Please answer the questions

Please answer the questions

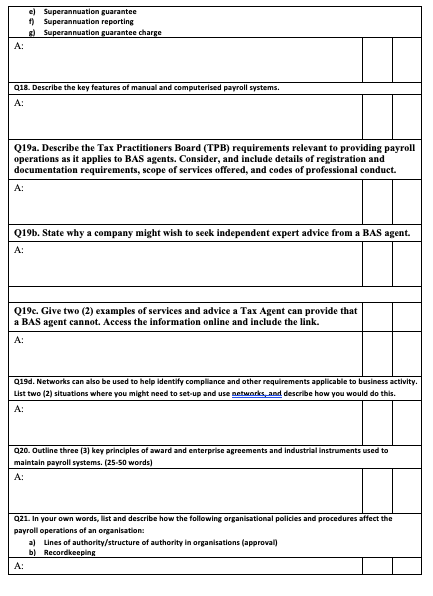

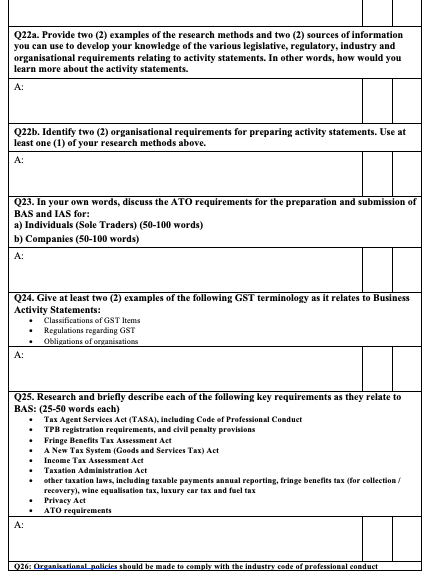

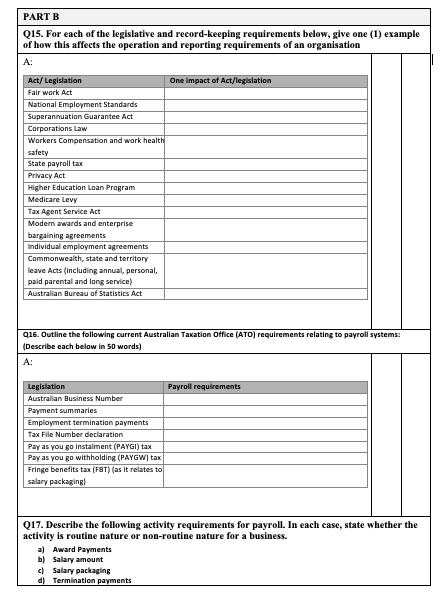

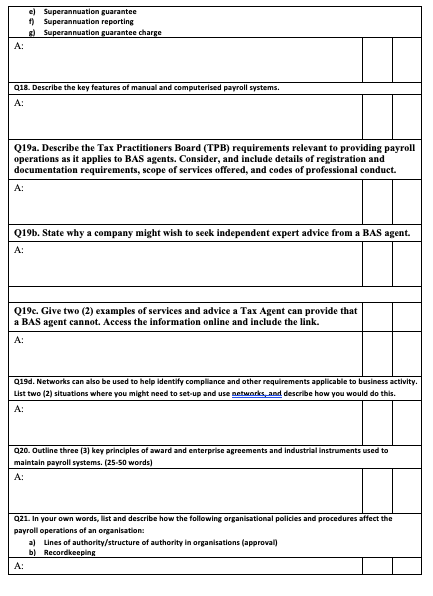

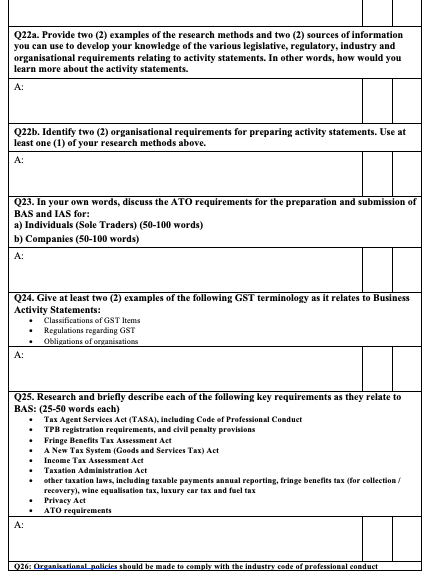

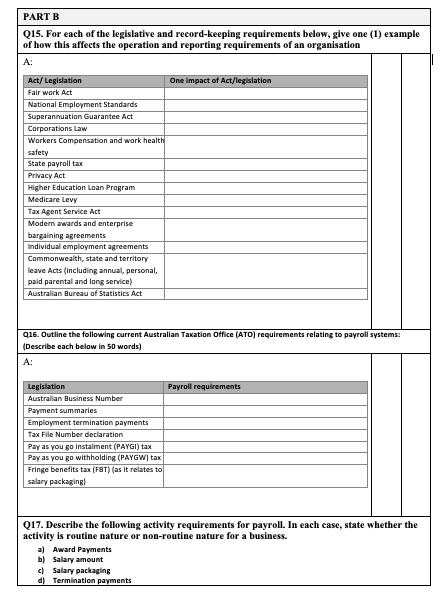

PARTB Q15. For each of the legislative and record-keeping requirements below, give one (1) example of how this affects the operation and reporting requirements of an organisation A: One impact of Act/legislation Act/ Legislation Fair work Act National Employment Standards Superannuation Guarantee Act Corporations Law Workers Compensation and work health safety State payroll tax Privacy Act Higher Education Loan Program Medicare Levy Tax Agent Service Act Modern awards and enterprise bargaining agreements Individual employment agreements Commonwealth, state and territory leave Acts (including annual, personal, paid parental and long service) Australian Bureau of Statistics Act Q16. Outline the following current Australian Taxation Office (ATO) requirements relating to payroll systems: (Describe each below in 50 words) A: Legislation Payroll requirements Australian Business Number Payment summaries Employment termination payments Tax File Number declaration Pay as you go Instalment (PAYGI) tax Pay as you go withholding (PAYGW) tax Fringe benefits tax (FBT) (as it relates to salary packaging Q17. Describe the following activity requirements for payroll. In each case, state whether the activity is routine nature or non-routine nature for a business. a) Award Payments b) Salary amount c) Salary packaging d) Termination payments e) Superannuation guarantee 1) Superannuation reporting Superannuation guarantee charge A: Q18. Describe the key features of manual and computerised payroll systems. A: Q19a. Describe the Tax Practitioners Board (TPB) requirements relevant to providing payroll operations as it applies to BAS agents. Consider, and include details of registration and documentation requirements, scope of services offered, and codes of professional conduct. A: Q19. State why a company might wish to seek independent expert advice from a BAS agent. A: Q19c. Give two (2) examples of services and advice a Tax Agent can provide that a BAS agent cannot. Access the information online and include the link. A: Q19d. Networks can also be used to help identity compliance and other requirements applicable to business activity. List two (2) situations where you might need to set-up and use networks and describe how you would do this. A: 920. Outline three (3) key principles of award and enterprise agreements and Industrial Instruments used to maintain payroll systems. (25-50 words) A: 921. In your own words, list and describe how the following organisational policies and procedures affect the payroll operations of an organisation: a) Lines of authority/structure of authority in organisations (approval) b) Recordkeeping A: Q22a. Provide two (2) examples of the research methods and two (2) sources of information you can use to develop your knowledge of the various legislative, regulatory, industry and organisational requirements relating to activity statements. In other words, how would you learn more about the activity statements. A: Q226. Identify two (2) organisational requirements for preparing activity statements. Use at least one (1) of your research methods above. A: Q23. In your own words, discuss the ATO requirements for the preparation and submission of BAS and IAS for: a) Individuals (Sole Traders) (50-100 words) b) Companies (50-100 words) A: Q24. Give at least two (2) examples of the following GST terminology as it relates to Business Activity Statements: Classifications of GST Items Regulations regarding GST Obligations of organisations A: Q25. Research and briefly describe each of the following key requirements as they relate to BAS: (25-50 words each) Tax Agent Services Act (TASA), including Code of Professional Conduct TPB registration requirements, and civil penalty provisions Fringe Benefits Tax Assessment Act A New Tax System (Goods and Services Tax) Act Income Tax Assessment Act Taxation Administration Act other taxation laws, including taxable payments annual reporting, fringe benefits tax (for collection/ recovery), wine equalisation tax, luxury car tax and fuel tax Privacy Act ATO requirements A: 026: Organisational policies should be made to comply with the industry code of professional conduct PARTB Q15. For each of the legislative and record-keeping requirements below, give one (1) example of how this affects the operation and reporting requirements of an organisation A: One impact of Act/legislation Act/ Legislation Fair work Act National Employment Standards Superannuation Guarantee Act Corporations Law Workers Compensation and work health safety State payroll tax Privacy Act Higher Education Loan Program Medicare Levy Tax Agent Service Act Modern awards and enterprise bargaining agreements Individual employment agreements Commonwealth, state and territory leave Acts (including annual, personal, paid parental and long service) Australian Bureau of Statistics Act Q16. Outline the following current Australian Taxation Office (ATO) requirements relating to payroll systems: (Describe each below in 50 words) A: Legislation Payroll requirements Australian Business Number Payment summaries Employment termination payments Tax File Number declaration Pay as you go Instalment (PAYGI) tax Pay as you go withholding (PAYGW) tax Fringe benefits tax (FBT) (as it relates to salary packaging Q17. Describe the following activity requirements for payroll. In each case, state whether the activity is routine nature or non-routine nature for a business. a) Award Payments b) Salary amount c) Salary packaging d) Termination payments e) Superannuation guarantee 1) Superannuation reporting Superannuation guarantee charge A: Q18. Describe the key features of manual and computerised payroll systems. A: Q19a. Describe the Tax Practitioners Board (TPB) requirements relevant to providing payroll operations as it applies to BAS agents. Consider, and include details of registration and documentation requirements, scope of services offered, and codes of professional conduct. A: Q19. State why a company might wish to seek independent expert advice from a BAS agent. A: Q19c. Give two (2) examples of services and advice a Tax Agent can provide that a BAS agent cannot. Access the information online and include the link. A: Q19d. Networks can also be used to help identity compliance and other requirements applicable to business activity. List two (2) situations where you might need to set-up and use networks and describe how you would do this. A: 920. Outline three (3) key principles of award and enterprise agreements and Industrial Instruments used to maintain payroll systems. (25-50 words) A: 921. In your own words, list and describe how the following organisational policies and procedures affect the payroll operations of an organisation: a) Lines of authority/structure of authority in organisations (approval) b) Recordkeeping A: Q22a. Provide two (2) examples of the research methods and two (2) sources of information you can use to develop your knowledge of the various legislative, regulatory, industry and organisational requirements relating to activity statements. In other words, how would you learn more about the activity statements. A: Q226. Identify two (2) organisational requirements for preparing activity statements. Use at least one (1) of your research methods above. A: Q23. In your own words, discuss the ATO requirements for the preparation and submission of BAS and IAS for: a) Individuals (Sole Traders) (50-100 words) b) Companies (50-100 words) A: Q24. Give at least two (2) examples of the following GST terminology as it relates to Business Activity Statements: Classifications of GST Items Regulations regarding GST Obligations of organisations A: Q25. Research and briefly describe each of the following key requirements as they relate to BAS: (25-50 words each) Tax Agent Services Act (TASA), including Code of Professional Conduct TPB registration requirements, and civil penalty provisions Fringe Benefits Tax Assessment Act A New Tax System (Goods and Services Tax) Act Income Tax Assessment Act Taxation Administration Act other taxation laws, including taxable payments annual reporting, fringe benefits tax (for collection/ recovery), wine equalisation tax, luxury car tax and fuel tax Privacy Act ATO requirements A: 026: Organisational policies should be made to comply with the industry code of professional conduct

Please answer the questions

Please answer the questions