Please answer them..

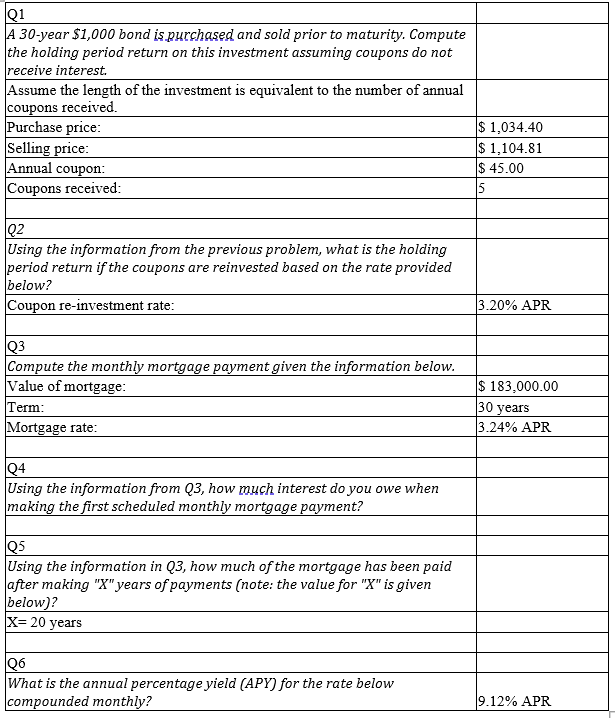

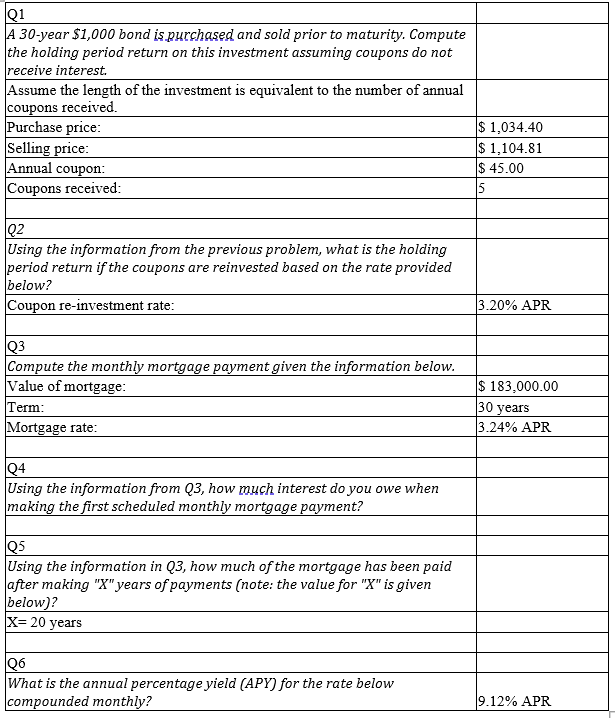

\begin{tabular}{|l|l|} \hline Q1 & \\ \hline A30-year$1,000bondispurchasedandsoldpriortomaturity.Computetheholdingperiodreturnonthisinvestmentassumingcouponsdonotreceiveinterest. & \\ \hline Assumethelengthoftheinvestmentisequivalenttothenumberofannualcouponsreceived. & \\ \hline Purchase price: & $1,034.40 \\ \hline Selling price: & $1,104.81 \\ \hline Annual coupon: & $45.00 \\ \hline Coupons received: & 5 \\ \hline & \\ \hline Q2 & \\ \hline Usingtheinformationfromthepreviousproblem,whatistheholdingperiodreturnifthecouponsarereinvestedbasedontherateprovidedbelow? & \\ \hline Coupon re-investment rate: & \\ \hline & 3.20%APR \\ \hline Q3 & \\ \hline Compute the monthly mortgage payment given the information below. & \\ \hline Value of mortgage: & $183,000.00 \\ \hline Term: & 30 years \\ \hline Mortgage rate: & 3.24% APR \\ \hline & \\ \hline Q4 & \\ \hline UsingtheinformationfromQ3,howmuchinterestdoyouowewhenmakingthefirstscheduledmonthlymortgagepayment? & \\ \hline & \\ \hline Q5 & \\ \hline UsingtheinformationinQ3,howmuchofthemortgagehasbeenpaidaftermaking"X"yearsofpayments(note:thevaluefor"Xisgivenbelow)? & \\ \hline X=20 years & \\ \hline WhatistheannualpercentageyieldAPY)fortheratebelowcompoundedmonthly? & \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline Q1 & \\ \hline A30-year$1,000bondispurchasedandsoldpriortomaturity.Computetheholdingperiodreturnonthisinvestmentassumingcouponsdonotreceiveinterest. & \\ \hline Assumethelengthoftheinvestmentisequivalenttothenumberofannualcouponsreceived. & \\ \hline Purchase price: & $1,034.40 \\ \hline Selling price: & $1,104.81 \\ \hline Annual coupon: & $45.00 \\ \hline Coupons received: & 5 \\ \hline & \\ \hline Q2 & \\ \hline Usingtheinformationfromthepreviousproblem,whatistheholdingperiodreturnifthecouponsarereinvestedbasedontherateprovidedbelow? & \\ \hline Coupon re-investment rate: & \\ \hline & 3.20%APR \\ \hline Q3 & \\ \hline Compute the monthly mortgage payment given the information below. & \\ \hline Value of mortgage: & $183,000.00 \\ \hline Term: & 30 years \\ \hline Mortgage rate: & 3.24% APR \\ \hline & \\ \hline Q4 & \\ \hline UsingtheinformationfromQ3,howmuchinterestdoyouowewhenmakingthefirstscheduledmonthlymortgagepayment? & \\ \hline & \\ \hline Q5 & \\ \hline UsingtheinformationinQ3,howmuchofthemortgagehasbeenpaidaftermaking"X"yearsofpayments(note:thevaluefor"Xisgivenbelow)? & \\ \hline X=20 years & \\ \hline WhatistheannualpercentageyieldAPY)fortheratebelowcompoundedmonthly? & \\ \hline \end{tabular}