Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer the questions. Soul Flights Inc. has net income of $5,000, total equity of $30,000, total assets of $60,000, and dividends of $1,000. What

Please answer the questions.

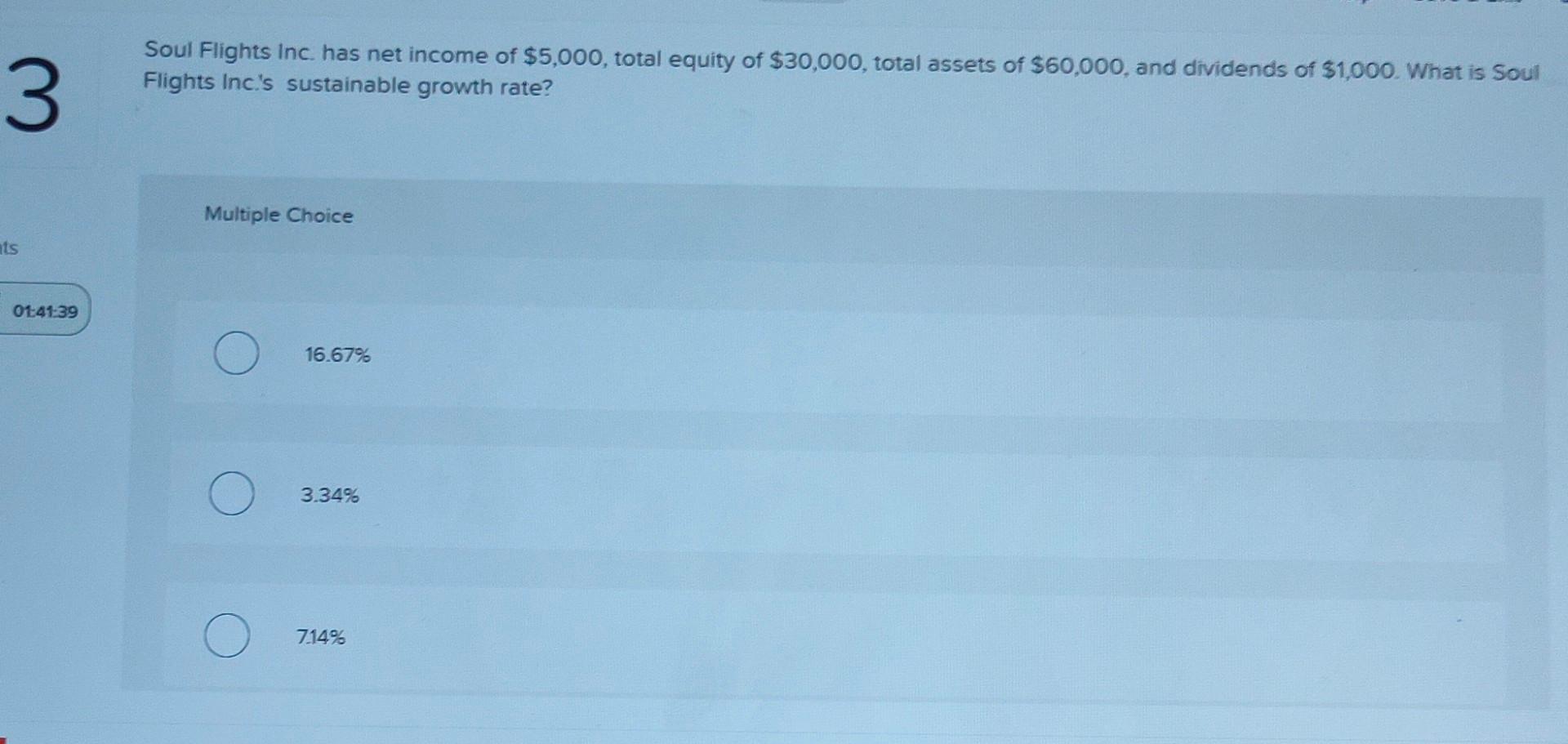

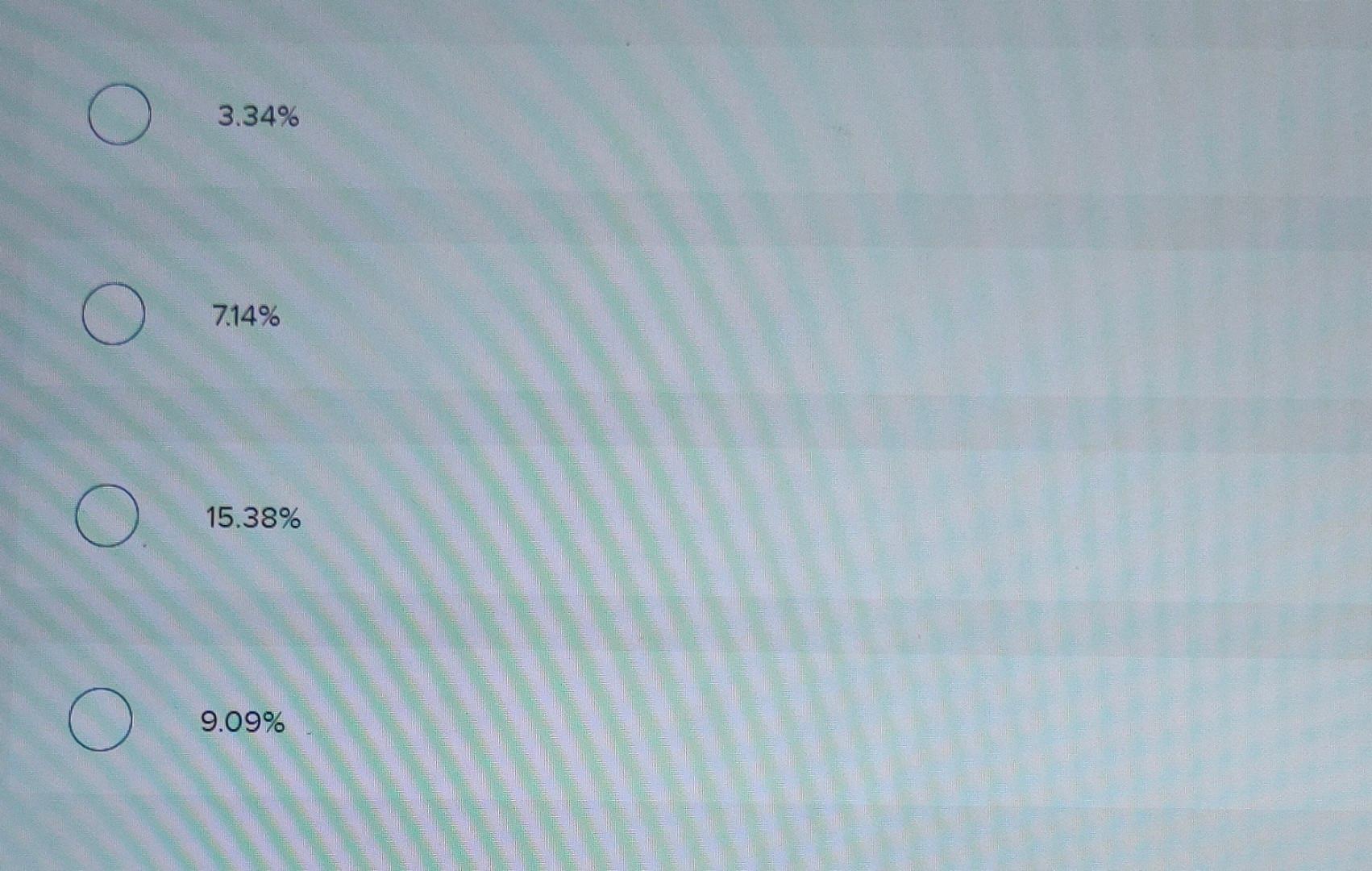

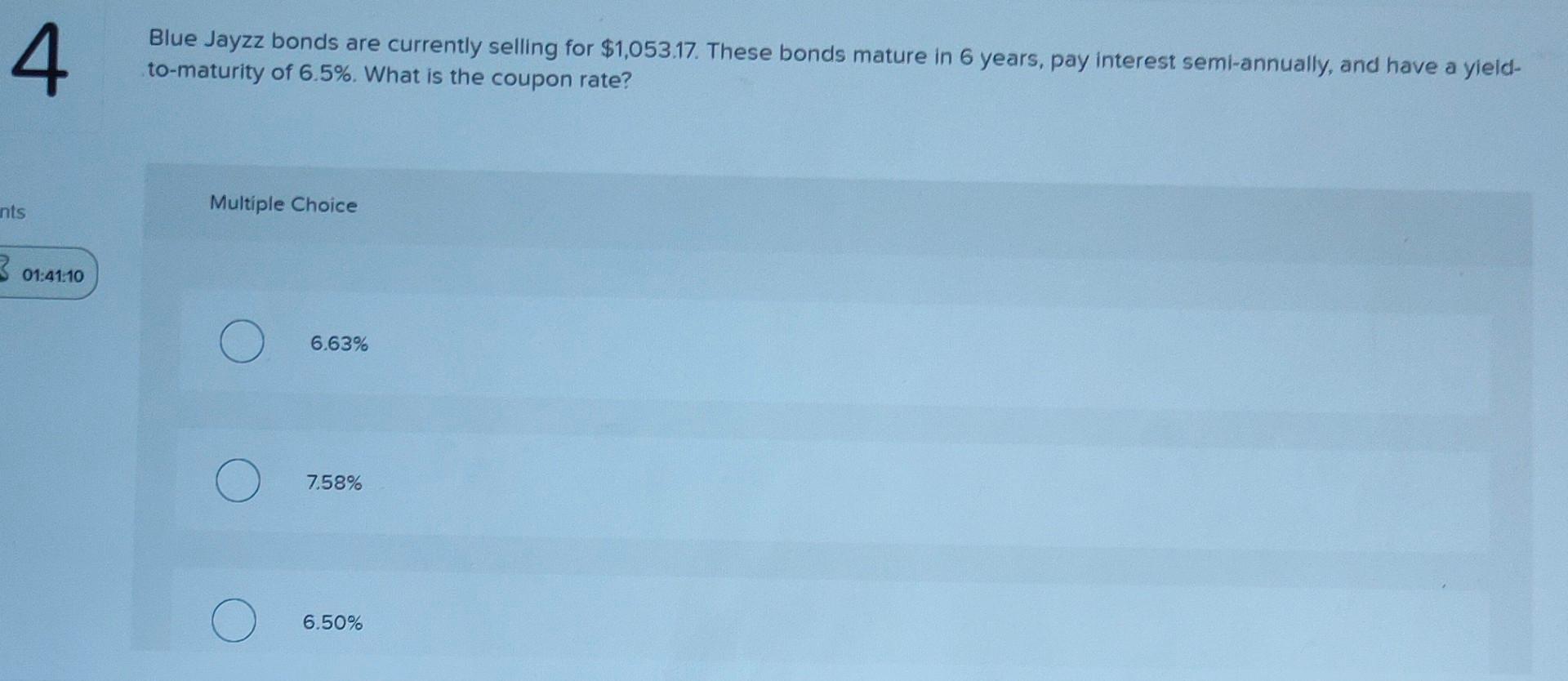

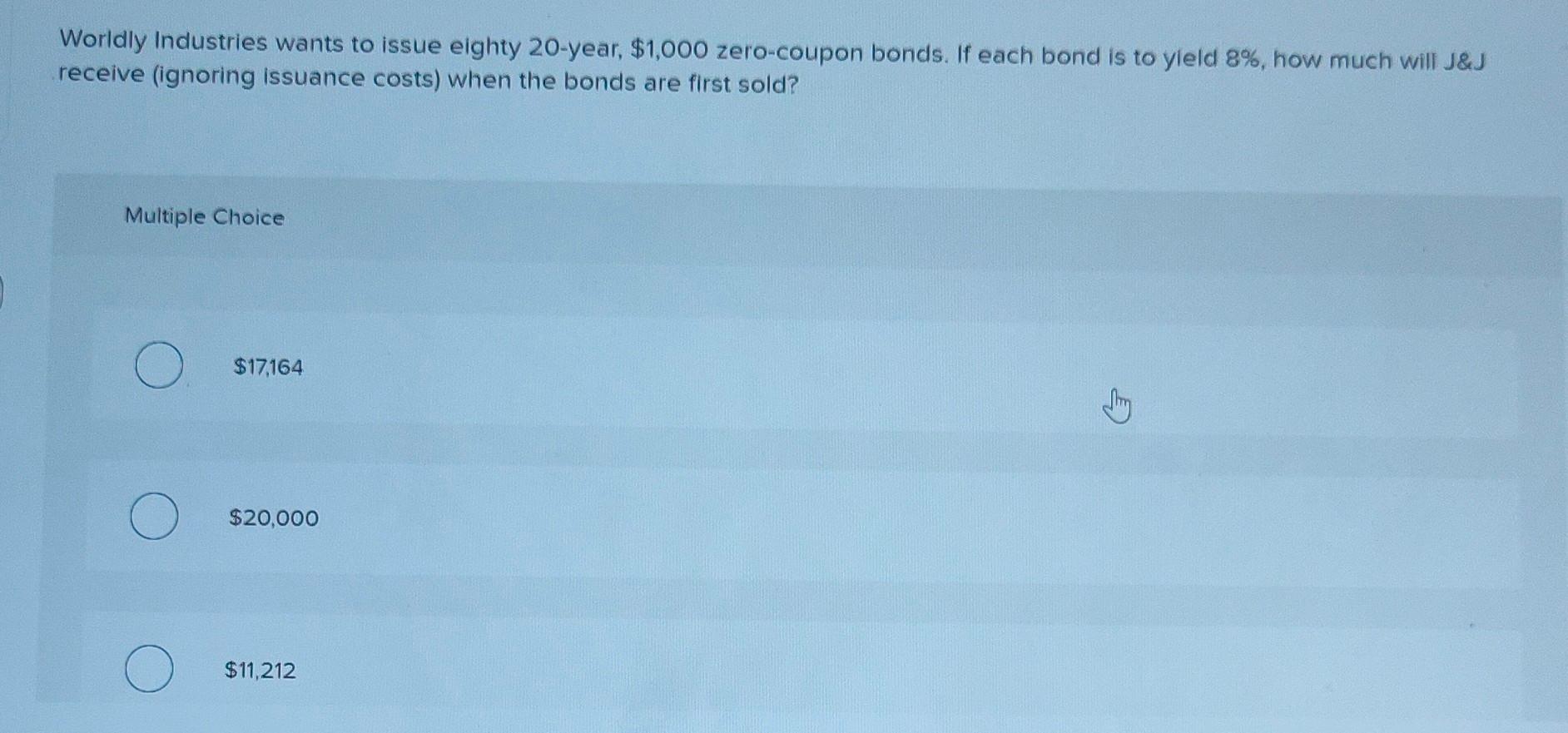

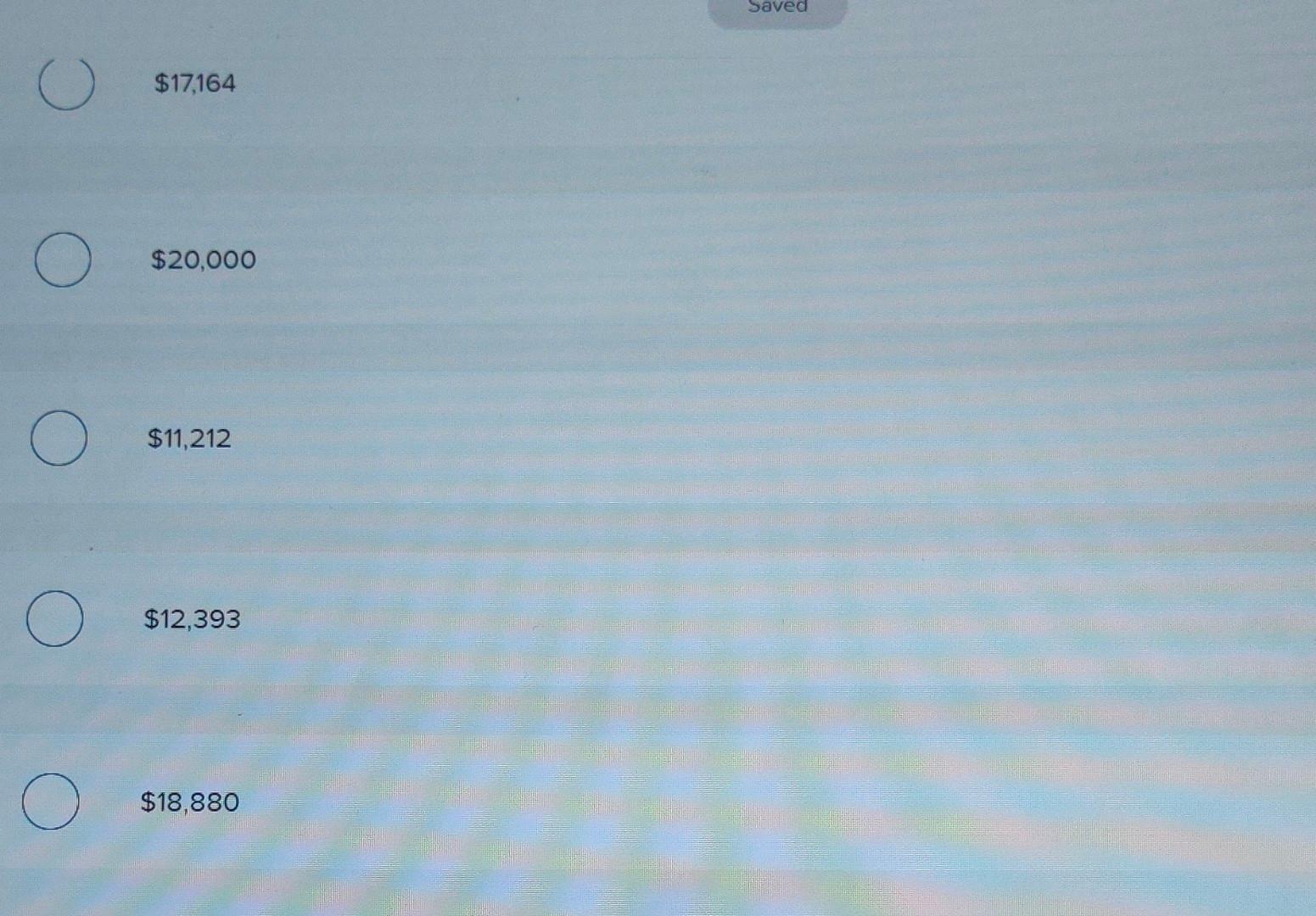

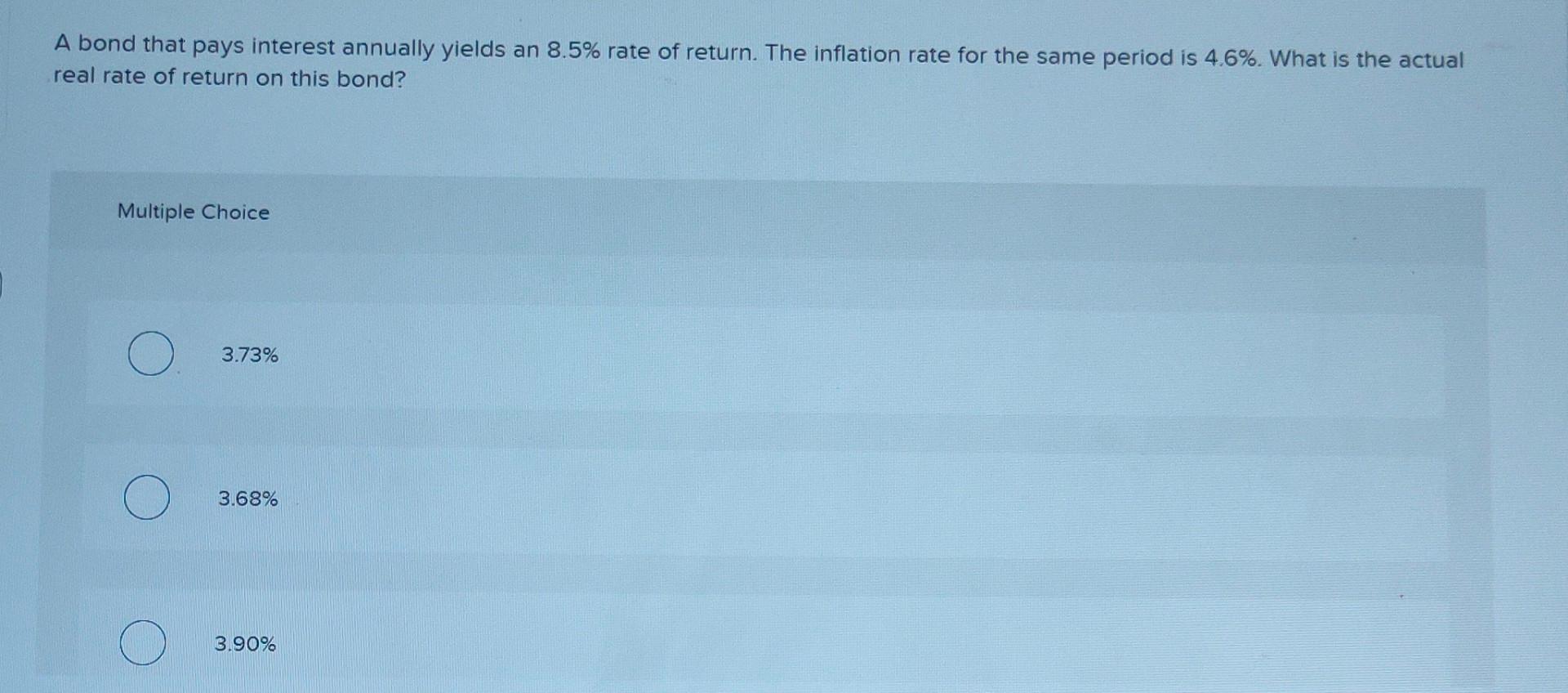

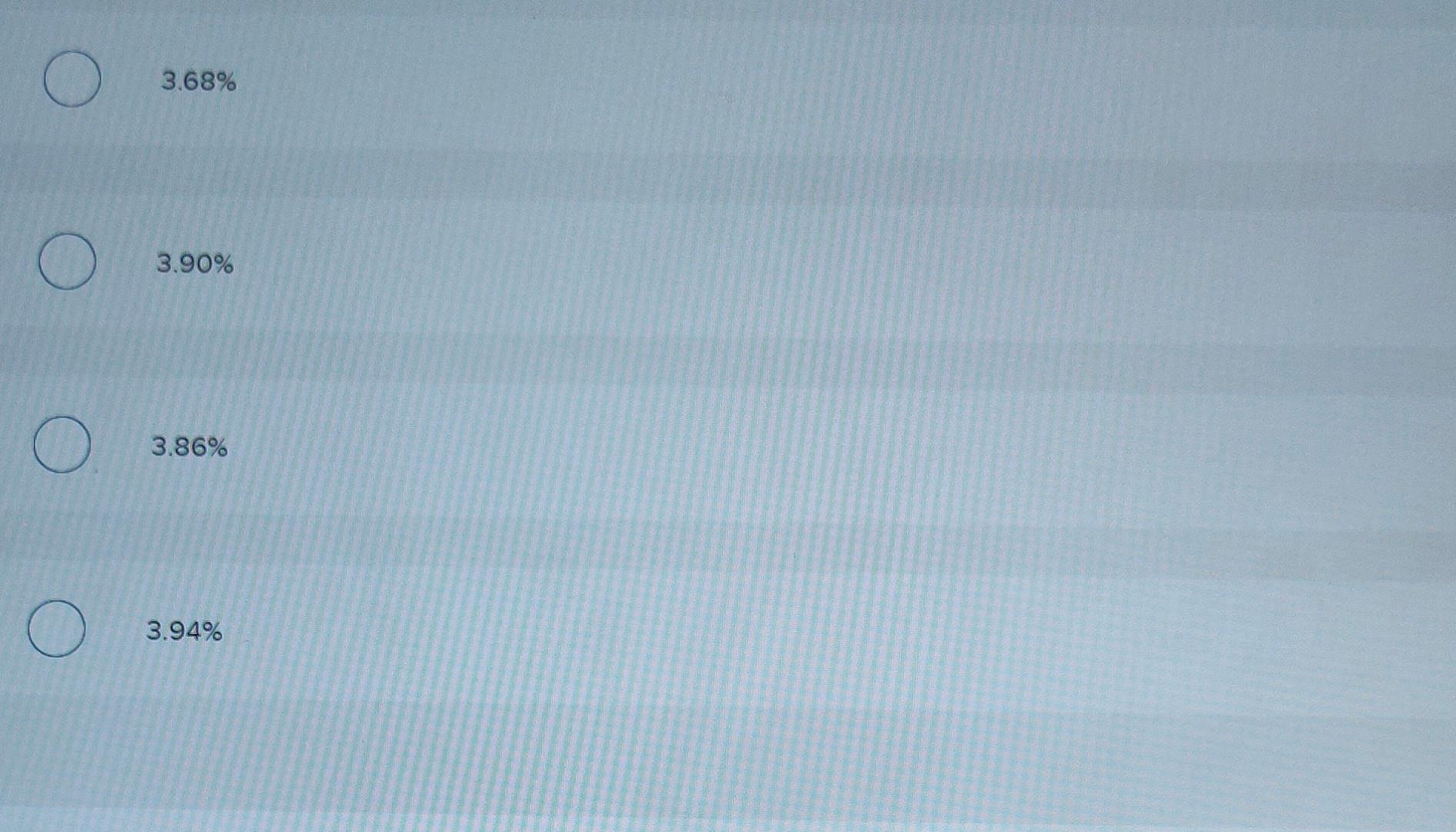

Soul Flights Inc. has net income of $5,000, total equity of $30,000, total assets of $60,000, and dividends of $1,000. What is $0ul Flights Inc.'s sustainable growth rate? Multiple Choice 16.67% 3.34% 7.14\% 3.34% 7.14% 15.38% 9.09% Blue Jayzz bonds are currently selling for $1,053.17. These bonds mature in 6 years, pay interest semi-annually, and have a yieldto-maturity of 6.5%. What is the coupon rate? Multiple Choice 6.63% 7.58% 6.50% 7.58% 6.50% 0% 3.80% Worldly Industries wants to issue eighty 20 -year, $1,000 zero-coupon bonds. If each bond is to yleld 8%, how much will J\&J receive (ignoring issuance costs) when the bonds are first sold? Multiple Choice $17,164 Sim $20,000 $11,212 $17,164 $20,000 $11,212 $12,393 $18,880 A bond that pays interest annually yields an 8.5% rate of return. The inflation rate for the same period is 4.6%. What is the actual real rate of return on this bond? Multiple Choice 3.73% 3.68% 3.90% 3.68% 3.90% 3.86% 3.94%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started