe Ratio for the market? Based on this information is the portfolio of the client doing well relative to the market or not? Suppose the client has a risk-aversion parameter of A = 4. Is this a good portfolio for your client? Briey explain why or why not. Page 2 of3 Standard Deviation 20.00% 30.00% 0.00%