Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer them all correctly as soon as possible and i would rate you 5 stars! thanks Use the following com futures quotes (priced in

please answer them all correctly as soon as possible and i would rate you 5 stars! thanks

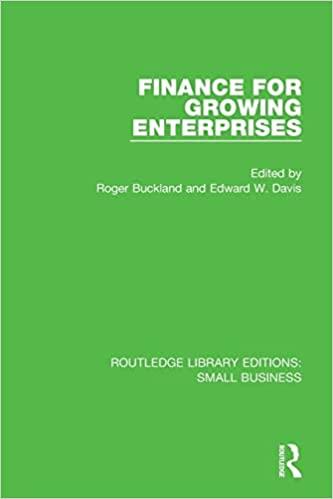

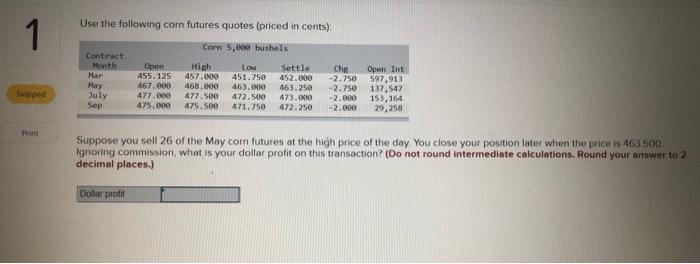

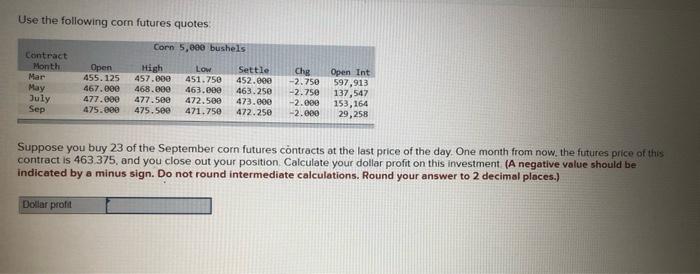

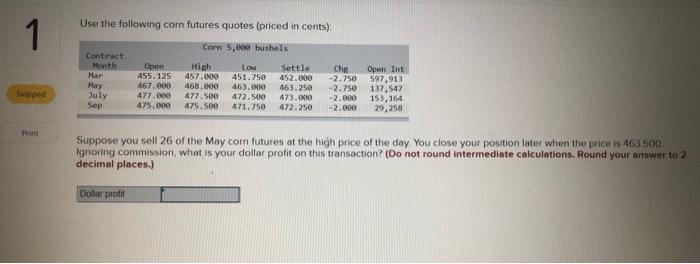

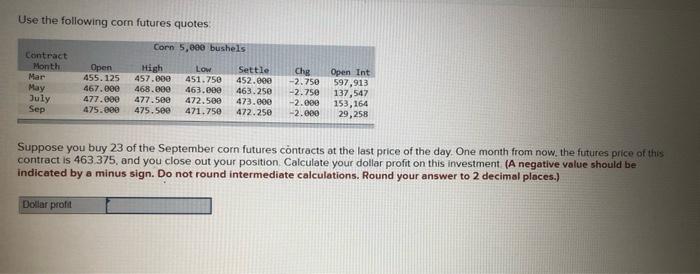

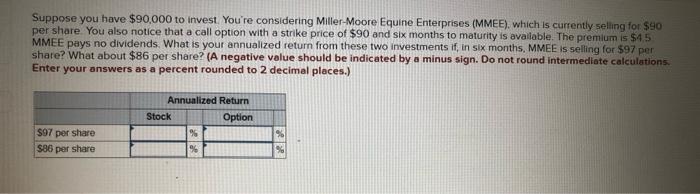

Use the following com futures quotes (priced in cents) 1 1 Corn 5,000 bushels Contract Month Mar May July Sep Open 455.125 467.000 477.00 475.NO High 457.000 468.000 477.500 475.500 Low 451.750 463. INNO 472.500 471.750 Settle 452.000 463.250 473.NO 472.250 Chies -2.750 -2.750 -2.000 -2.000 Open Int 597,913 137,547 153, 164 29,258 Skloped Suppose you sell 26 of the May corn futures of the high price of the day you close your position later when the price is 463 500 Ignoring commission, what is your dollar profit on this transaction? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Dollar profit Use the following corn futures quotes Corn 5,000 bushels Contract Month Mar May July Sep Open 455. 125 467.000 477.000 475.000 High 457.000 468.000 477.500 475.500 Low 451.750 463.000 472.500 471.750 Settle 452.000 463.250 473.000 472.250 Che -2.750 -2.750 -2.000 -2.000 Open Int 597,913 137,547 153, 164 29,258 Suppose you buy 23 of the September corn futures contracts at the last price of the day. One month from now, the futures price of this contract is 463 375, and you close out your position Calculate your dollar profit on this investment. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.) Dollar profit Suppose you have $90,000 to invest. You're considering Miller-Moore Equine Enterprises (MMEE), which is currently selling for $90 per share. You also notice that a call option with a strike price of $90 and six months to maturity is available. The premium is $1,5 MMEE pays no dividends. What is your annualized return from these two investments if, in six months, MMEE is selling for $97 per share? What about $86 per share? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Annualized Return Stock Option 96 $97 per share $86 per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started