Answered step by step

Verified Expert Solution

Question

1 Approved Answer

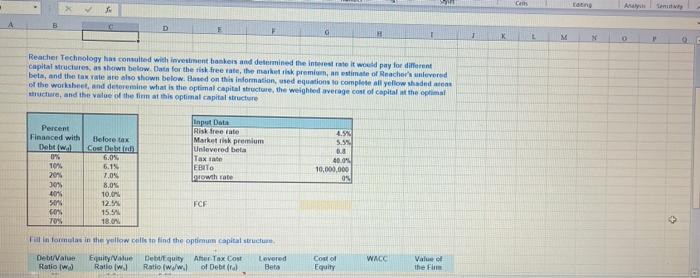

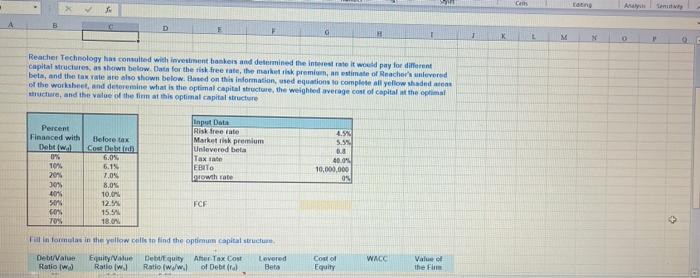

please answer the yellow blanks and show the formulas as well. Cam Eating L M M O Reacher Technology has consulted with investment bankers and

please answer the yellow blanks and show the formulas as well.

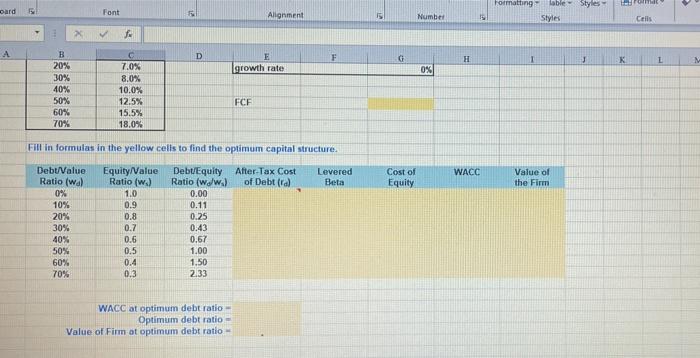

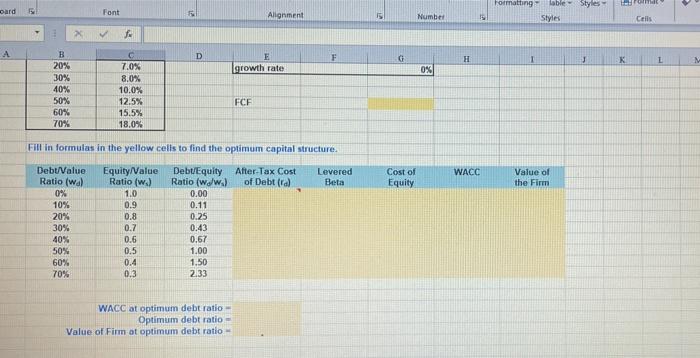

Cam Eating L M M O Reacher Technology has consulted with investment bankers and determined the interest rate it would pay for different capital structures, as shown below. Data for the risk free rate, the marketisk premium, an estimate of Reacher's lovered bets, and the tax rate realo shown below. Based on this information, sed equations to complete all yellow shaded of the worksheet, and determine what is the optimal capital structure, the weighted average cost of capital at the optimal structure, and the value of them at this optimal capital structure 4.5 5.5% Percent Financed with Debt will 06 10% 2014 30% 4046 5076 Before tax Cor Debt 6.0% 6.1% 7,0% 8.05 10. 12.5 15.50 18.04. Input Data Risk free fate Marketink premium Unlovered beta Taxate EBITO prowth rate 40.0% 10,000,000 0 FCF 7045 Fill in formata in the yellow cells to find the optimum capital struct Debt/Value EquityValue Debt/Equity Ate Tax Com Lovered Ratio wa Rallow) Ratio (www.1 of Debt Bets WACC Cost of Equity Valu the F Formatting table Styles HOME Dard Font Alignment Number Styles Ceils 2 f D G K K growth rate 0% B 20% 30% 40% 50% 60% 70% 7.0% 8.0% 10.0% 12.5% 15.5% 18.0% FCF Fill in formulas in the yellow cells to find the optimum capital structure. Levered Beta WACC After-Tax Cost of Debt (ra Equity/Value Ratio (w.) 1.0 0.9 Cost of Equity Value of the Firm 21 0.8 Debt/Value Ratio (wal 0% 10% 20% 30% 40% 50% 60% 70% Debt/Equity Ratio (w/w) 0.00 0.11 0.25 0.43 0.67 1.00 1.50 2.33 OOO 0.7 0.6 0.5 0.4 0.3 WACC at optimum debt ratio- Optimum debt ratio Value of Firm at optimum debt ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started