Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer the three questions! Thank you! i will give rating! QUESTION 1 Determining current tax expense begins with estimating the current tax liabilities to

please answer the three questions! Thank you! i will give rating!

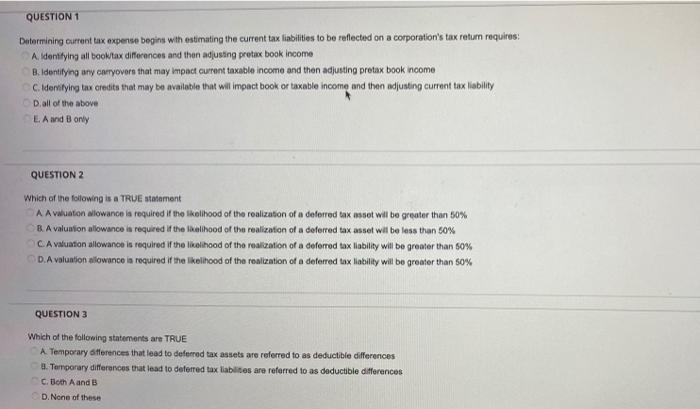

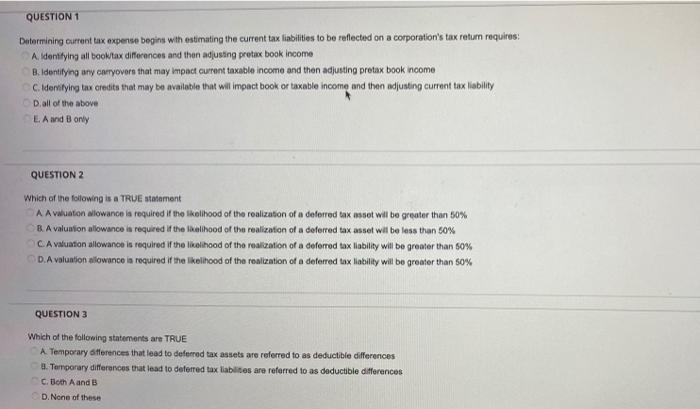

QUESTION 1 Determining current tax expense begins with estimating the current tax liabilities to be reflected on a corporation's tax return requires: A. Identifying all booktax differences and then adjusting pretax book income B. Identifying any owryovers that may impact current taxable income and then adjusting protax book income Cideritying tax credits that may be available that will impact book or taxable income and then adjusting current tax liability D. all of the above L. A and B only QUESTION 2 Which of the following is a TRUE statement A Awuation wlowance is required if the likelihood of the realization of a deferred tax asset wil be greater than 50% B. A valuation allowance is required if the belihood of the realization of a deferred tax asset will be less than 50% Avaluation allowance is required if the likelihood of the realization of a deferred tax liability will be greater than 50% D. A valuation allowance is required if the likelihood of the realization of a deferred tax lability will be greater than 50% QUESTION 3 Which of the following statements are TRUE A Temporary differences that lead to deferred tax assets are referred to as deductible differences 3. Temporary differences that lead to deferred tax liabites are referred to as deductible differences Cloth A and B D. None of these

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started