Answered step by step

Verified Expert Solution

Question

1 Approved Answer

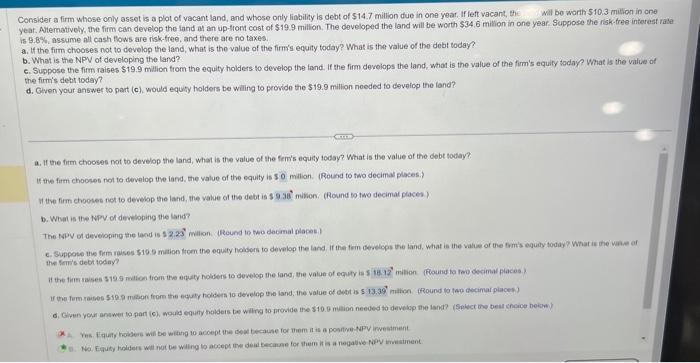

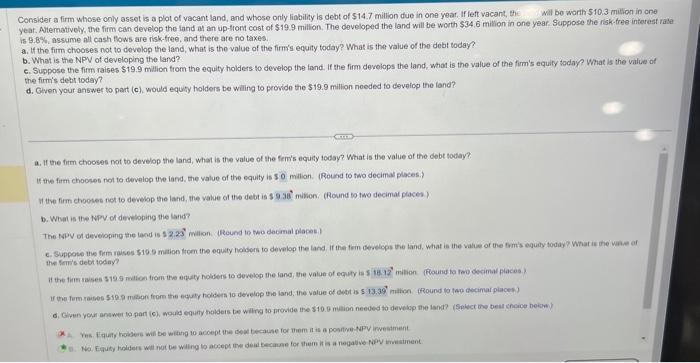

Please answer the second picture based off of the first pictures questions Consider a firm whose only asset is a plot of vacant land, and

Please answer the second picture based off of the first pictures questions

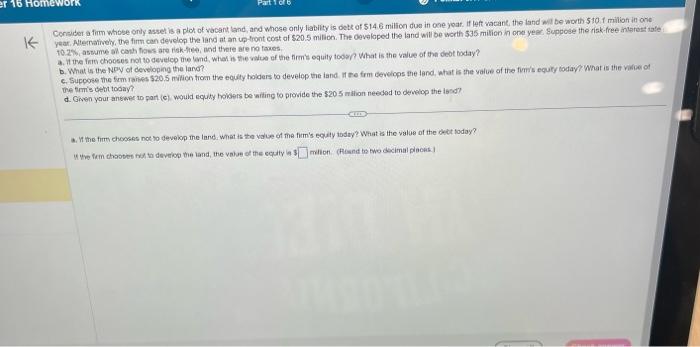

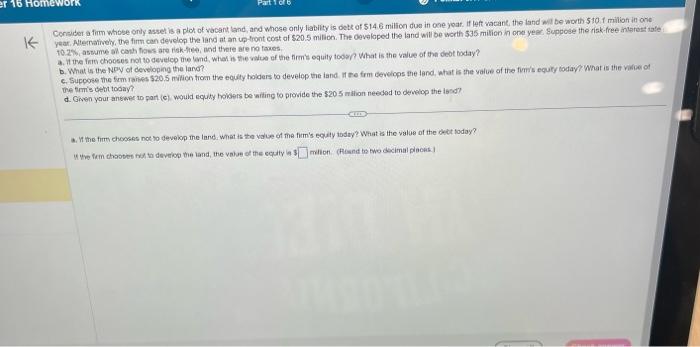

Consider a firm whose only asset is a plot of vacant land, and whose only liobility is debt of $14.7 million due in one year, If left vacant, the year. Altematvely. the firm can develop the land af an up-from cost of $19.9 million. The developed the land will be worth $34.6 million in ane year. Suppose the isk-tree interest rase is 9.8%, assume all cash tlows are risk-tree, and there are no taxes. a. If the firm chooses not to dovelop the land, what is the value of the firms equity today? What is the value of the debt today? b. What is the NPV of developing the land? c. Suppose the firm raises $19.9 milion from the equity holders to develop the fand. If the firm develops the land, whot is the value of the firm's equity today? What is the viliue of the firm's debt 1oday? d. Given your answer to part (c), would equiy halders be wiling to provide the $19.9 million needed to develop the land? a. If the fitm chooses not to develop the land, what is the value of the fern's equily today? What is the value of the debt today? If the firm chooses not to develop the iand, the value of the equity is 50 milion. (Round to two decimal places.) It the firm chootes not to develop the land, the value of the debt is 39.95 mifion. (Round to two decimat places? b. What is the Nopv of developing the land? The tapy of deveioping the land is 52.23 maikn. dRound to tho decmal places.) the fartis debtioday? Consider a firm whose only assel is a plot of vacant land, and whose only labilty is detk of 514.6 milion dun in one yeat. if left wacant, the land wit be worth 5 to 1 milion it ane year. Alerrativeby, the firm can develop the land at an up-tront cost af $20.5 milion. The oevelaped the land will be worth 535 milion in one yees, Suppode the risk-free anlerest iate to.2\%, astumb an cath thass e tigk-lied, and there are no faxes. a. It the fint chooses not to develeo the land, What is the waice of the firm oquity togyn what is the value of the debt hoday? c. Supoote the firm rables 520.5 mition from the equity holders to develop the iand. It the frmt cevelops the land, what is the yalie of the fimtis equity today? What is the vilioe of b. What is the NDy of developing the iand? the timis cett today? d. Gmen your answer io part (c) would equity holbers be aiting to provide the 520.5 m thion needod to dervelop the lasd? a. It the firm chooses not ro develop the landi. What is the value of the fimis egaly todny? What ia the vilae of the chot today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started