please answer the required questions in a nice format

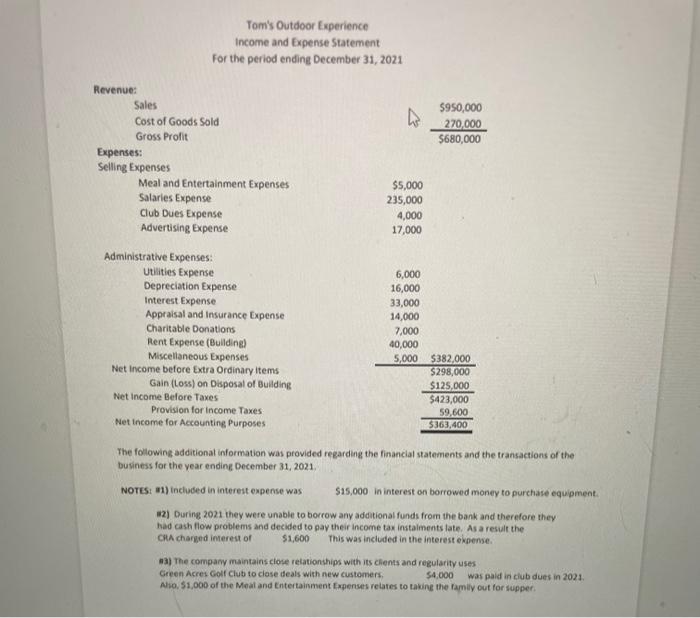

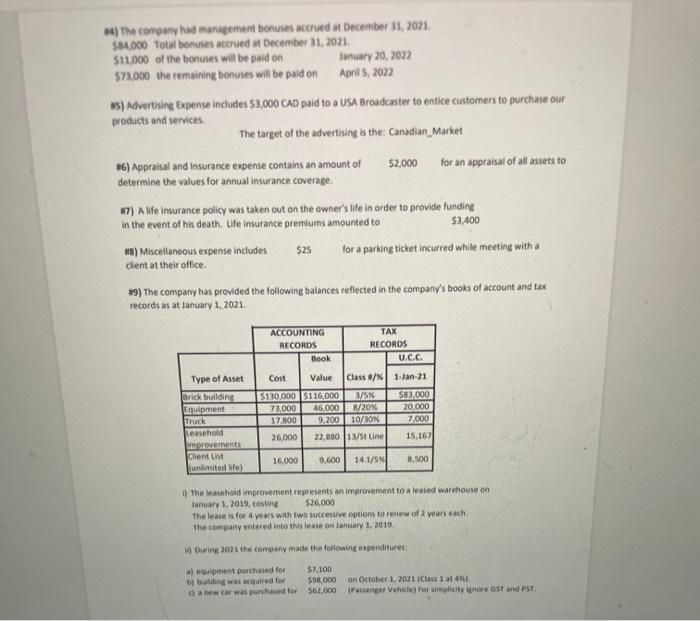

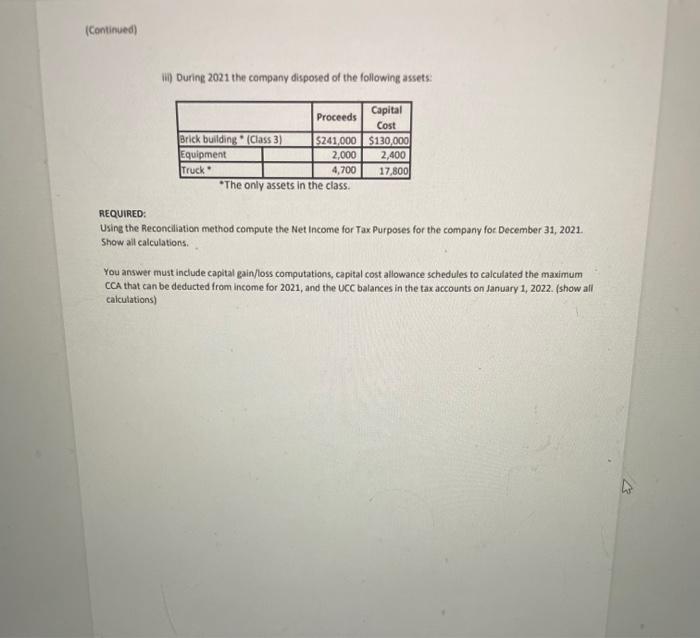

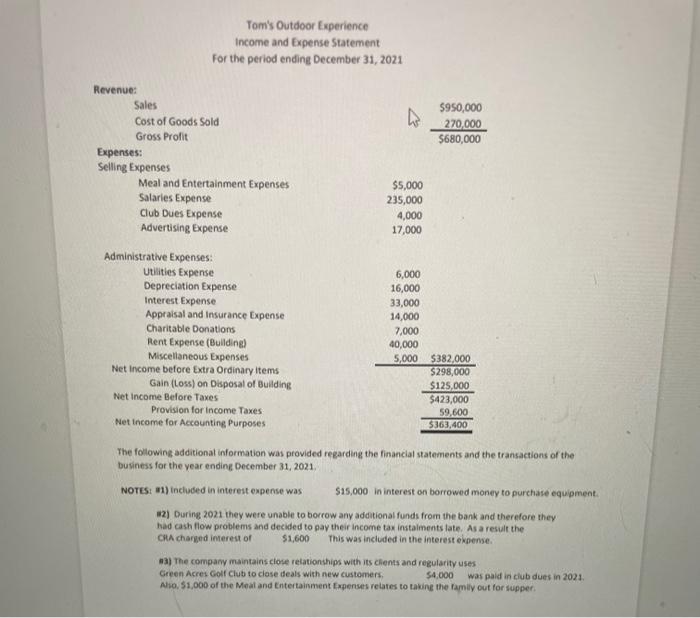

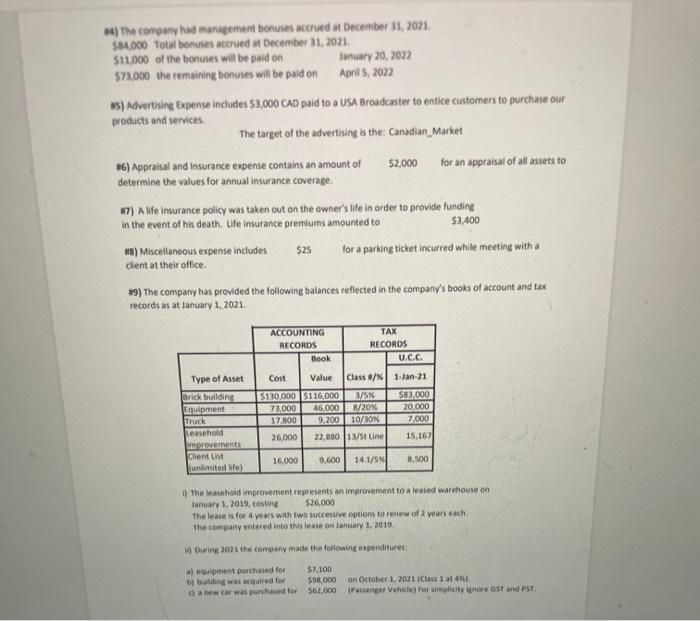

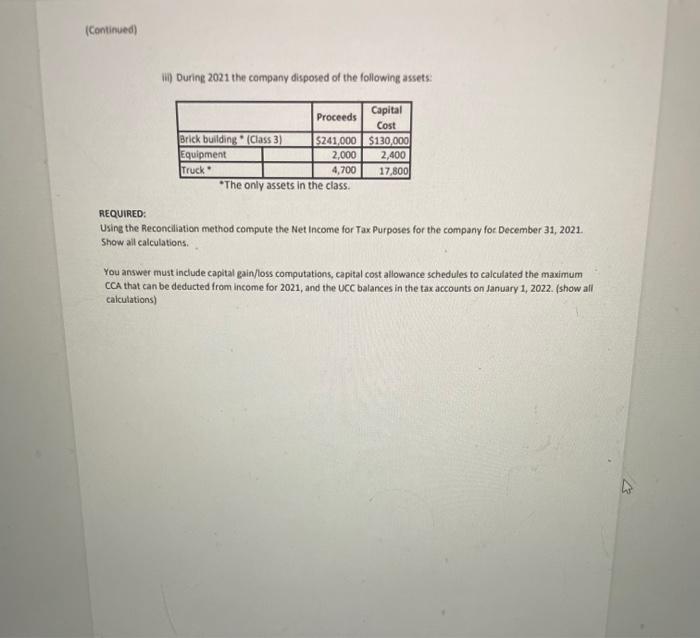

Tom's Outdoor Experience income and Expense statement For the period ending December 31,2021 The folowing additional information was provided regarding the financial statements and the transactions of the business for the year ending December 31,2021 NOTES: a1) inclubed in intereut expense was 515,000 in interest on borrowed money to purchase equipment. m2) During 2021 they were unable to borrow any addional funds from the bank and therefore they had cash flow problems and decided to gay their income tax instalments late. As a result the cith charged inerest of 51,600 This was included in the interest ekgense. 83) The company maintains ciose relationships with its clients and regularify uses Green Acres Golf Club to ciase deals with new customers, 54000 was paid in ciub dues in 2021. Aio. 51,000 of the Moat and Entertainment Expenses relates to tavine the family out for supper. 84) The company had manatement bonules acerued at December 31. 2011. Se4.000 Totar bonuses accrued at December 31. 2021. $11,000 of the bontnes will be paid on January 20,2022 \$73,000 the remaining bonuses will be paid on April 5, 2022 E5) Advertising Expense includes 53,000CAD paid to a USA Broadcaster to entice customers to purcha products and services. The target of the advertising is the: Canadian_Market 16) Appraisal and lnsurance expense contains an amount of 52,000 for an appraisal of all determine the values for annual insurance coverage. 7) A life insurance policy was taken out on the owner's life in order to provide funding in the event of his death. Ufe insurance premiums amounted to 53,400 i8) Miscellaneous expense includes $25 for a parking ticket incurred while meetins with a clent at their office. 59) The company has provided the following balances reflected in the company's books of account and records as at lanuary 1,2021. 1) The learehold improvement represents an improvement to a leased warehosse on lanuary 1,2019 , cesting 526,000 the lease is for 4 years wat two woccesive options to renew of 2 vears each. the company entered into this leace on lancary 1,2019. 1. buring zeat the conwany made the following expenditures: a) equipmeet purchased for 57,100 b) buldies was acouired for 59i.,000 on october 1. 2023 iclans 1 at 4N). ci a new cat was porchased for 562,000 (Paskrnger Vehicle) for simpenity ienere est and FSr. iin) During 2021 the company disposed of the following assets: me ony assets in the crass. REQUIRED: Using the Reconciliation method compute the Net Income for Tax Purposes for the company foc December 31, 2021. Show all calculations. You answer must indude capital gain/loss computations, capital cost allowance schedules to calculated the maximum CCA that can be deducted from income for 2021, and the UCC balances in the tax accounts on January 1, 2022. (show all calculations)