please answer the questions with what given

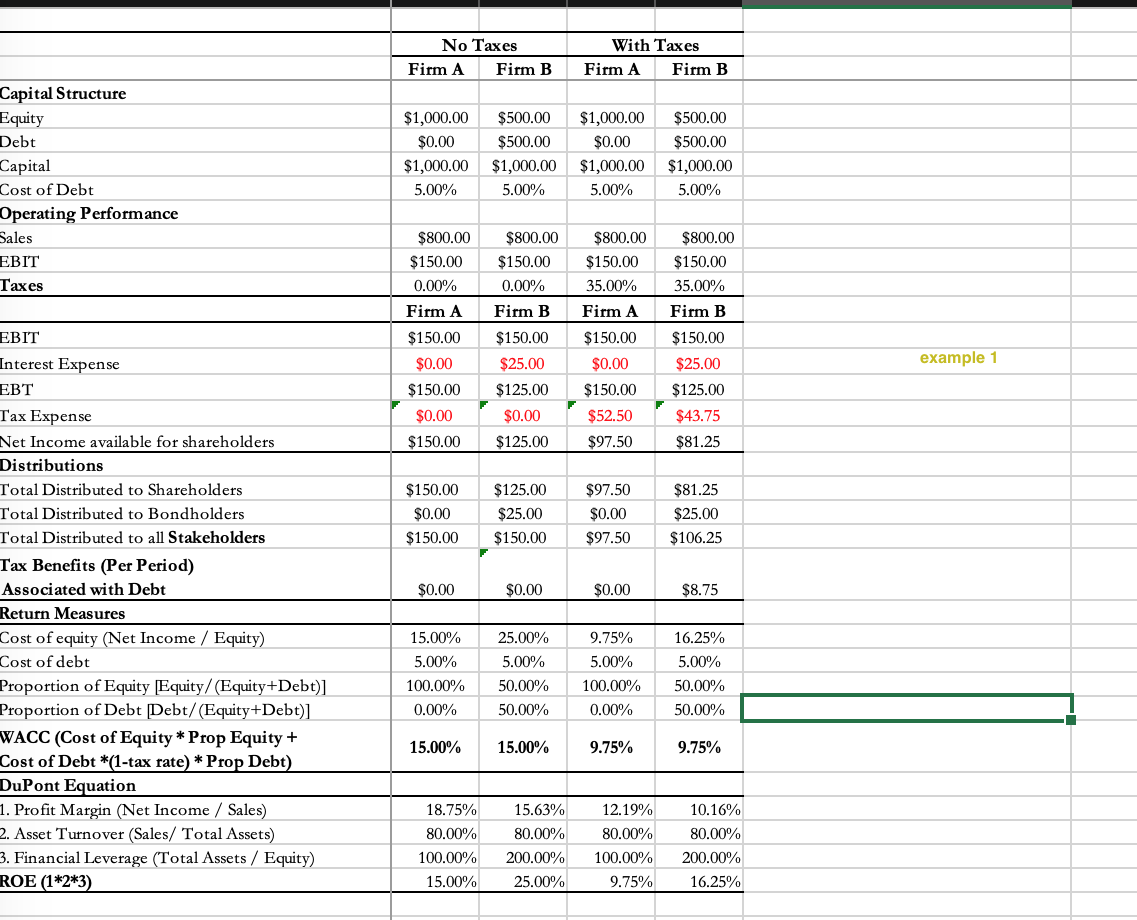

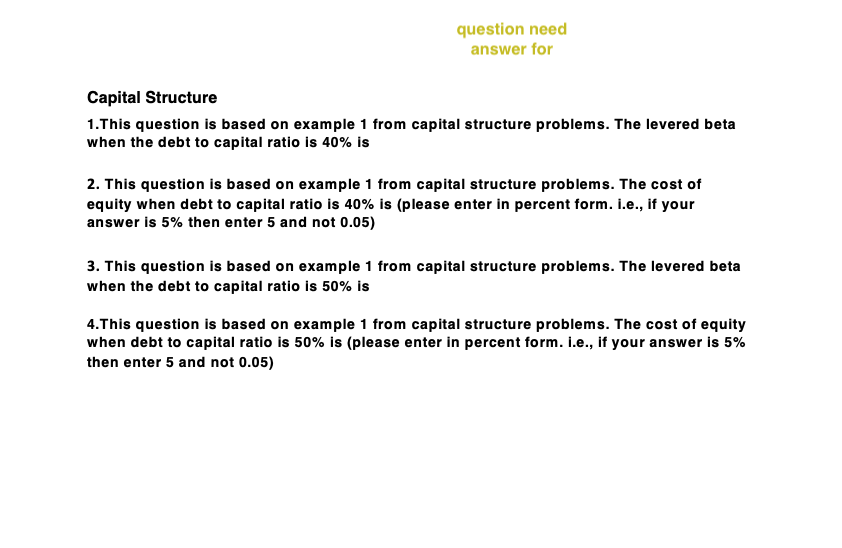

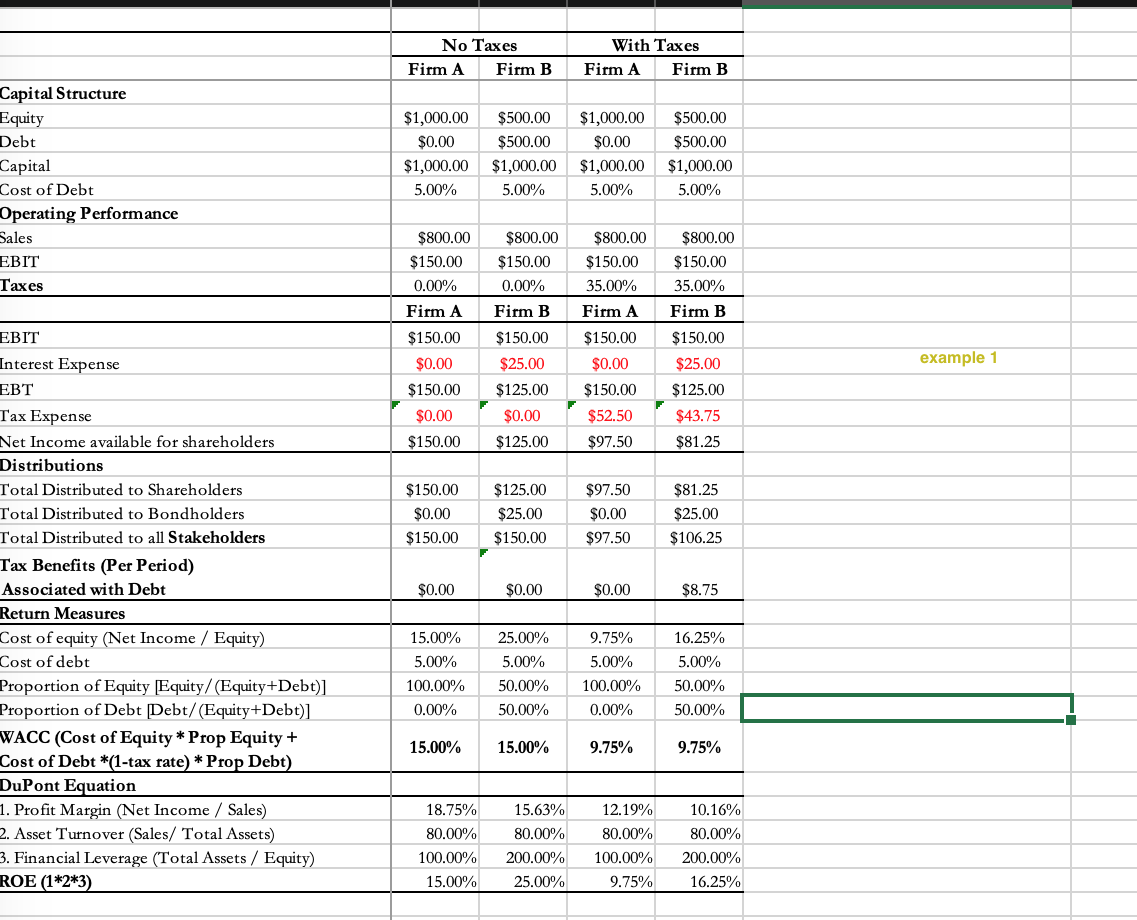

No Taxes Firm A Firm With Taxes Firm A Firm B B Capital Structure Equity Debt Capital Cost of Debt Operating Performance Sales EBIT Taxes $1,000.00 $0.00 $1,000.00 5.00% $500.00 $500.00 $1,000.00 5.00% $1,000.00 $0.00 $1,000.00 5.00% $500.00 $500.00 $1,000.00 5.00% $800.00 $150.00 0.00% Firm A $150.00 $0.00 $150.00 $0.00 $150.00 $800.00 $150.00 0.00% Firm B $150.00 $25.00 $125.00 $0.00 $125.00 $800.00 $150.00 35.00% Firm A $150.00 $0.00 $150.00 $52.50 $97.50 $800.00 $150.00 35.00% Firm B $150.00 $25.00 $125.00 $43.75 $81.25 example 1 $150.00 $0.00 $150.00 $125.00 $25.00 $150.00 $97.50 $0.00 $97.50 $81.25 $25.00 $106.25 $0.00 $0.00 $0.00 $8.75 EBIT Interest Expense Tax Expense Net Income available for shareholders Distributions Total Distributed to Shareholders Total Distributed to Bondholders Total Distributed to all Stakeholders Tax Benefits (Per Period) Associated with Debt Return Measures Cost of equity (Net Income / Equity) Cost of debt Proportion of Equity Equity/(Equity+Debt)] Proportion of Debt Debt/(Equity+Debt)] WACC (Cost of Equity * Prop Equity + Cost of Debt *(1-tax rate) * Prop Debt) DuPont Equation 1. Profit Margin (Net Income / Sales) 2. Asset Turnover (Sales/ Total Assets) 3. Financial Leverage (Total Assets / Equity) ROE (1*2*3) 15.00% 5.00% 100.00% 25.00% 5.00% 50.00% 50.00% 9.75% 5.00% 100.00% 0.00% 16.25% 5.00% 50.00% 50.00% 0.00% 15.00% 15.00% 9.75% 9.75% 18.75% 80.00% 100.00% 15.00% 15.63% 80.00% 200.00% 25.00% 12.19% 80.00% 100.00% 9.75% 10.16% 80.00% 200.00% 16.25% question need answer for Capital Structure 1.This question is based on example 1 from capital structure problems. The levered beta when the debt to capital ratio is 40% is 2. This question is based on example 1 from capital structure problems. The cost of equity when debt to capital ratio is 40% is (please enter in percent form. I.e., if your answer is 5% then enter 5 and not 0.05) 3. This question is based on example 1 from capital structure problems. The levered beta when the debt to capital ratio is 50% is 4.This question is based on example 1 from capital structure problems. The cost of equity when debt to capital ratio is 50% is (please enter in percent form. i.e., if your answer is 5% then enter 5 and not 0.05) No Taxes Firm A Firm With Taxes Firm A Firm B B Capital Structure Equity Debt Capital Cost of Debt Operating Performance Sales EBIT Taxes $1,000.00 $0.00 $1,000.00 5.00% $500.00 $500.00 $1,000.00 5.00% $1,000.00 $0.00 $1,000.00 5.00% $500.00 $500.00 $1,000.00 5.00% $800.00 $150.00 0.00% Firm A $150.00 $0.00 $150.00 $0.00 $150.00 $800.00 $150.00 0.00% Firm B $150.00 $25.00 $125.00 $0.00 $125.00 $800.00 $150.00 35.00% Firm A $150.00 $0.00 $150.00 $52.50 $97.50 $800.00 $150.00 35.00% Firm B $150.00 $25.00 $125.00 $43.75 $81.25 example 1 $150.00 $0.00 $150.00 $125.00 $25.00 $150.00 $97.50 $0.00 $97.50 $81.25 $25.00 $106.25 $0.00 $0.00 $0.00 $8.75 EBIT Interest Expense Tax Expense Net Income available for shareholders Distributions Total Distributed to Shareholders Total Distributed to Bondholders Total Distributed to all Stakeholders Tax Benefits (Per Period) Associated with Debt Return Measures Cost of equity (Net Income / Equity) Cost of debt Proportion of Equity Equity/(Equity+Debt)] Proportion of Debt Debt/(Equity+Debt)] WACC (Cost of Equity * Prop Equity + Cost of Debt *(1-tax rate) * Prop Debt) DuPont Equation 1. Profit Margin (Net Income / Sales) 2. Asset Turnover (Sales/ Total Assets) 3. Financial Leverage (Total Assets / Equity) ROE (1*2*3) 15.00% 5.00% 100.00% 25.00% 5.00% 50.00% 50.00% 9.75% 5.00% 100.00% 0.00% 16.25% 5.00% 50.00% 50.00% 0.00% 15.00% 15.00% 9.75% 9.75% 18.75% 80.00% 100.00% 15.00% 15.63% 80.00% 200.00% 25.00% 12.19% 80.00% 100.00% 9.75% 10.16% 80.00% 200.00% 16.25% question need answer for Capital Structure 1.This question is based on example 1 from capital structure problems. The levered beta when the debt to capital ratio is 40% is 2. This question is based on example 1 from capital structure problems. The cost of equity when debt to capital ratio is 40% is (please enter in percent form. I.e., if your answer is 5% then enter 5 and not 0.05) 3. This question is based on example 1 from capital structure problems. The levered beta when the debt to capital ratio is 50% is 4.This question is based on example 1 from capital structure problems. The cost of equity when debt to capital ratio is 50% is (please enter in percent form. i.e., if your answer is 5% then enter 5 and not 0.05)