Answered step by step

Verified Expert Solution

Question

1 Approved Answer

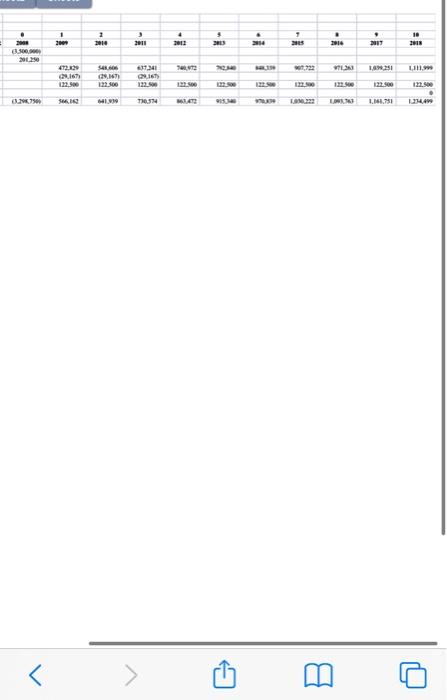

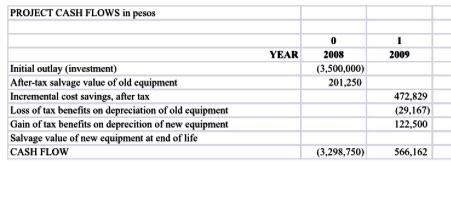

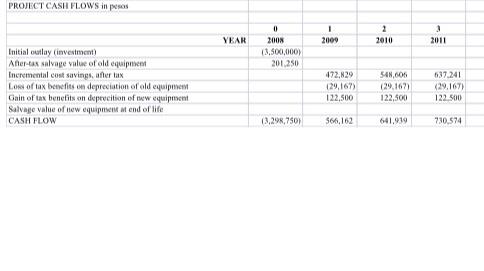

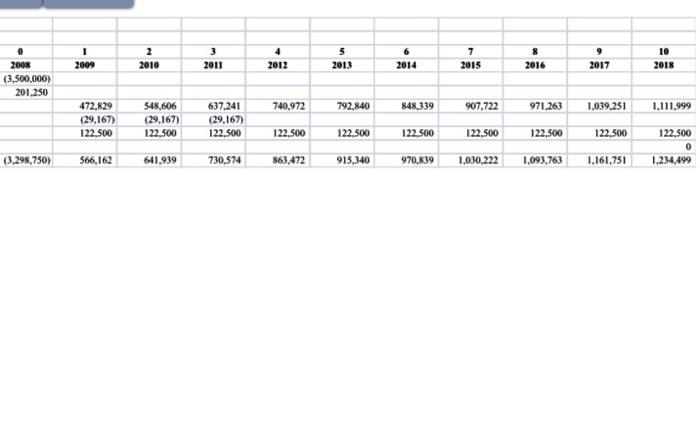

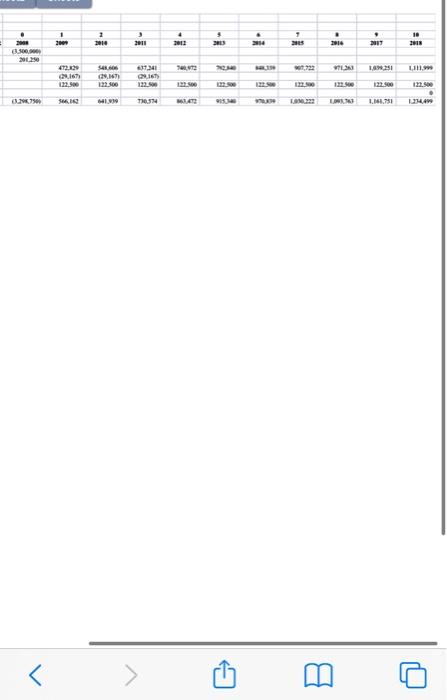

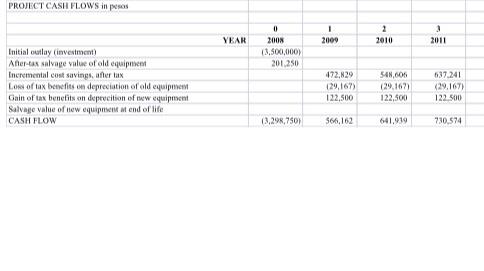

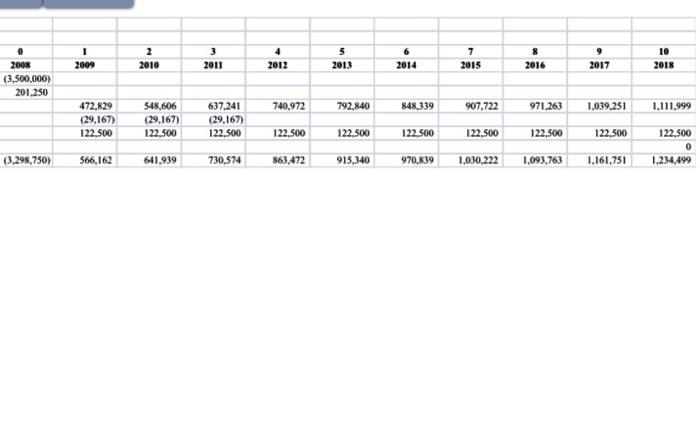

Please, answer the questions on the memorandum using the table and with some calculations. I divided the table because it could not fit. Year 1

Please, answer the questions on the memorandum using the table and with some calculations.

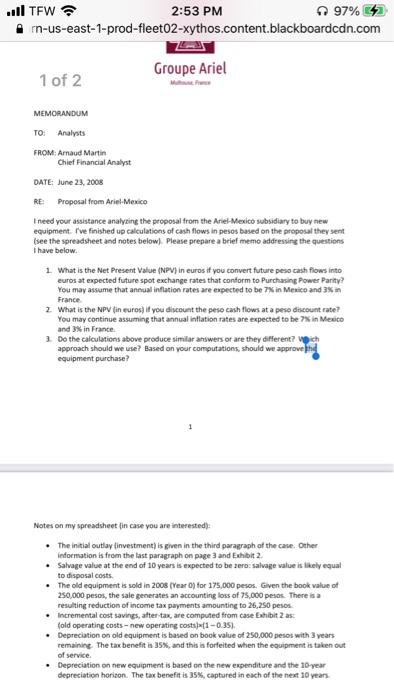

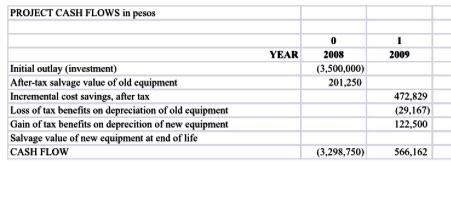

... TFW 2:53 PM 97% -us-east-1-prod-fleet02-xythos.content.blackboardcdn.com Groupe Ariel 1 of 2 MEMORANDUM TO Analysts FROM: Arnaud Martin Chief Financial Analyst DATE: June 23, 2008 RE: Proposal from Ariel-Mexico I need your assistance analyzing the proposal from the Ariel-Mexico subsidiary to buy new equipment. I've finished up calcul ons of cash flows in pesos based on the proposal they sent (see the spreadsheet and notes below). Please prepare a brief memo addressing the questions I have below. 1 What is the Net Present Value (NPV) in euros if you convert future peso cash flows into euros at expected future spot exchange rates that conform to Purchasing Power Parity? You may assume that annual inflation rates are expected to be 7 in Mexico and 3 in France 2. What is the NPV in curos) if you discount the peso cash flows at a peso discount rate? You may continue assuming that annual inflation rates are expected to be in Mexico and 3% in France 1. Do the calculations above produce similar answers or are they different? ich approach should we use? Based on your computations, should we approved equipment purchase? 1 Notes on my spreadsheet in case you are interested): The initial outlay investment) is given in the third paragraph of the case. Other information is from the last paragraph on page 3 and Exhibit 2. Salvage value at the end of 10 years is expected to be zero: salvage value is likely equal to disposal costs. The old equipment is sold in 2008 (Year for 175,000 pesos. Given the book value of 250,000 pesos, the sale generates an accounting loss of 75.000 pesos. There is a resulting reduction of income tax payments amounting to 26,250 pesos Incremental cost savings, after tax, are computed from case Exhibit 2 as: (old operating costs-new operating costs]{1 -0.35) Depreciation on old equipment is based on book value of 250.000 pesos with 3 years remaining. The tax benefit a 35%, and this is forfeited when the equipment is taken out of service Depreciation on new equipment is based on the new expenditure and the 10-year depreciation horizon. The tax benefit is 35%, captured in each of the next 10 years E 1 2014 . 1 2000 f 3 2011 10 HIN TIME PIC 2008 500,00 2015 STER WW SA 9,167) 637,241 VE IR NOT 1111 ON 122.500 HI T10,514 MATE LON33 1 14 I divided the table because it could not fit. Year 1 to year's 10 data is there.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started