Answered step by step

Verified Expert Solution

Question

1 Approved Answer

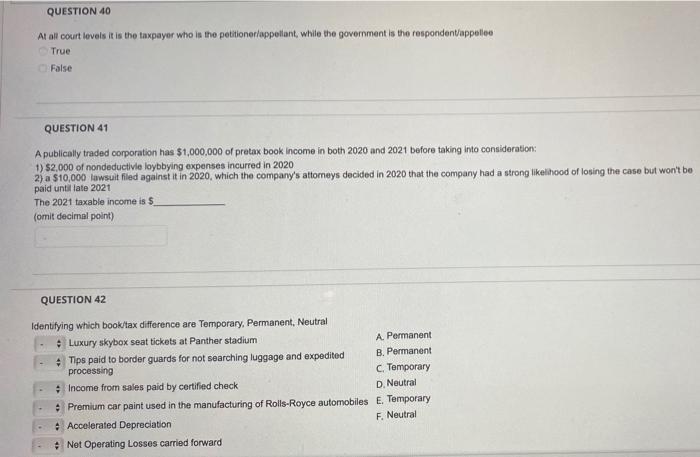

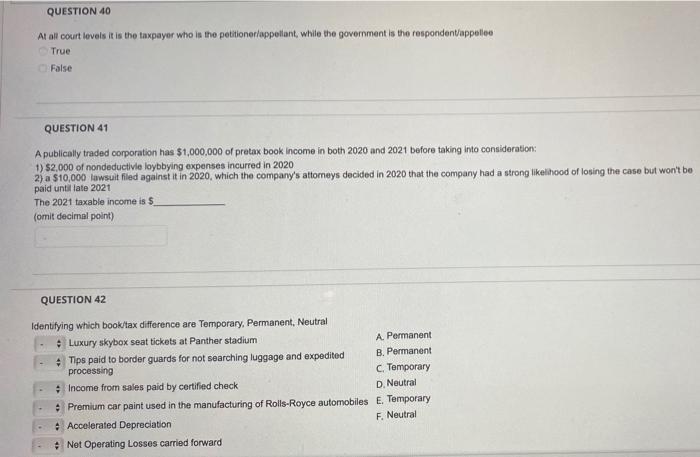

please answer the three questions! Thank you! i will give rating! QUESTION 40 At all court levels it is the taxpayer who is the petitioner/appottant,

please answer the three questions! Thank you! i will give rating!

QUESTION 40 At all court levels it is the taxpayer who is the petitioner/appottant, while the government is the respondent/uppalee True False QUESTION 41 A publically traded corporation has $1,000,000 of protax book income in both 2020 and 2021 before taking into consideration: 1) $2,000 of nondeductive lobbying expenses incurred in 2020 2) a $10,000 lawsuit filed against it in 2020, which the company's attomeys decided in 2020 that the company had a strong likelihood of losing the case but won't be paid until late 2021 The 2021 taxable income is $ (omit decimal point) QUESTION 42 Identifying which book/tax difference are Temporary, Permanent, Neutral Luxury skybox seat tickets at Panther stadium A. Permanent Tips paid to border guards for not searching luggage and expedited B. Permanent processing C. Temporary Income from sales paid by certified check D Neutral Premium car paint used in the manufacturing of Rolls-Royce automobiles E. Temporary Accelerated Depreciation F. Neutral + Not Operating Losses carried forward

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started