Answered step by step

Verified Expert Solution

Question

1 Approved Answer

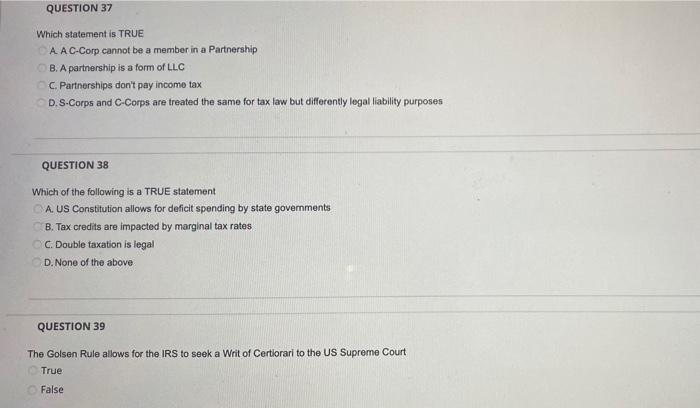

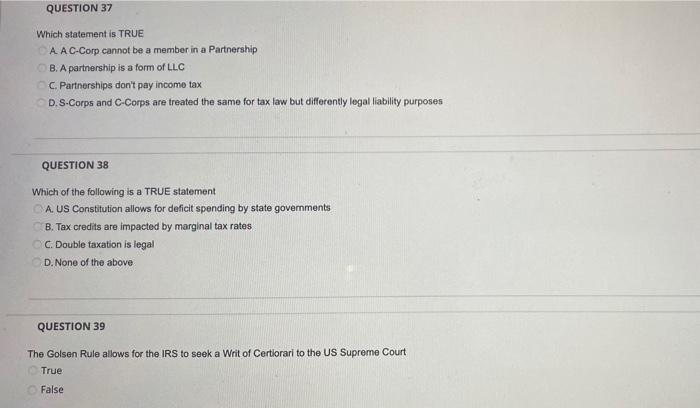

please answer the three questions! Thank you! i will give rating! QUESTION 37 Which statement is TRUE A AC-Corp cannot be a member in a

please answer the three questions! Thank you! i will give rating!

QUESTION 37 Which statement is TRUE A AC-Corp cannot be a member in a Partnership B. A partnership is a form of LLC Partnerships don't pay income tax D.S-Corps and C-Corps are treated the same for tax law but differently legal liability purposes QUESTION 38 Which of the following is a TRUE statement A. US Constitution allows for deficit spending by state governments B. Tax credits are impacted by marginal tax rates C. Double taxation is legal D. None of the above QUESTION 39 The Golsen Rule allows for the IRS to seek a Writ of Certiorarl to the US Supreme Court True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started