Answered step by step

Verified Expert Solution

Question

1 Approved Answer

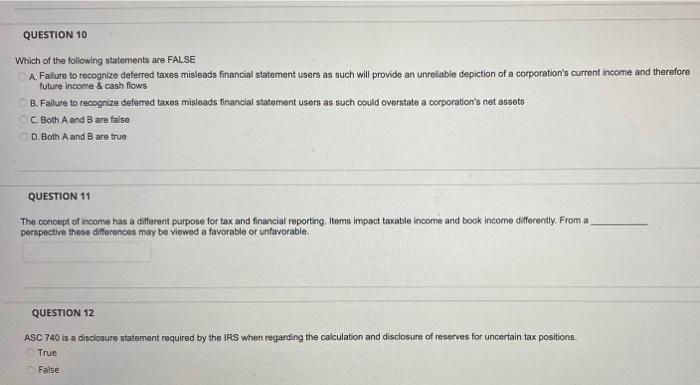

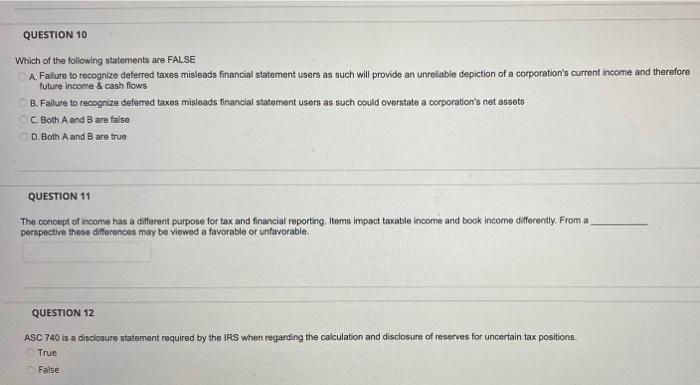

please answer the three questions! Thank you! i will give rating! QUESTION 10 Which of the following statements are FALSE A Failure to recognize deferred

please answer the three questions! Thank you! i will give rating!

QUESTION 10 Which of the following statements are FALSE A Failure to recognize deferred taxes misioads financial statement users as such will provide an unreliable depiction of a corporation's current income and therefore future income & cash flows B. Failure to recognize deferred taxes misleads financial statement users as such could overstate a corporation's net assets C. Both A and B are false D. Both A and B are true QUESTION 11 The concept of income has a different purpose for tax and financial reporting. Items impact taxable income and book income differently. From a perspective these differences may be viewed a favorable or unfavorable QUESTION 12 ASC 740 is a disclosure statement required by the IRS when regarding the calculation and disclosure of reserves for uncertain tax positions True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started