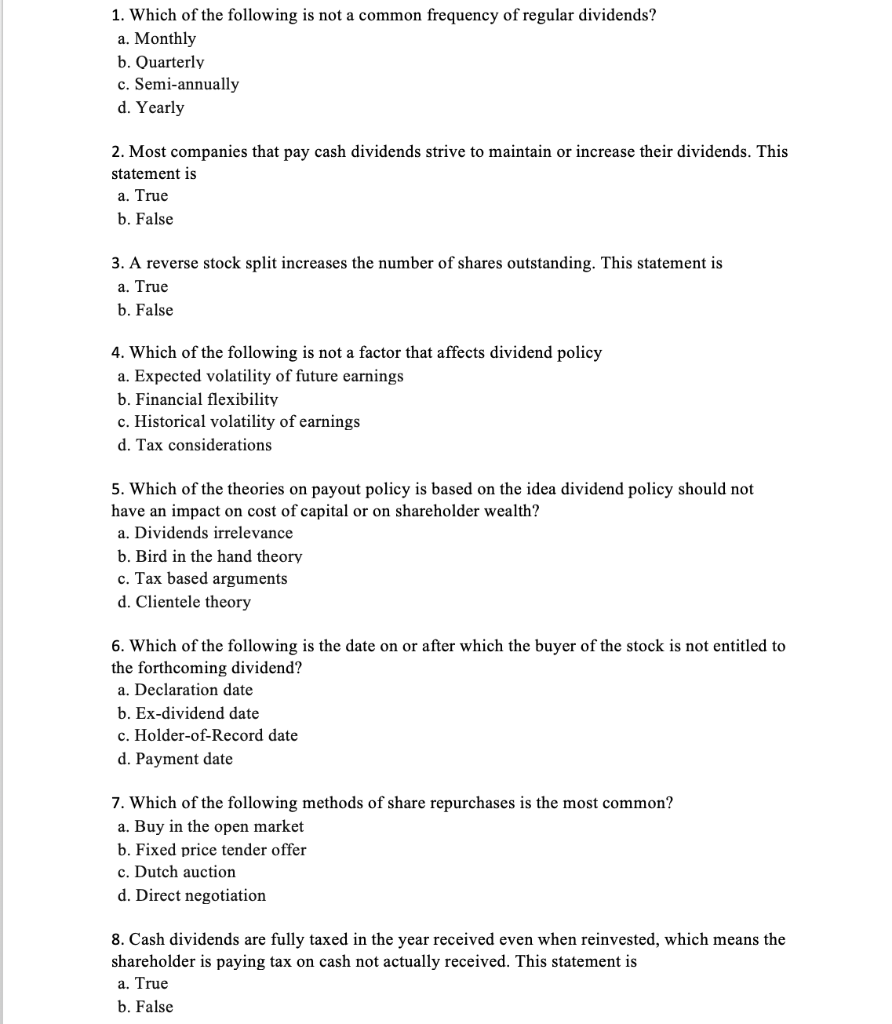

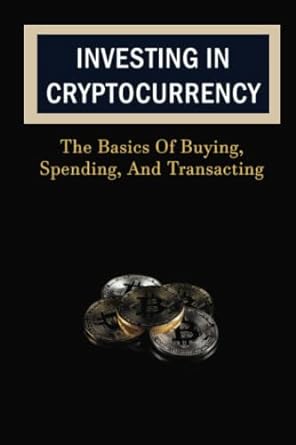

please answer them correctly

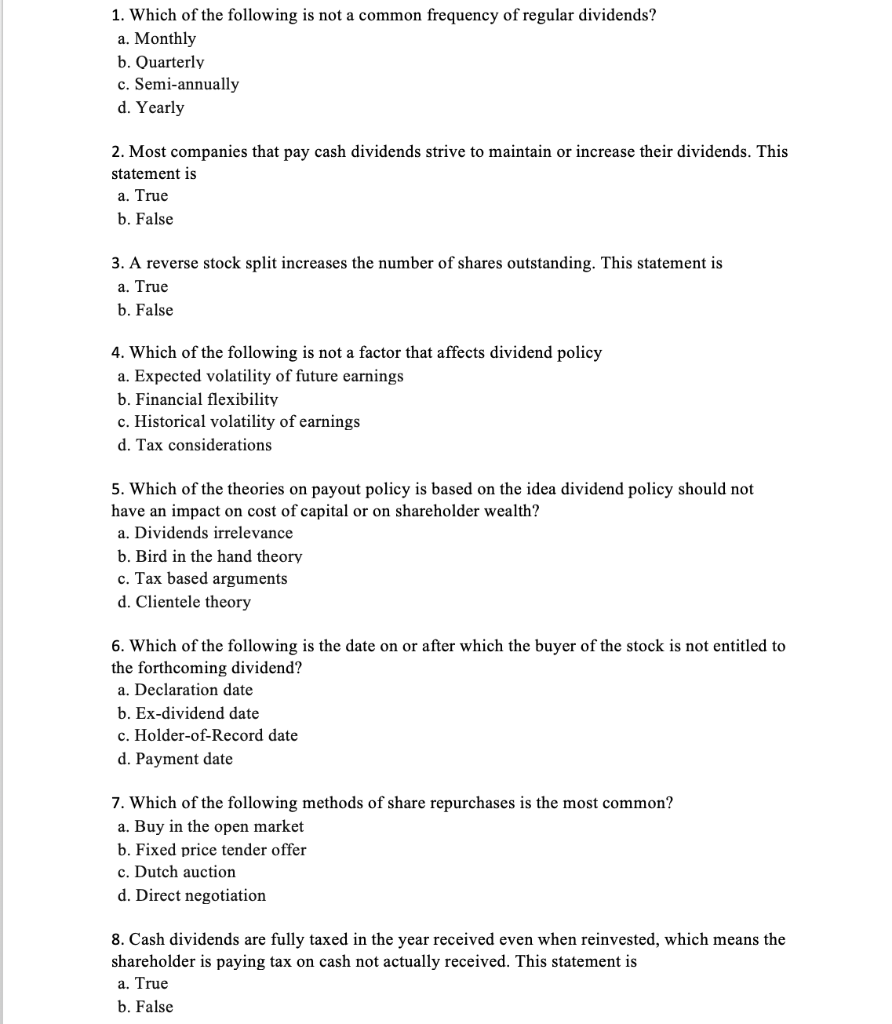

1. Which of the following is not a common frequency of regular dividends? a. Monthly b. Quarterly c. Semi-annually d. Yearly 2. Most companies that pay cash dividends strive to maintain or increase their dividends. This statement is a. True b. False 3. A reverse stock split increases the number of shares outstanding. This statement is a. True b. False 4. Which of the following is not a factor that affects dividend policy a. Expected volatility of future earnings b. Financial flexibility c. Historical volatility of earnings d. Tax considerations 5. Which of the theories on payout policy is based on the idea dividend policy should not have an impact on cost of capital or on shareholder wealth? a. Dividends irrelevance b. Bird in the hand theory c. Tax based arguments d. Clientele theory 6. Which of the following is the date on or after which the buyer of the stock is not entitled to the forthcoming dividend? a. Declaration date b. Ex-dividend date c. Holder-of-Record date d. Payment date 7. Which of the following methods of share repurchases is the most common? a. Buy in the open market b. Fixed price tender offer c. Dutch auction d. Direct negotiation 8. Cash dividends are fully taxed in the year received even when reinvested, which means the shareholder is paying tax on cash not actually received. This statement is a. True b. False 9. A stock dividend affects a company's capital structure whereas a cash dividend has no economic impact on a company. This statement is a. True b. False 10. A stock dividend does not alter a company's asset base or earning power. This statement a. True b. False 11. Which of the following methods of share repurchases is the most flexible form of repurchase for the company? a. Buy in the open market b. Fixed price tender offer c. Dutch auction d. Direct negotiation 12. A dividend reinvestment plan in which the company purchases shares in the open market + to acquire the additional shares credited to plan participants is known as a. Open market DRP b. New-issue DRP 13. If a company announces a two- for- one stock split, each shareholder will own half the number of shares she used to own. This statement is a. True b. False 14. Which of the following is an example of a cash distribution? a. Liquidating dividend b. Stock split c. Stock dividend d. Reverse stock split 15. Reasons for preferring repurchasing stock over paying a cash dividend do not include a. Signaling c. Offset dilution from executive stock options d. Asymmetric information