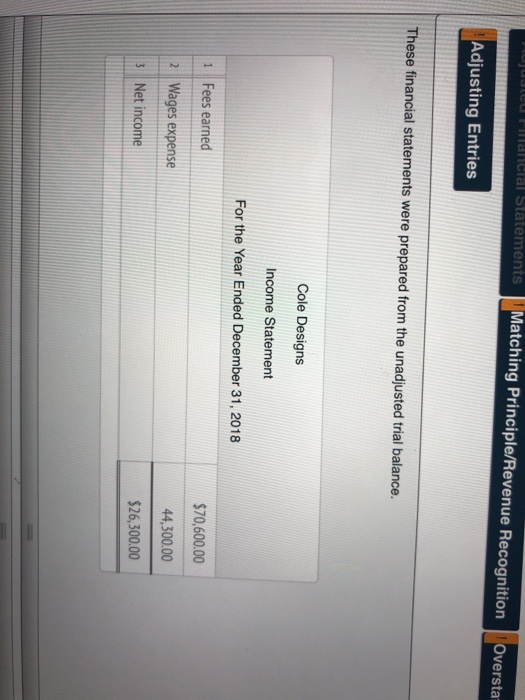

please answer the red boxes. one of the red boxes is not Capital, cash or equipment. the first two boxes are not net income.

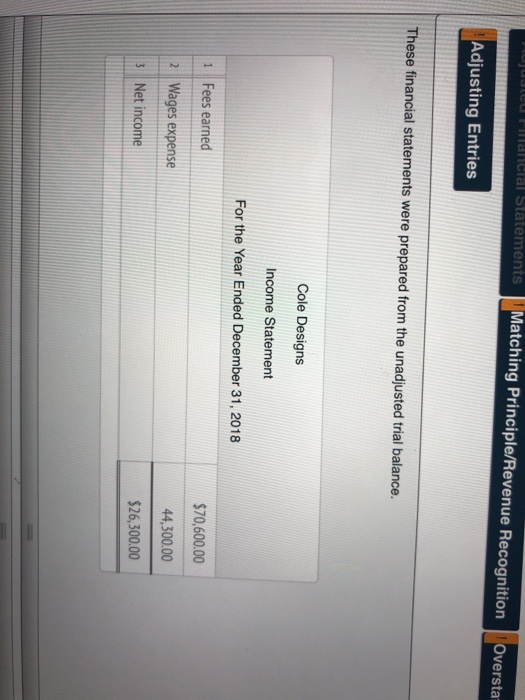

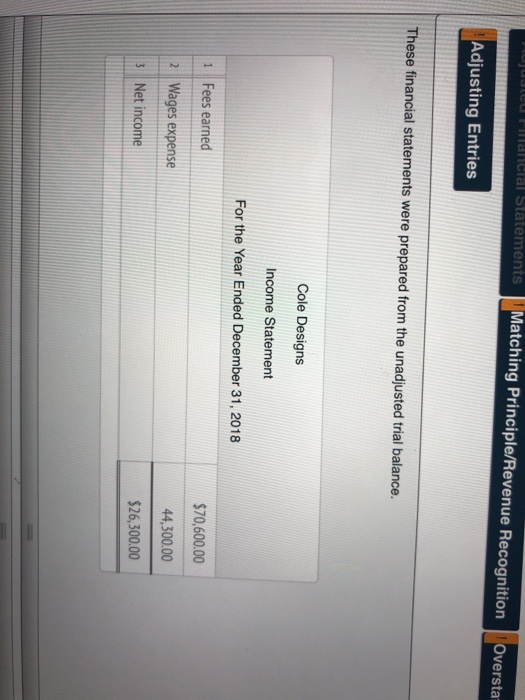

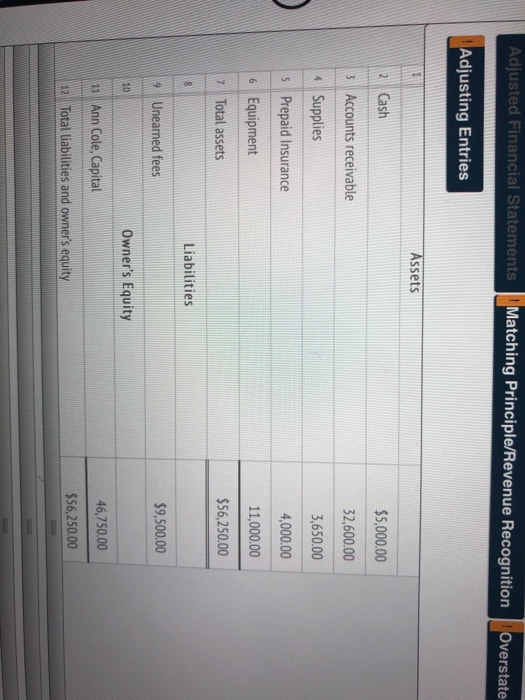

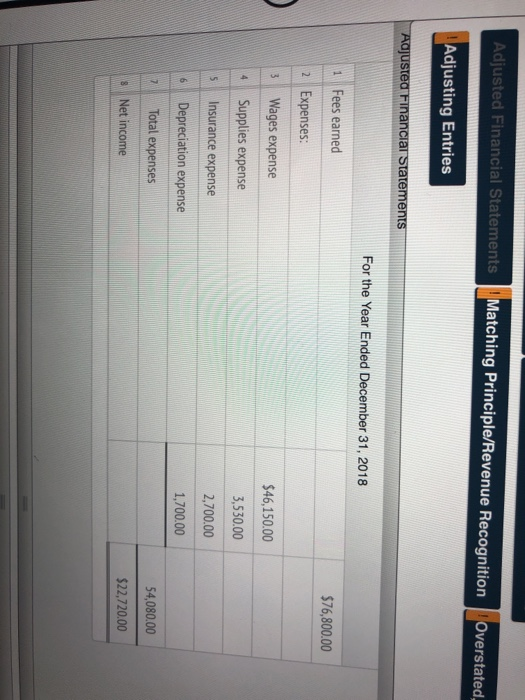

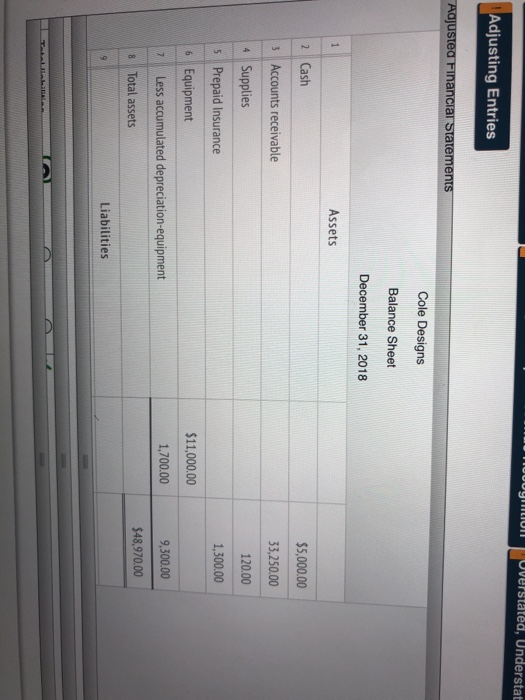

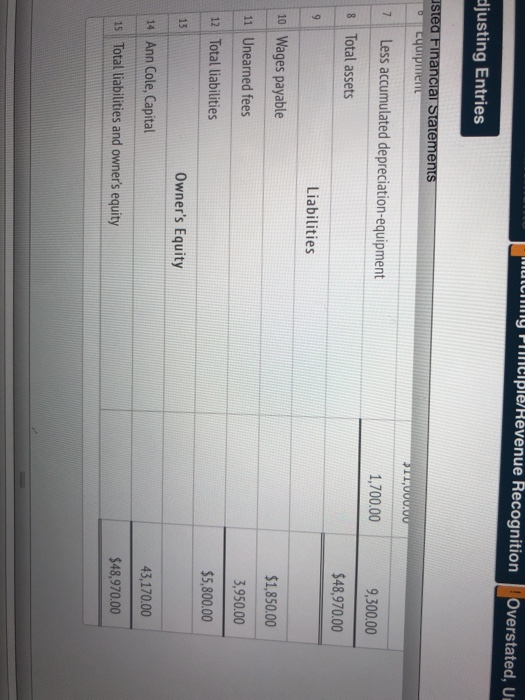

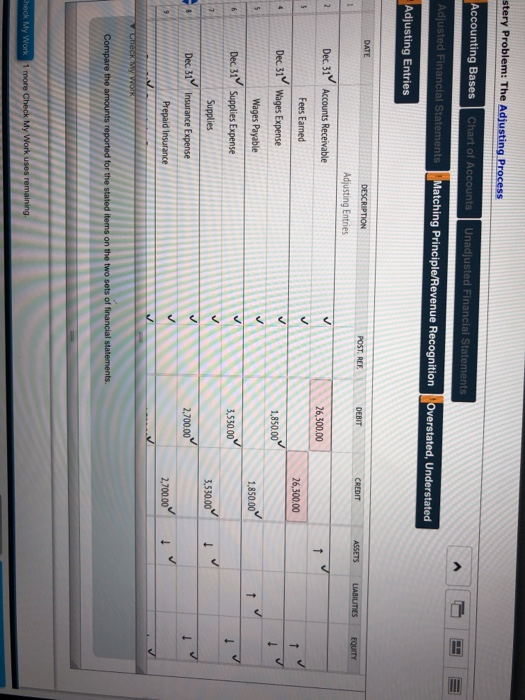

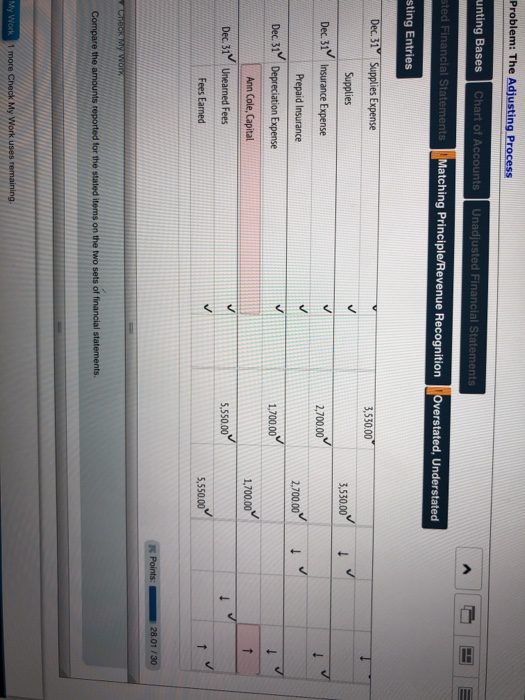

Aujusteu PInancial Statements Matching Principle/Revenue Recognition Oversta- Adjusting Entries These financial statements were prepared from the unadjusted trial balance. Cole Designs Income Statement For the Year Ended December 31, 2018 1 Fees earned $70,600.00 2 Wages expense 44,300.00 3 Net income $26,300.00 Adjusted Financial Statements Matching Principle/Revenue RecognitionOverstate- Adjusting Entries Assets 2 Cash $5,000.00 3 Accounts receivable 32,600.00 4 Supplies 3,650.00 5 Prepaid Insurance 4,000.00 6 Equipment 11,000.00 7 Total assets $56,250.00 Liabilities 9 Unearned fees $9,500.00 10 Owner's Equity 11 Ann Cole, Capital 46,750.00 12 Total liabilities and owner's equity $56,250.00 Adjusted Financial Statements Matching Principle/Revenue Recognition Overstated Adjusting Entries Adjusted Financial Statements For the Year Ended December 31, 2018 1 Fees earned $76,800.00 2 Expenses: 3 Wages expense $46,150.00 Supplies expense 3,530.00 4. Insurance expense 2,700.00 15 Depreciation expense 1,700.00 54,080.00 Total expenses $22,720.00 s Net income 1. Ho0ogiition Overstated, Understat Adjusting Entries Adjusted Financiar Statements Cole Designs Balance Sheet December 31, 2018 Assets 2 Cash $5,000.00 3 Accounts receivable 33,250.00 4 Supplies 120.00 5 Prepaid Insurance 1,300.00 6 Equipment $11,000.00 1,700.00 9,300.00 Less accumulated depreciation-equipment $48,970.00 8 Total assets Liabilities Tatellialbilitinn mutcing PiMlelple/Revenue Recognition Overstated, U djusting Entries usted Financial Statements tquipment I1,000.00 7. Less accumulated depreciation-equipment 1,700.00 9,300.00 8 Total assets $48,970.00 Liabilities 10 Wages payable $1,850.00 11 Unearned fees 3,950.00 12 Total liabilities $5,800.00 13 Owner's Equity 14 Ann Cole, Capital 43,170.00 15 Total liabilities and owner's equity $48,970.00 stery Problem: The Adjusting Process Accounting Bases Chart of Accounts Unadjusted Financial Statements Adjusted Financial Statements Matching Principle/Revenue Recognition overstated, Understated Adjusting Entries DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Adjusting Entries Dec. 31 Accounts Receivable 26,300.00 Fees Earned 26,300.00 Dec 31 Wages Expense 1,850.00 Wages Payable 1,850.00 Dec. 31 Supplies Expense 3,530.00 Supplies 3,530.00 Dec 31 Insurance Expense 2,700.00 Prepaid Insurance 2,700.00 Check My WorK Compare the amounts reported for the stated items on the two sets of financial statements. Check My Work 1 more Check My Work uses remaining. Problem: The Adjusting Process unting Bases Chart of Accounts Unadjusted Financial Statements sted Financial Statements Matching Principle/Revenue RecognitionOverstated, Understated sting Entries Dec. 31 Supplies Expense 3,530.00 Supplies 3,530.00 Dec. 31 Insurance Expense 2,700.00 Prepaid Insurance 2,700.00 Dec. 31 Depreciation Expense 1,700.00 Ann Cole, Capital 1,700.00 Dec. 31 Unearned Fees 5,550.00 Fees Earned 5,550.00 Points: 28.01 /30 Check My Work Compare the amounts reported for the stated items on the two sets of financial statements. My Work 1 more Check My Work uses remaining