Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer them by excel. Thank you so much Question #3 Part of this course involves being able to visualize and complete the accounting cycle.

please answer them by excel. Thank you so much

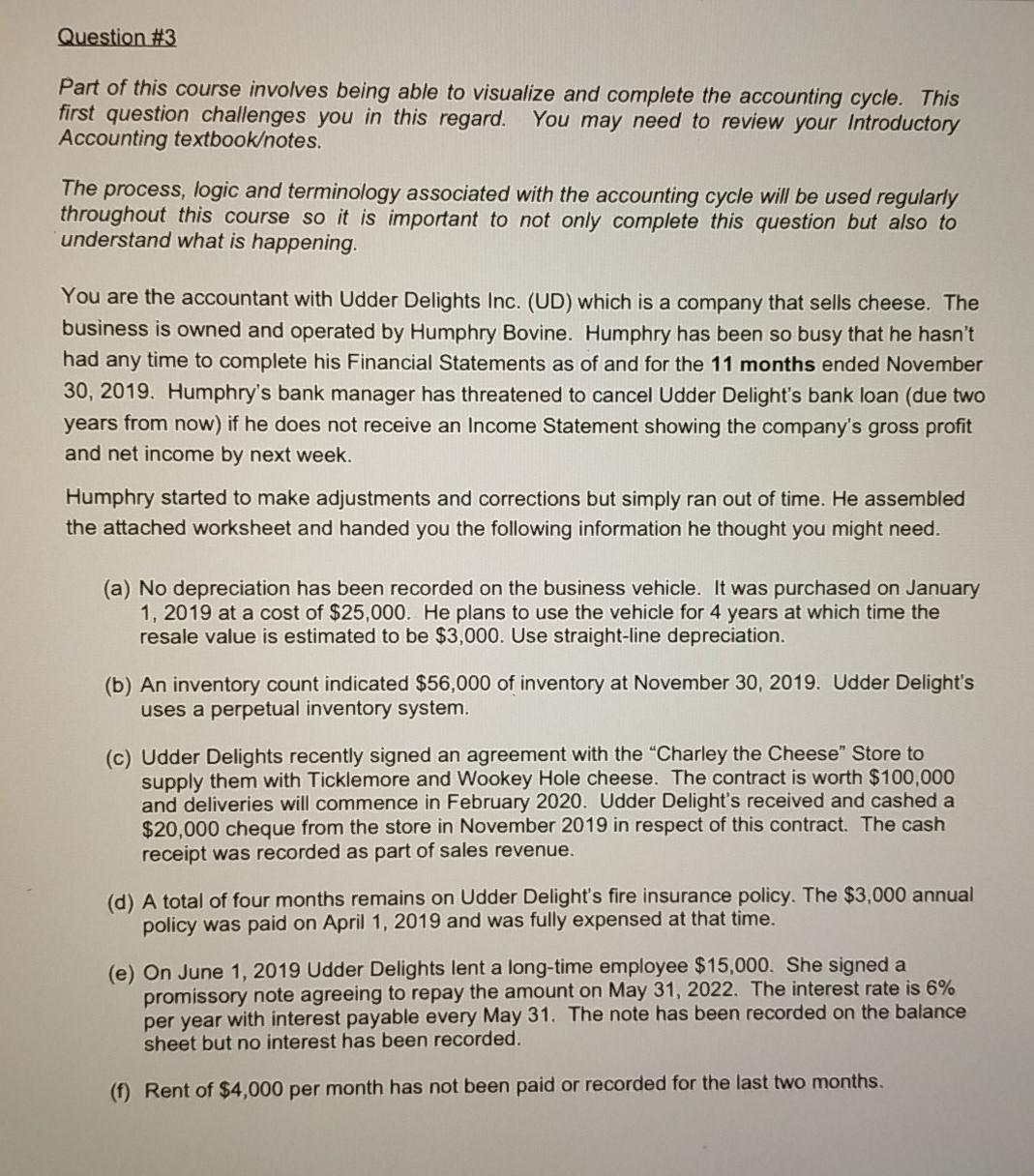

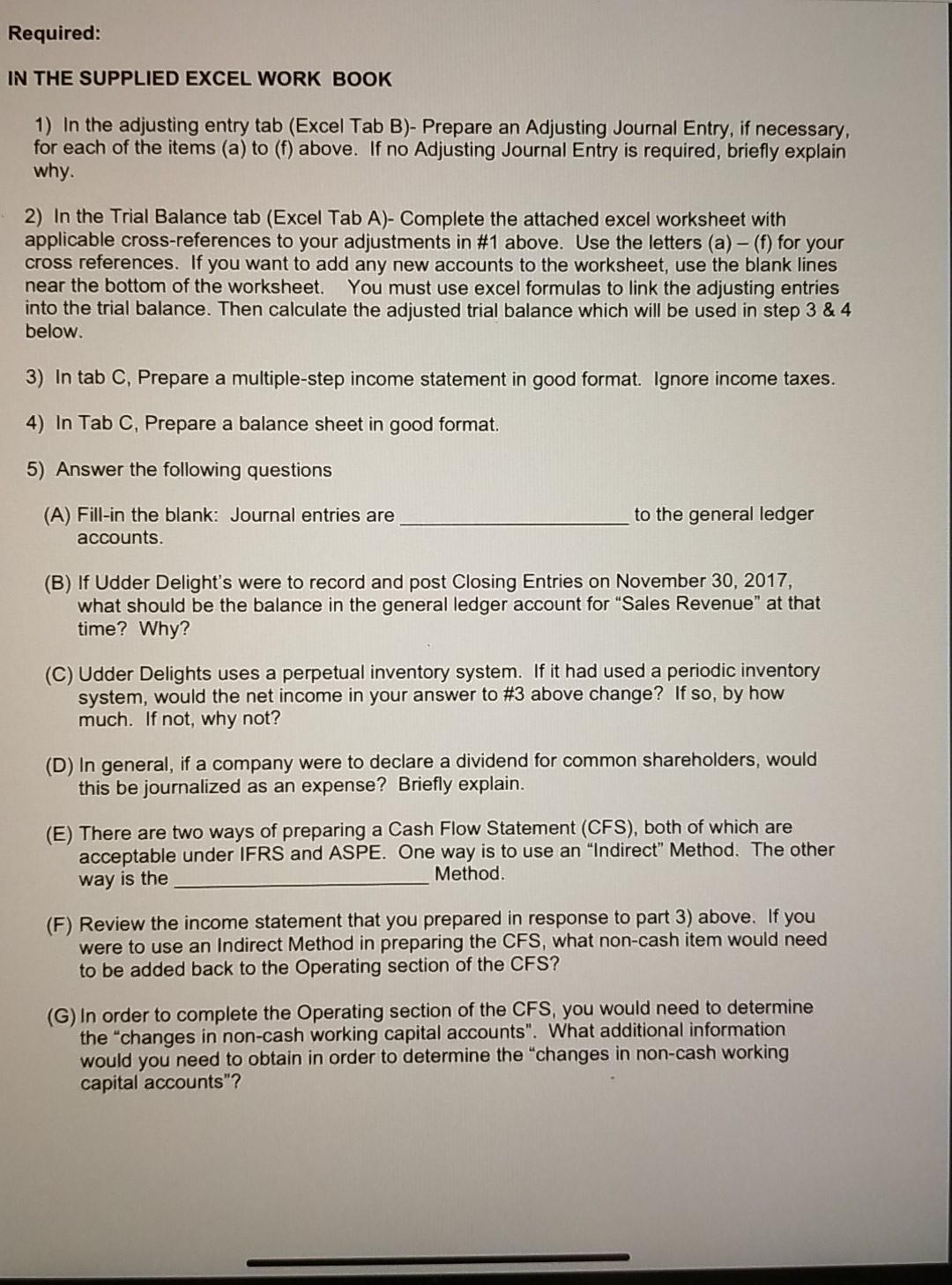

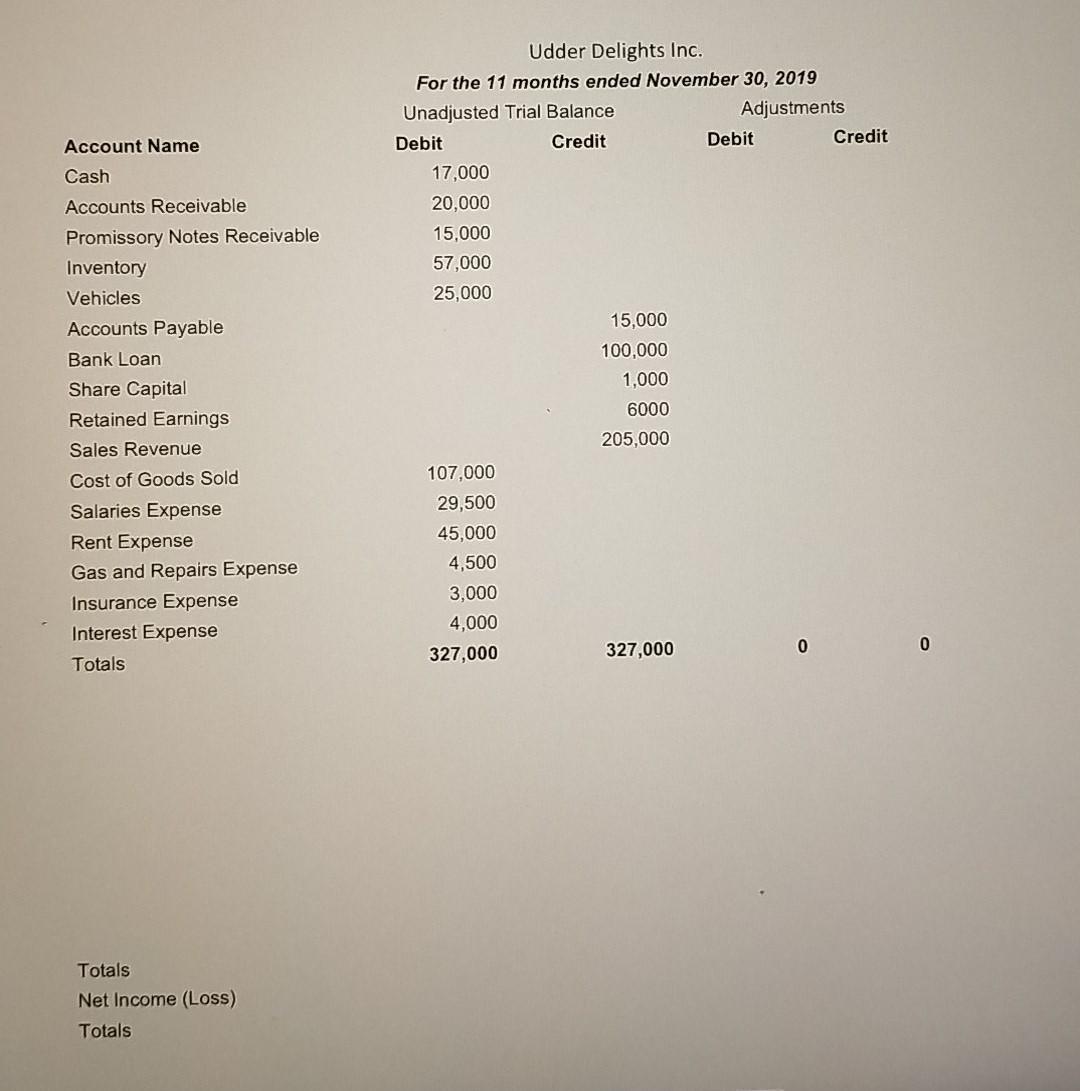

Question #3 Part of this course involves being able to visualize and complete the accounting cycle. This first question challenges you in this regard. You may need to review your Introductory Accounting textbookotes. The process, logic and terminology associated with the accounting cycle will be used regularly throughout this course so it is important to not only complete this question but also to understand what is happening. You are the accountant with Udder Delights Inc. (UD) which is a company that sells cheese. The business is owned and operated by Humphry Bovine. Humphry has been so busy that he hasn't had any time to complete his Financial Statements as of and for the 11 months ended November 30, 2019. Humphry's bank manager has threatened to cancel Udder Delight's bank loan (due two years from now) if he does not receive an Income Statement showing the company's gross profit and net income by next week. Humphry started to make adjustments and corrections but simply ran out of time. He assembled the attached worksheet and handed you the following information he thought you might need. (a) No depreciation has been recorded on the business vehicle. It was purchased on January 1, 2019 at a cost of $25,000. He plans to use the vehicle for 4 years at which time the resale value is estimated to be $3,000. Use straight-line depreciation. (b) An inventory count indicated $56,000 of inventory at November 30, 2019. Udder Delight's uses a perpetual inventory system. (c) Udder Delights recently signed an agreement with the "Charley the Cheese" Store to supply them with Ticklemore and Wookey Hole cheese. The contract is worth $100,000 and deliveries will commence in February 2020. Udder Delight's received and cashed a $20,000 cheque from the store in November 2019 in respect of this contract. The cash receipt was recorded as part of sales revenue. (d) A total of four months remains on Udder Delight's fire insurance policy. The $3,000 annual policy was paid on April 1, 2019 and was fully expensed at that time. (e) On June 1, 2019 Udder Delights lent a long-time employee $15,000. She signed a promissory note agreeing to repay the amount on May 31, 2022. The interest rate is 6% per year with interest payable every May 31. The note has been recorded on the balance sheet but no interest has been recorded. (1) Rent of $4,000 per month has not been paid or recorded for the last two months. Required: IN THE SUPPLIED EXCEL WORK BOOK 1) In the adjusting entry tab (Excel Tab B)- Prepare an Adjusting Journal Entry, if necessary, for each of the items (a) to (f) above. If no Adjusting Journal Entry is required, briefly explain why. 2) In the Trial Balance tab (Excel Tab A)- Complete the attached excel worksheet with applicable cross-references to your adjustments in #1 above. Use the letters (a) - (f) for your cross references. If you want to add any new accounts to the worksheet, use the blank lines near the bottom of the worksheet. You must use excel formulas to link the adjusting entries into the trial balance. Then calculate the adjusted trial balance which will be used in step 3 & 4 below. 3) In tab C, Prepare a multiple-step income statement in good format. Ignore income taxes. 4) In Tab C, Prepare a balance sheet in good format. 5) Answer the following questions (A) Fill-in the blank: Journal entries are accounts. to the general ledger (B) If Udder Delight's were to record and post Closing Entries on November 30, 2017, what should be the balance in the general ledger account for "Sales Revenue" at that time? Why? (C) Udder Delights uses a perpetual inventory system. If it had used a periodic inventory system, would the net income in your answer to #3 above change? If so, by how much. If not, why not? (D) In general, if a company were to declare a dividend for common shareholders, would this be journalized as an expense? Briefly explain. (E) There are two ways of preparing a Cash Flow Statement (CFS), both of which are acceptable under IFRS and ASPE. One way is to use an "Indirect" Method. The other Method. way is the (F) Review the income statement that you prepared in response to part 3) above. If you were to use an Indirect Method in preparing the CFS, what non-cash item would need to be added back to the Operating section of the CFS? (G) In order to complete the Operating section of the CFS, you would need to determine the changes in non-cash working capital accounts". What additional information would you need to obtain in order to determine the changes in non-cash working capital accounts"? Account Name Cash Accounts Receivable Promissory Notes Receivable Inventory Vehicles Accounts Payable Bank Loan Share Capital Retained Earnings Sales Revenue Cost of Goods Sold Salaries Expense Rent Expense Gas and Repairs Expense Insurance Expense Interest Expense Totals Udder Delights Inc. For the 11 months ended November 30, 2019 Unadjusted Trial Balance Adjustments Debit Credit Debit Credit 17,000 20,000 15,000 57,000 25,000 15,000 100,000 1,000 6000 205,000 107,000 29,500 45,000 4,500 3,000 4,000 327,000 327,000 0 0 Totals Net Income (Loss) TotalsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started