Question

Please answer these 2 questions: 5. Temporarily, ignore your work on Questions 2, 3, and 4. Lows luck at the race track is over; he

Please answer these 2 questions:

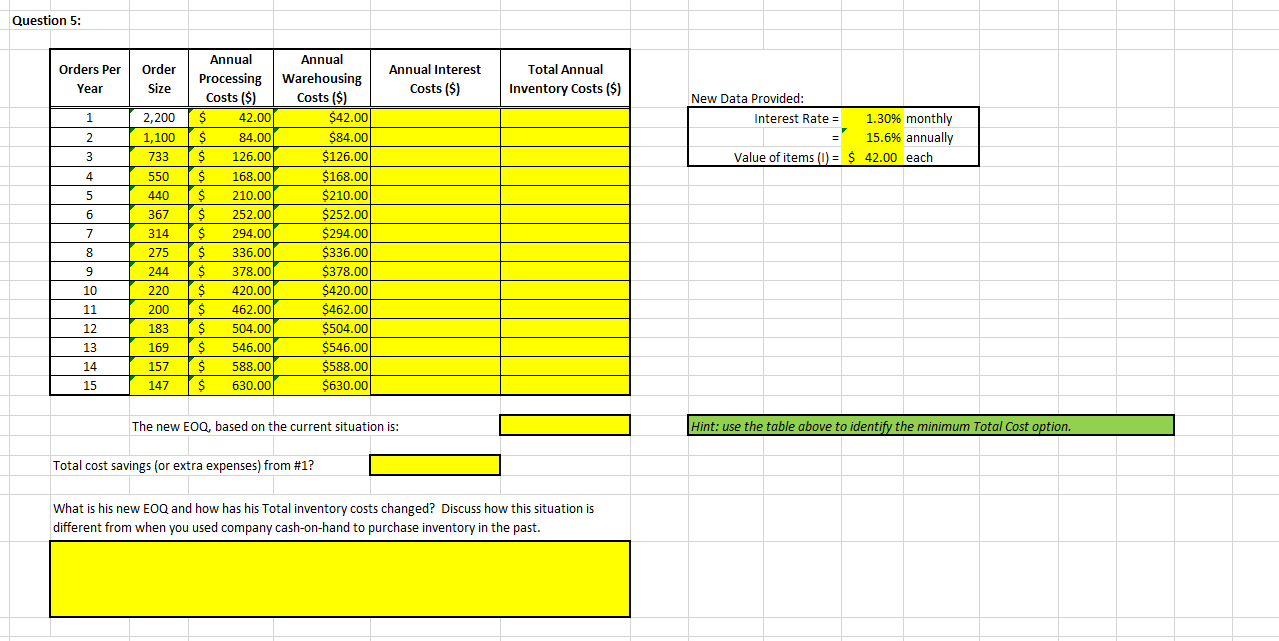

5. Temporarily, ignore your work on Questions 2, 3, and 4. Lows luck at the race track is over; he now must borrow money to finance his inventory of nails. Looking at the situation outlined in Question 1, assume that the wholesale cost of nails is $42 per keg and that Low must pay interest at the rate of 1.3% per month on unsold inventory. What is his new EOQ and how has his Total inventory costs changed? Discuss how this situation is different from when you used company cash-on-hand to purchase inventory in the past.

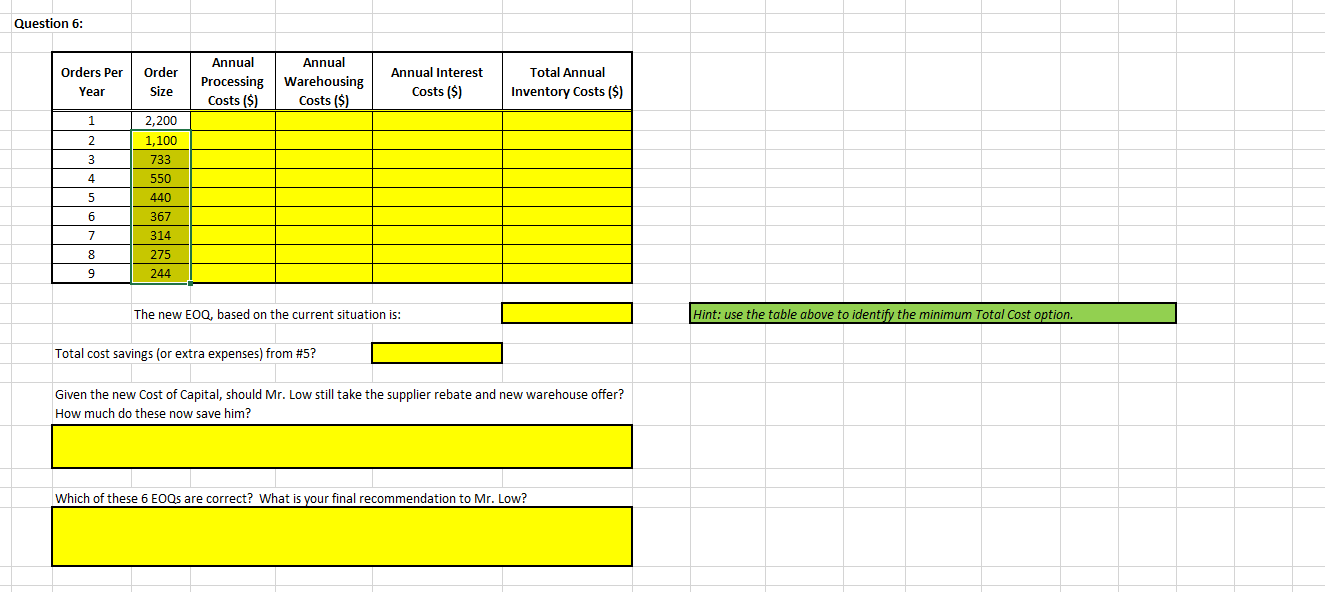

6. Taking into account all the factors listed in Questions 1, 2, 3, and 5, calculate Lows EOQ for kegs of nails. Given the new Cost of Capital, should Mr. Low still take the supplier rebate and new warehouse offer? How much do these now save him? Which of these 6 EOQs are correct? What is your final recommendation to Mr. Low?

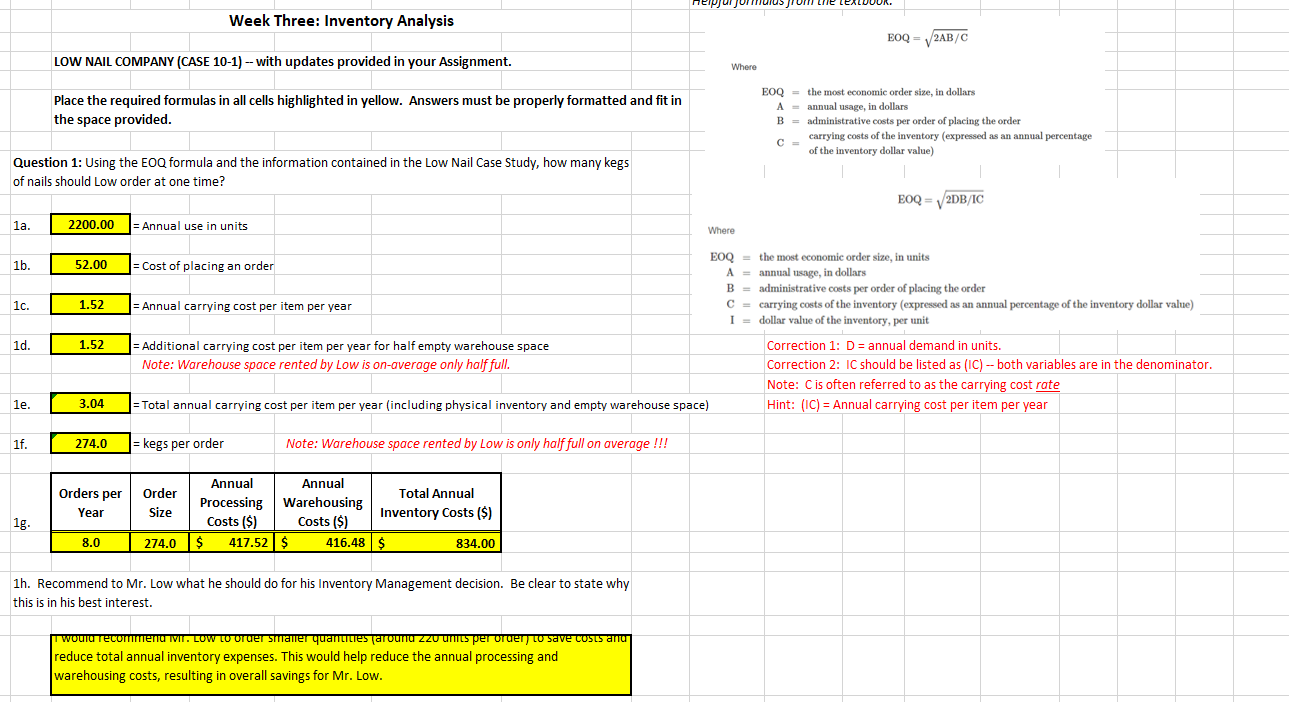

Week Three: Inventory Analysis LOW NAIL COMPANY (CASE 10-1) -- with updates provided in your Assignment. Place the required formulas in all cells highlighted in yellow. Answers must be properly formatted and fit in the space provided. Question 1: Using the EOQ formula and the information contained in the Low Nail Case Study, how many kegs of nails should Low order at one time? 1b. 52.00= Cost of placing an order 1c. 1.52 = Annual carrying cost per item per year 1d. 1.52 = Additional carrying cost per item per year for half empty warehouse space Note: Warehouse space rented by Low is on-average only half full. 1e. 1f. 1g. 1h. Recommend to Mr. Low what he should do for his Inventory Management decision. Be clear to state why this is in his best interest. warehousing costs, resulting in overall savings for Mr. Low. Where EOQ=2AB/C EOQ= the most economic order size, in dollars A= annual usage, in dollars B= administrative costs per order of placing the order carrying costs of the inventory (expressed as an annual percentage of the inventory dollar value) EOQ=2DB/IC Where EOQ= the most economic order size, in units A= annual usage, in dollars B= administrative costs per order of placing the order C= carrying costs of the inventory (expressed as an annual percentage of the inventory dollar value) I= dollar value of the inventory, per unit Correction 1: D= annual demand in units. Correction 2: IC should be listed as (IC) - both variables are in the denominator. Note: C is often referred to as the carrying cost rate Hint: (IC) = Annual carrying cost per item per year The new EOQ, based on the current situation is: Total cost savings (or extra expenses) from \# 1 ? What is his new EOQ and how has his Total inventory costs changed? Discuss how this situation is different from when you used company cash-on-hand to purchase inventory in the past. Hint: use the table above to identify the minimum Total cost option. Question 6: The new EOQ, based on the current situation is: Hint: use the table above to identify the minimum Total cost option. Total cost savings (or extra expenses) from \#5? Given the new Cost of Capital, should Mr. Low still take the supplier rebate and new warehouse offer? How much do these now save him? Which of these 6 EOQs are correct? What is your final recommendation to Mr. Low

Week Three: Inventory Analysis LOW NAIL COMPANY (CASE 10-1) -- with updates provided in your Assignment. Place the required formulas in all cells highlighted in yellow. Answers must be properly formatted and fit in the space provided. Question 1: Using the EOQ formula and the information contained in the Low Nail Case Study, how many kegs of nails should Low order at one time? 1b. 52.00= Cost of placing an order 1c. 1.52 = Annual carrying cost per item per year 1d. 1.52 = Additional carrying cost per item per year for half empty warehouse space Note: Warehouse space rented by Low is on-average only half full. 1e. 1f. 1g. 1h. Recommend to Mr. Low what he should do for his Inventory Management decision. Be clear to state why this is in his best interest. warehousing costs, resulting in overall savings for Mr. Low. Where EOQ=2AB/C EOQ= the most economic order size, in dollars A= annual usage, in dollars B= administrative costs per order of placing the order carrying costs of the inventory (expressed as an annual percentage of the inventory dollar value) EOQ=2DB/IC Where EOQ= the most economic order size, in units A= annual usage, in dollars B= administrative costs per order of placing the order C= carrying costs of the inventory (expressed as an annual percentage of the inventory dollar value) I= dollar value of the inventory, per unit Correction 1: D= annual demand in units. Correction 2: IC should be listed as (IC) - both variables are in the denominator. Note: C is often referred to as the carrying cost rate Hint: (IC) = Annual carrying cost per item per year The new EOQ, based on the current situation is: Total cost savings (or extra expenses) from \# 1 ? What is his new EOQ and how has his Total inventory costs changed? Discuss how this situation is different from when you used company cash-on-hand to purchase inventory in the past. Hint: use the table above to identify the minimum Total cost option. Question 6: The new EOQ, based on the current situation is: Hint: use the table above to identify the minimum Total cost option. Total cost savings (or extra expenses) from \#5? Given the new Cost of Capital, should Mr. Low still take the supplier rebate and new warehouse offer? How much do these now save him? Which of these 6 EOQs are correct? What is your final recommendation to Mr. Low Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started