PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU

PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU

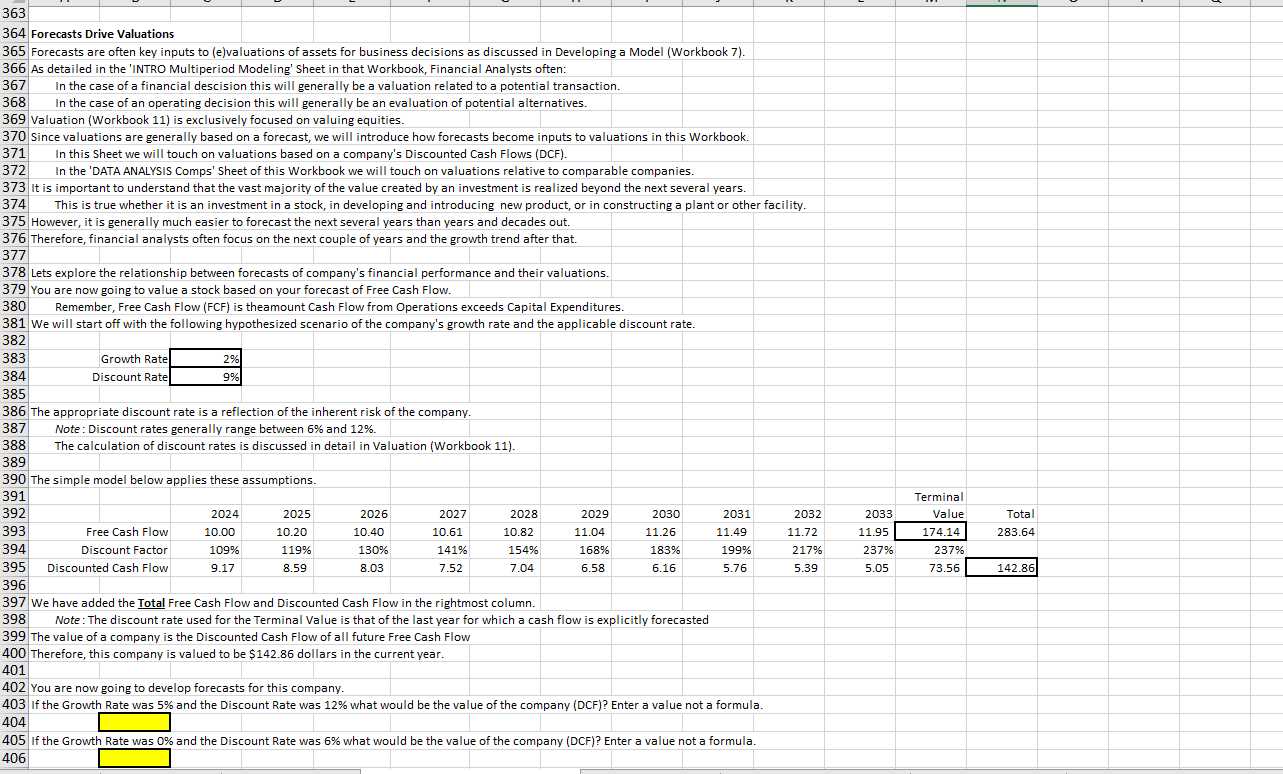

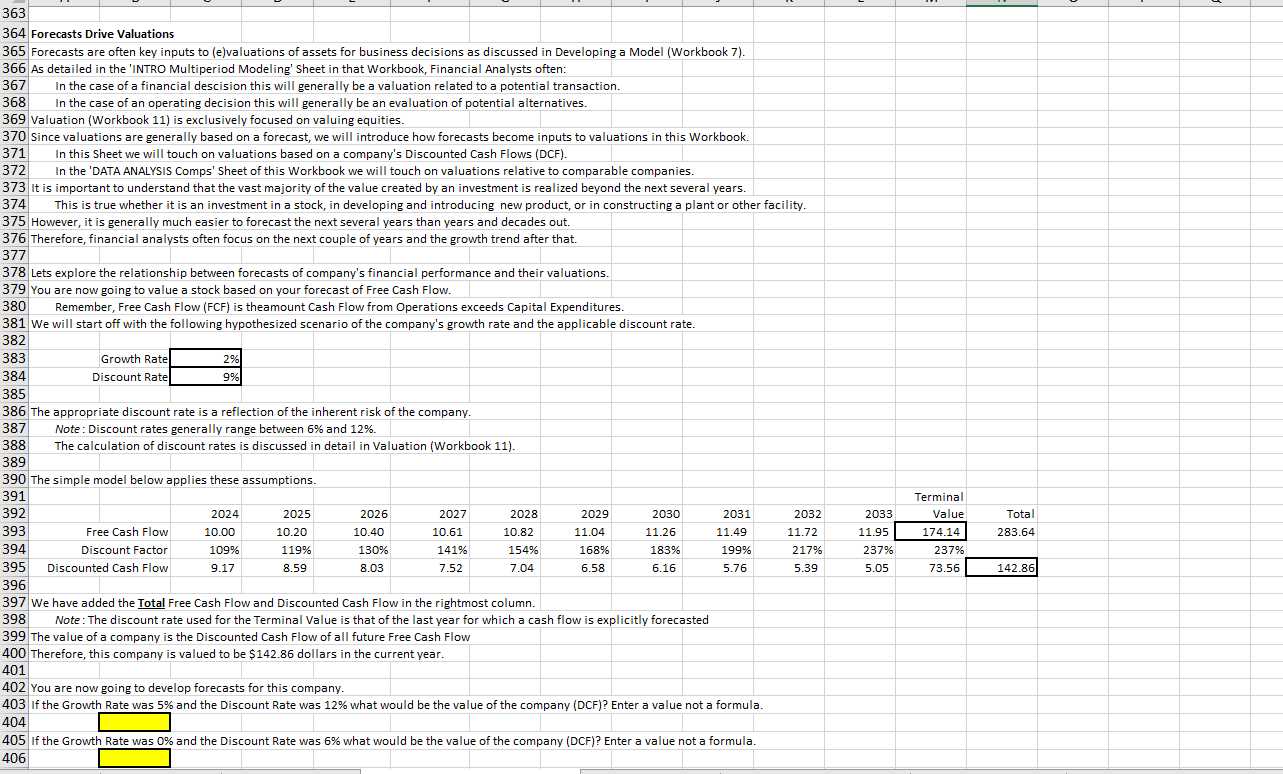

363 364 Forecasts Drive Valuations 365 Forecasts are often key inputs to (e)valuations of assets for business decisions as discussed in Developing a Model (Workbook 7). 366 As detailed in the 'INTRO Multiperiod Modeling' Sheet in that Workbook, Financial Analysts often: 367 In the case of a financial descision this will generally be a valuation related to a potential transaction. 368 In the case of an operating decision this will generally be an evaluation of potential alternatives. 369 Valuation (Workbook 11) is exclusively focused on valuing equities. 370 Since valuations are generally based on a forecast, we will introduce how forecasts become inputs to valuations in this Workbook. 371 In this Sheet we will touch on valuations based on a company's Discounted Cash Flows (DCF). 372 In the 'DATA ANALYSIS Comps' Sheet of this Workbook we will touch on valuations relative to comparable companies. 373 It is important to understand that the vast majority of the value created by an investment is realized beyond the next several years. 374 This is true whether it is an investment in a stock, in developing and introducing new product, or in constructing a plant or other facility. 375 However, it is generally much easier to forecast the next several years than years and decades out. 376 Therefore, financial analysts often focus on the next couple of years and the growth trend after that. 377 378 Lets explore the relationship between forecasts of company's financial performance and their valuations. 379 You are now going to value a stock based on your forecast of Free Cash Flow. 380 Remember, Free Cash Flow (FCF) is theamount Cash Flow from Operations exceeds Capital Expenditures. 381 We will start off with the following hypothesized scenario of the company's growth rate and the applicable discount rate. \begin{tabular}{r|r|r|} \hline 382 & & \\ \hline 383 & Growth Rate & 2% \\ & Discount Rate & 9% \\ \hline 385 & & \end{tabular} 386 The appropriate discount rate is a reflection of the inherent risk of the company. 387 Note: Discount rates generally range between 6% and 12%. 388 The calculation of discount rates is discussed in detail in Valuation (Workbook 11). 389 The simple model below applies these assumptions. 397 We have added the Total Free Cash Flow and Discounted Cash Flow in the rightmost column. 398 Note: The discount rate used for the Terminal Value is that of the last year for which a cash flow is explicitly forecasted 399 The value of a company is the Discounted Cash Flow of all future Free Cash Flow 400 Therefore, this company is valued to be $142.86 dollars in the current year. 401 402 You are now going to develop forecasts for this company. 403 If the Growth Rate was 5% and the Discount Rate was 12% what would be the value of the company (DCF)? Enter a value not a formula. 404 405 If the Growth Rate was 0\% and the Discount Rate was 6% what would be the value of the company (DCF)? Enter a value not a formula. 406

PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU

PLEASE ANSWER THE TWO BLANK CELLS. THANK YOU