Please answer the questions

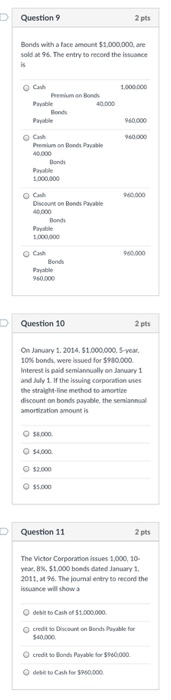

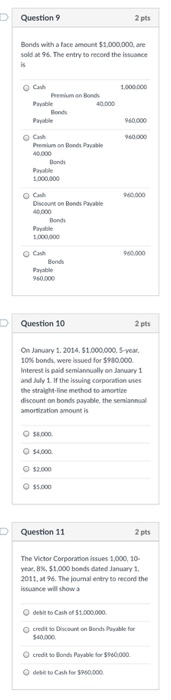

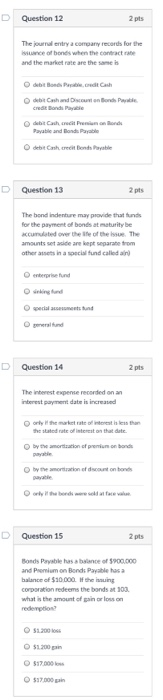

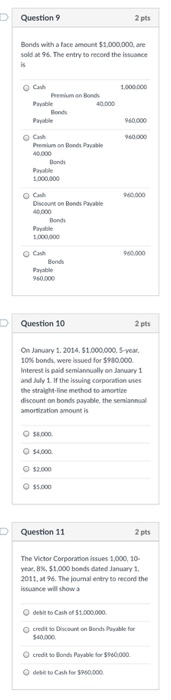

Question 9 2 pts Bonds with a face amount $1.000.000 are sold at96. The entry to record the issuance Premium on Bonds Payable 40,000 Payabile 960,000 960 000 Pemum on Bonds Payable onds Payable 1000,000 Discount on Bands Payable 1000,000 960.000 Bonds Payable | Question 10 2 pts On January 1.2014, $1.000.000, S-year 10% bonds, were issued for $960000 Interest is paid semiannually on January and July 1,If he isuine coporation use the straight-line method to amortize discount on bonds payable, the semiannual $8.000 o$4,000. o $2,000 O $5,000 DQuestion 11 2 pts The Victor Corporation issues 1,000, 10 year, 8%, S1.000 bonds dated January 1 2011, at 96. The journal entry to record the issuance will show a O debit to Cash of $1.000000 O credit to Discount on Bonds Payable for O credit to Bonds Payable for $960,000 O debit to Cash for $960,000 D Question 12 2 pts The journal entry a company records for the unce of bones and the market rate are the same the contract ra D Question 13 2 pts The bond indenture may provide that funds for the payment of bonds at maburity be ccumulated over the e of te se The amounts set acide are kept separabe from other asses in a spocial fund called an) Ospecial auesments und general fund D | Question 14 2 pts The inberest expense recorded on an inberest payment date is increased D Question 15 2 pts Bonds Paysble has a bsiance of 5900000 and Penium on Bonds Payable a balance of $30.000. If the inuing corparation redeems the bonds at 303 what is the amount of ain or losson redemptio $1200gai 517.000 $37000 D Question 16 2 pts When the market rate of interest was 11%, Valley Corporation issued $100.000, 8%, 10-year bonds that pay interest semiannually. Using the straight-line method, the amount of discount or premium to be amortized each interest period would be $4,000 $17.926 $1.293 D Question 17 2 pts One potential advantage of fhnancing corporations through the use of bonds rather than common stock is O the interest on bonds must be paid when the corporation must pay the bonds at maturity the iteest egese ide stie for tax purposes by the corporation O ahigher earnings per share is guaranteed for iting common shareholders DQuestion 18 2 pts A corporation issues for cash $1,000,000 of 10%, 20-year bonds, interest payable annually, at a time when the market rate of interest is 12%. The straight-line method is adopted for the amortization of bond discount or premium. Which of the following statements is true O The amount of the annual interest expense iscompused an 10%ofthe bond carrying amount at the beginning of the year O The amount of the annual interest expense gradually decreases over the life of the O The amount of unamortiaed disco its balance at issuance date to a zero balance at maturity O The bonds will be hsued at a premium