please answer the questions using excel

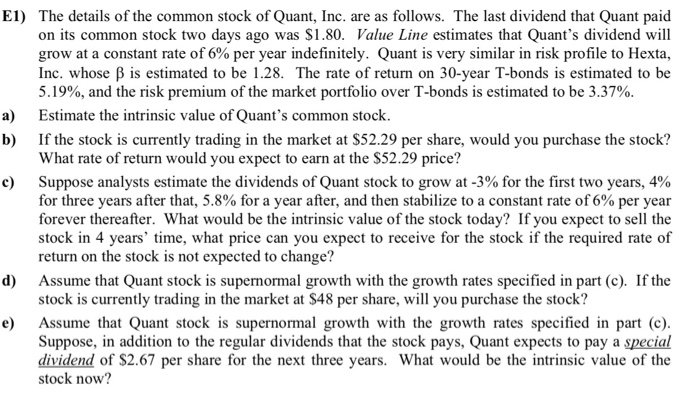

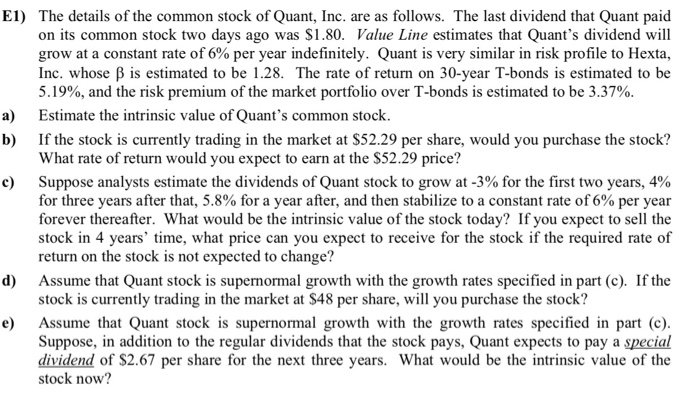

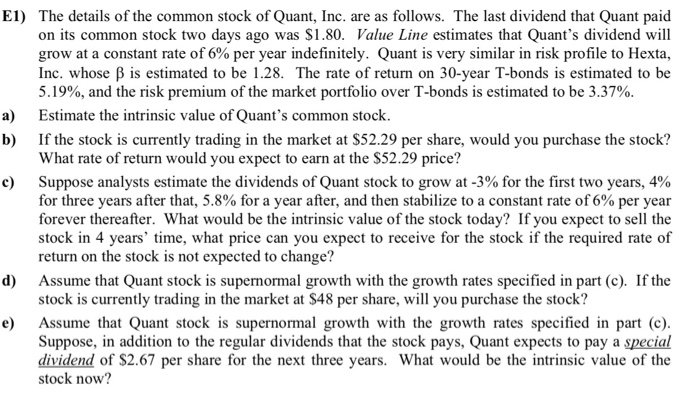

a) E1) The details of the common stock of Quant, Inc. are as follows. The last dividend that Quant paid on its common stock two days ago was $1.80. Value Line estimates that Quant's dividend will grow at a constant rate of 6% per year indefinitely. Quant is very similar in risk profile to Hexta, Inc. whose B is estimated to be 1.28. The rate of return on 30-year T-bonds is estimated to be 5.19%, and the risk premium of the market portfolio over T-bonds is estimated to be 3.37%. Estimate the intrinsic value of Quant's common stock. b) If the stock is currently trading in the market at $52.29 per share, would you purchase the stock? What rate of return would you expect to earn at the $52.29 price? Suppose analysts estimate the dividends of Quant stock to grow at -3% for the first two years, 4% for three years after that, 5.8% for a year after, and then stabilize to a constant rate of 6% per year forever thereafter. What would be the intrinsic value of the stock today? If you expect to sell the stock in 4 years' time, what price can you expect to receive for the stock if the required rate of return on the stock is not expected to change? Assume that Quant stock is supernormal growth with the growth rates specified in part (c). If the stock is currently trading in the market at $48 per share, will you purchase the stock? Assume that Quant stock is supernormal growth with the growth rates specified in part (c). Suppose, in addition to the regular dividends that the stock pays, Quant expects to pay a special dividend of $2.67 per share for the next three years. What would be the intrinsic value of the stock now? e) a) E1) The details of the common stock of Quant, Inc. are as follows. The last dividend that Quant paid on its common stock two days ago was $1.80. Value Line estimates that Quant's dividend will grow at a constant rate of 6% per year indefinitely. Quant is very similar in risk profile to Hexta, Inc. whose B is estimated to be 1.28. The rate of return on 30-year T-bonds is estimated to be 5.19%, and the risk premium of the market portfolio over T-bonds is estimated to be 3.37%. Estimate the intrinsic value of Quant's common stock. b) If the stock is currently trading in the market at $52.29 per share, would you purchase the stock? What rate of return would you expect to earn at the $52.29 price? Suppose analysts estimate the dividends of Quant stock to grow at -3% for the first two years, 4% for three years after that, 5.8% for a year after, and then stabilize to a constant rate of 6% per year forever thereafter. What would be the intrinsic value of the stock today? If you expect to sell the stock in 4 years' time, what price can you expect to receive for the stock if the required rate of return on the stock is not expected to change? Assume that Quant stock is supernormal growth with the growth rates specified in part (c). If the stock is currently trading in the market at $48 per share, will you purchase the stock? Assume that Quant stock is supernormal growth with the growth rates specified in part (c). Suppose, in addition to the regular dividends that the stock pays, Quant expects to pay a special dividend of $2.67 per share for the next three years. What would be the intrinsic value of the stock now? e)