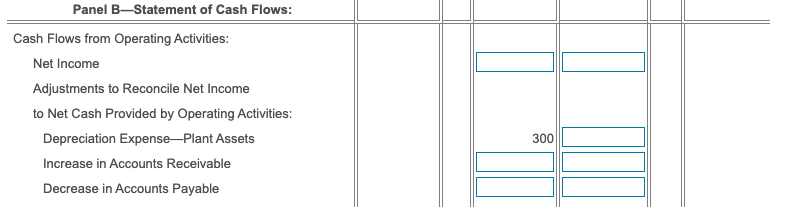

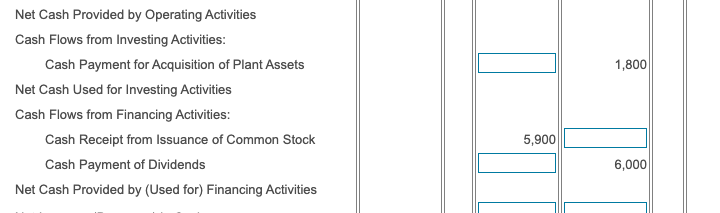

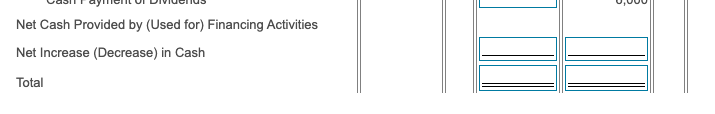

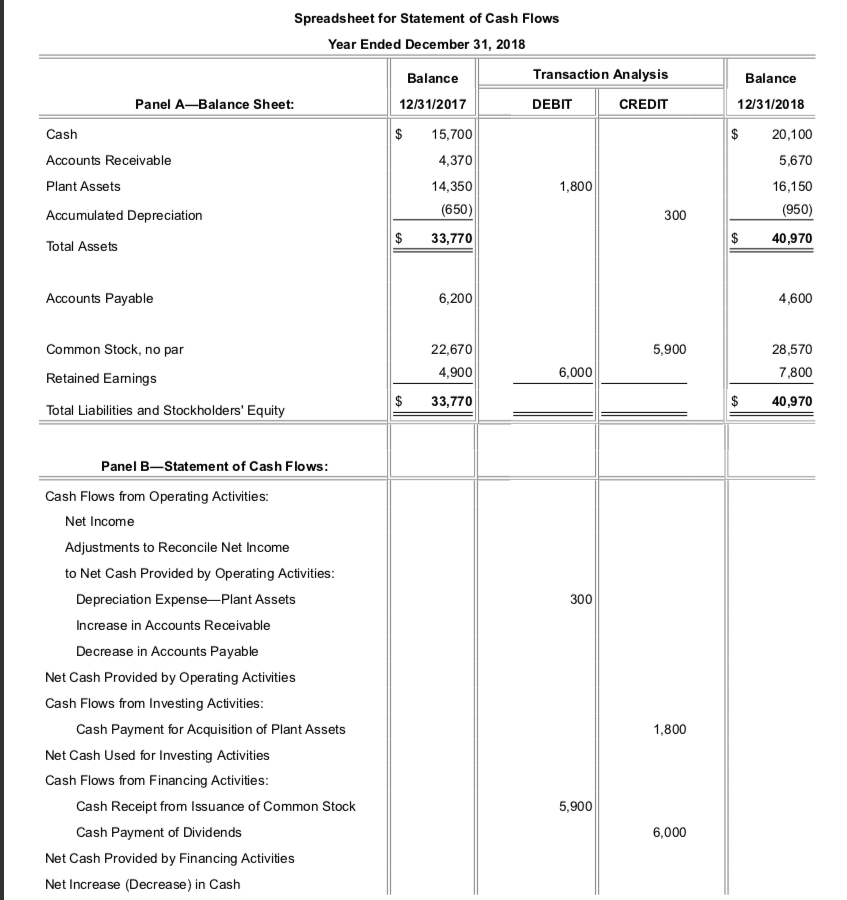

Please answer the way the boxes are

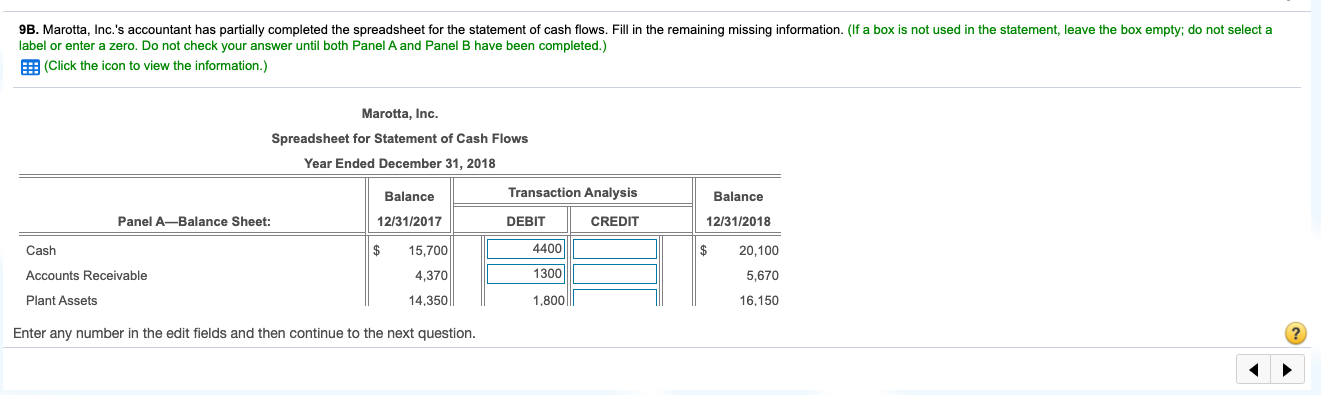

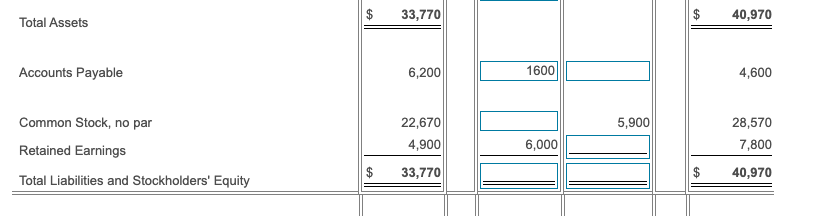

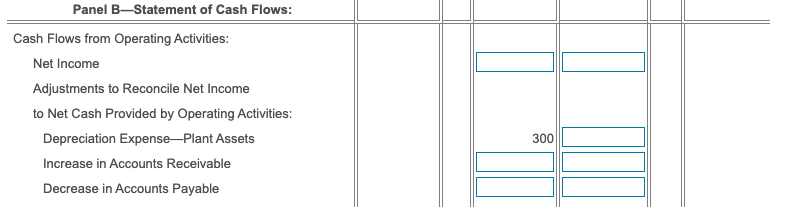

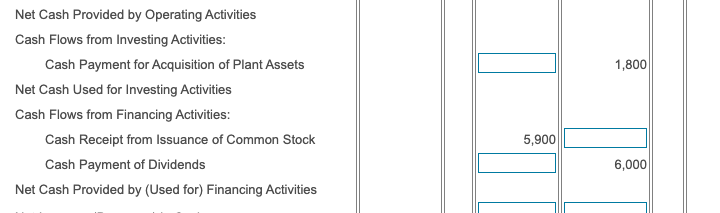

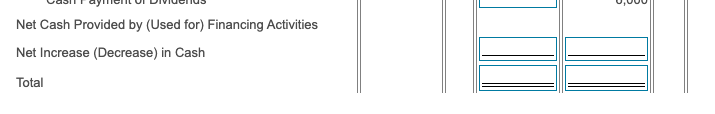

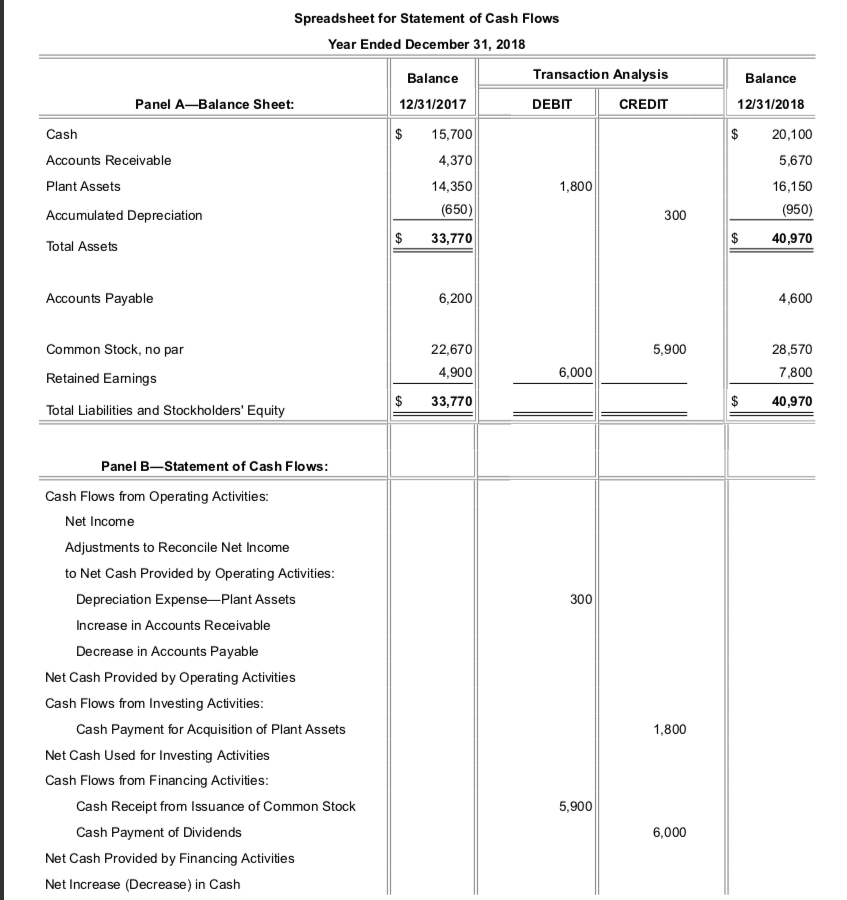

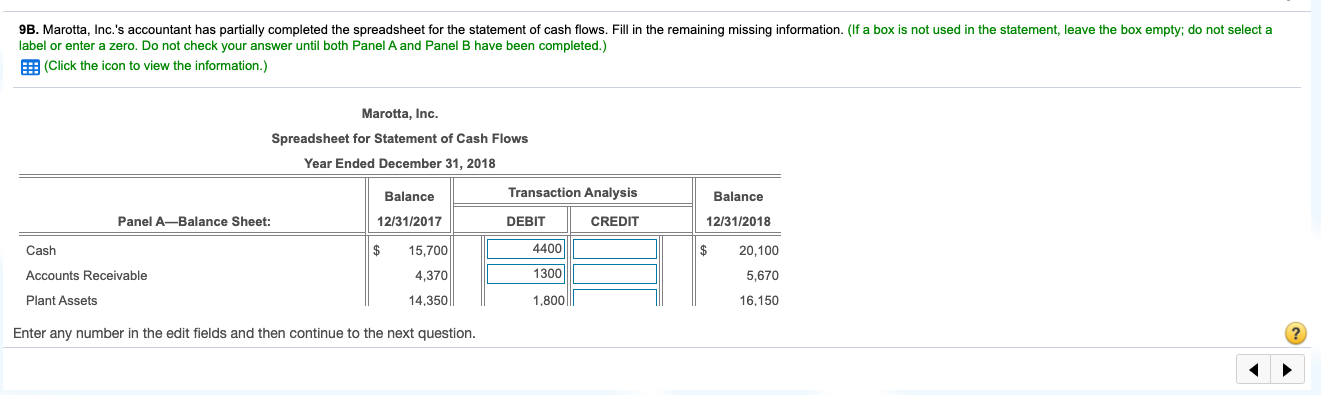

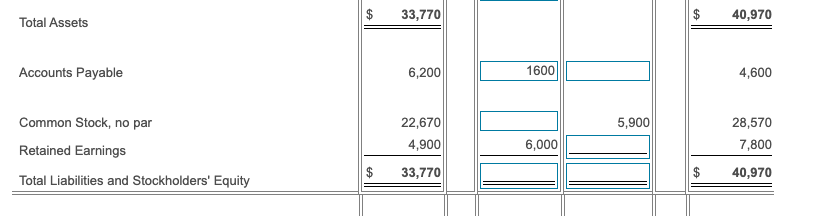

9B. Marotta, Inc.'s accountant has partially completed the spreadsheet for the statement of cash flows. Fill in the remaining missing information. (If a box is not used in the statement, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) E: (Click the icon to view the information.) Marotta, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2018 Balance Transaction Analysis DEBIT CREDIT Balance 12/31/2018 Panel A-Balance Sheet: 12/31/2017 Cash 15,700 4400 20,100 5,670 4,370 1300 Accounts Receivable Plant Assets 14,350 || 1.800 16,150 Enter any number in the edit fields and then continue to the next question. $ 33,770 40,970 Total Assets Accounts Payable 6,200 1600 4,600 Common Stock, no par 22,670 4,900 28,570 7,800 ,000 Retained Earnings 33,770 40,970 Total Liabilities and Stockholders' Equity Panel B-Statement of Cash Flows: Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Depreciation Expense-Plant Assets Increase in Accounts Receivable Decrease in Accounts Payable 1,800 Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Net Cash Used for Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Provided by (Used for) Financing Activities 5,900 6,000 Duo ILOI Divuclus Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Total Spreadsheet for Statement of Cash Flows Year Ended December 31, 2018 Transaction Analysis Balance 12/31/2017 Balance 12/31/2018 Panel A-Balance Sheet: DEBIT CREDIT Cash $ 20,100 Accounts Receivable 5,670 15,700 4,370 14,350 (650) Plant Assets 1,800 16,150 (950) Accumulated Depreciation 300 33,770 40,970 Total Assets Accounts Payable 6,200 4,600 Common Stock, no par 5,900 22,670 4,900 28,570 7,800 Retained Earnings 6,000 33,770 40,970 Total Liabilities and Stockholders' Equity Panel B-Statement of Cash Flows: Cash Flows from Operating Activities: Net Income 300 Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Depreciation Expense-Plant Assets Increase in Accounts Receivable Decrease in Accounts Payable Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Net Cash Used for Investing Activities Cash Flows from Financing Activities: Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Provided by Financing Activities Net Increase (Decrease) in Cash 1,800 5,900 6,000