Please answer these 2 questions.

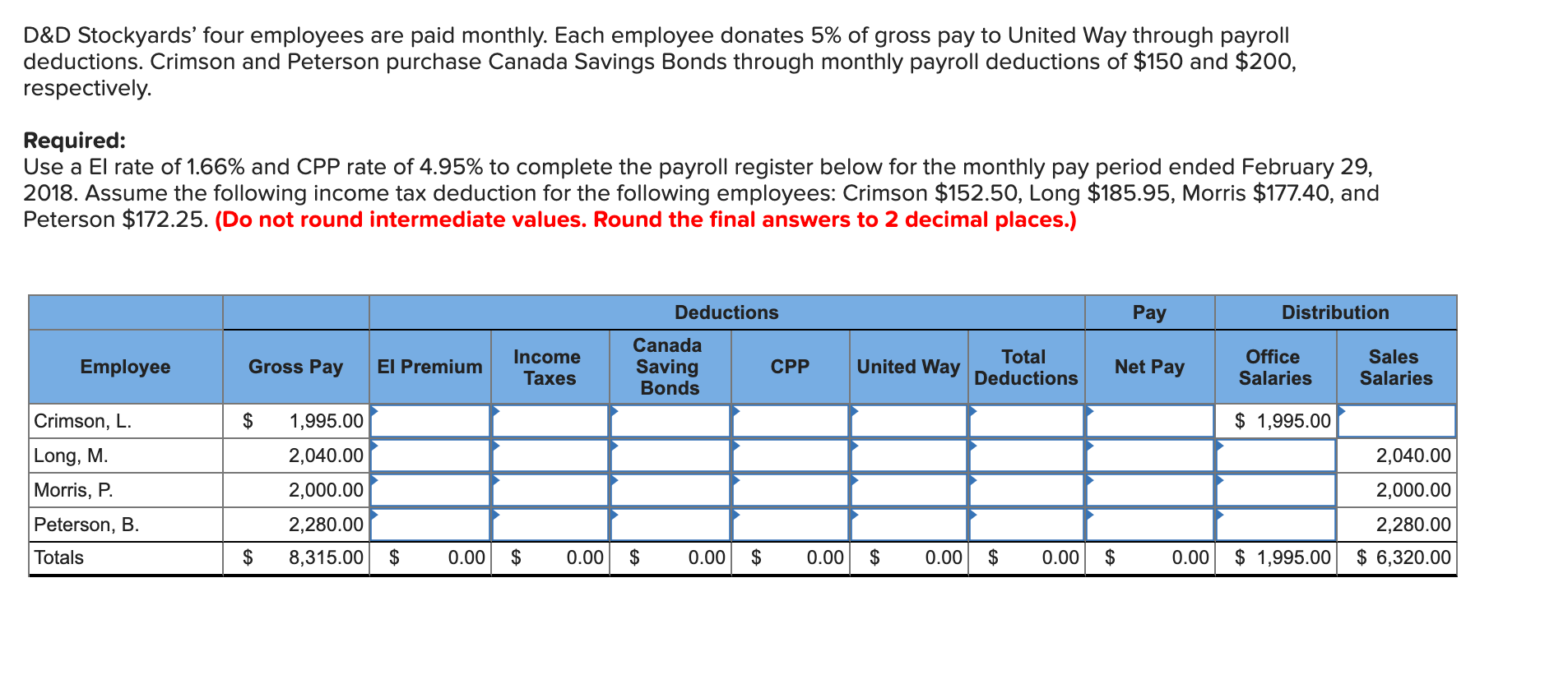

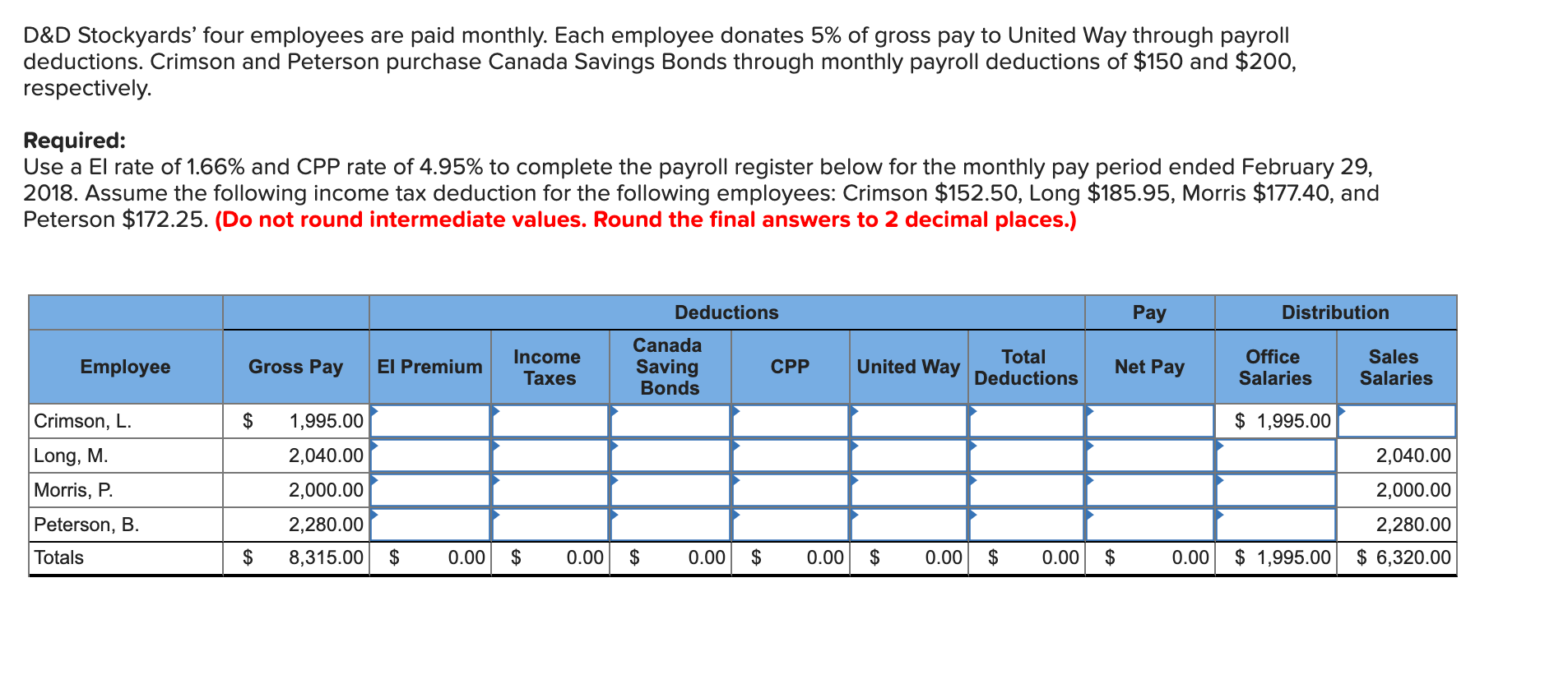

D&D Stockyards four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200, respectively. Required: Use a EI rate of 1.66% and CPP rate of 4.95% to complete the payroll register below for the monthly pay period ended February 29, 2018. Assume the following income tax deduction for the following employees: Crimson $152.50, Long $185.95, Morris $177.40, and Peterson $172.25. (Do not round intermediate values. Round the final answers to 2 decimal places.)

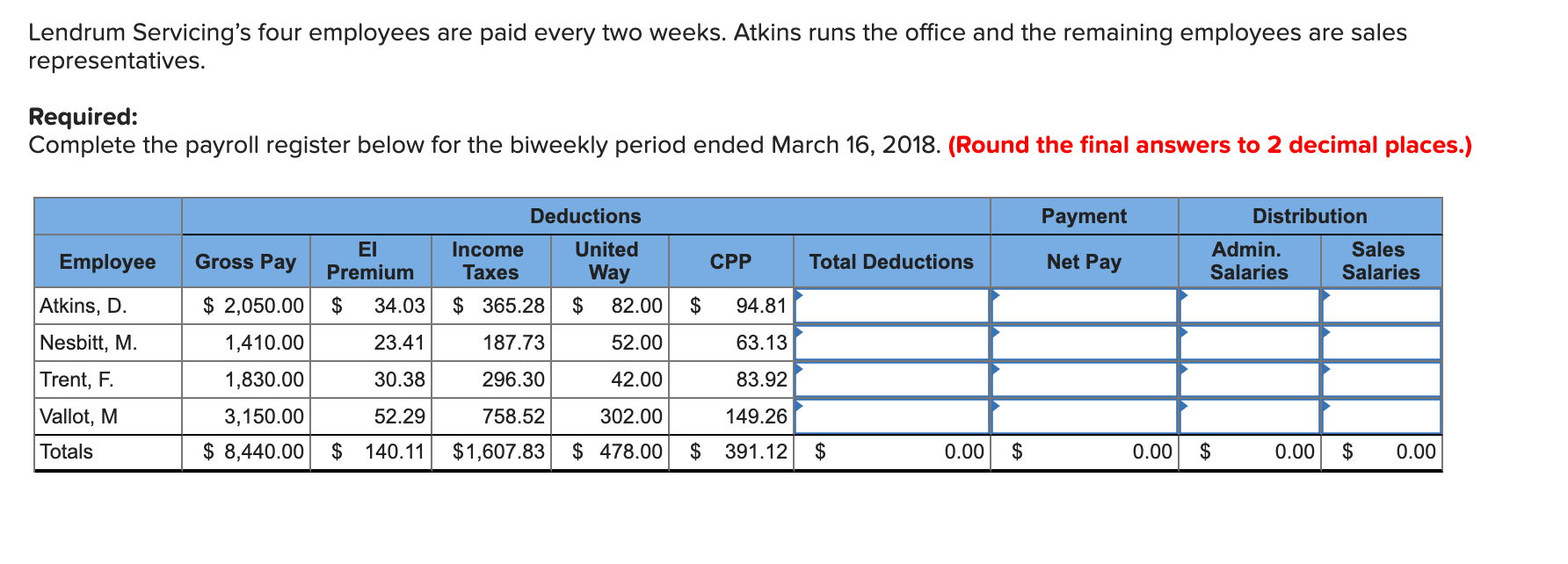

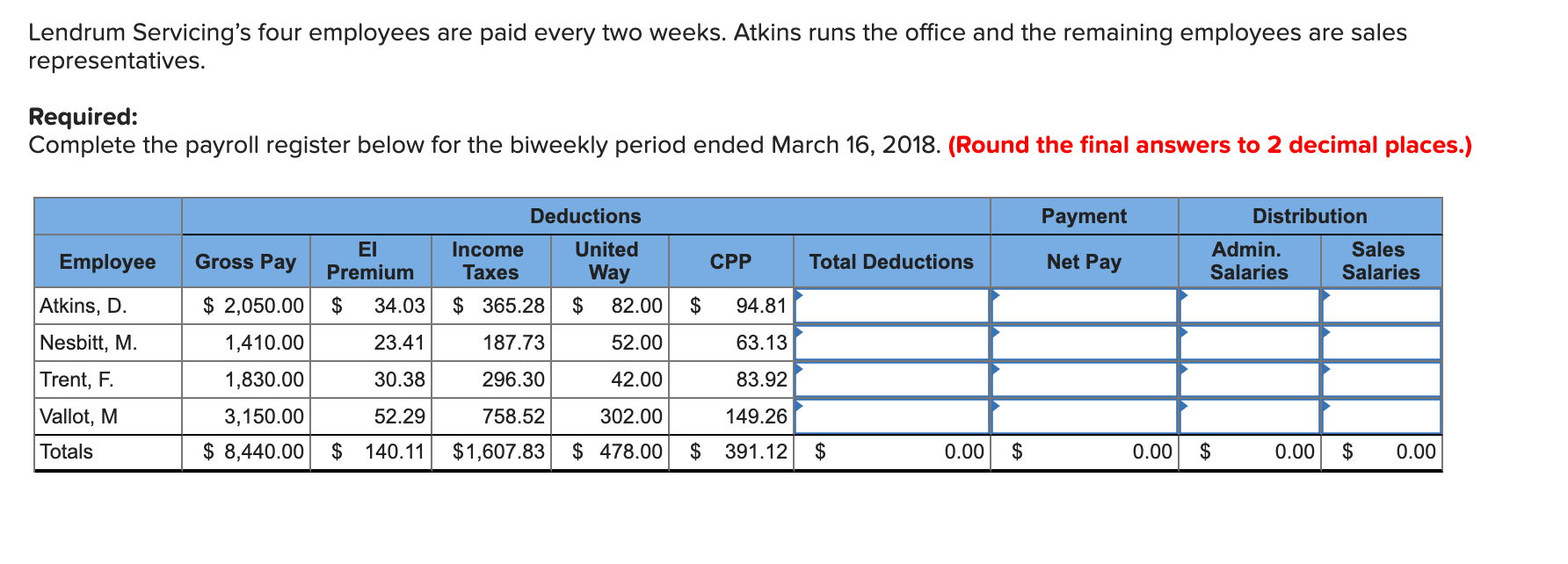

Lendrum Servicings four employees are paid every two weeks. Atkins runs the office and the remaining employees are sales representatives. Required: Complete the payroll register below for the biweekly period ended March 16, 2018. (Round the final answers to 2 decimal places.)

D&D Stockyards' four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200, respectively. Required: Use a El rate of 1.66% and CPP rate of 4.95% to complete the payroll register below for the monthly pay period ended February 29, 2018. Assume the following income tax deduction for the following employees: Crimson $152.50, Long $185.95, Morris $177.40, and Peterson $172.25. (Do not round intermediate values. Round the final answers to 2 decimal places.) Pay Distribution Deductions Canada Saving CPP Bonds Employee Gross Pay El Premium Income Taxes United Way Total Deductions Net Pay Office Salaries Sales Salaries Crimson, L. $ 1,995.00 $ 1,995.00 Long, M. 2,040.00 Morris, P. 2,000.00 2,040.00 2,000.00 2,280.00 $ 6,320.00 Peterson, B. 2,280.00 8,315.00 Totals $ $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 1,995.00 Lendrum Servicing's four employees are paid every two weeks. Atkins runs the office and the remaining employees are sales representatives. Required: Complete the payroll register below for the biweekly period ended March 16, 2018. (Round the final answers to 2 decimal places.) Deductions Payment Distribution Employee Gross Pay Premium Income Taxes CPP Total Deductions Net Pay United Way $ 82.00 Admin. Salaries Sales Salaries Atkins, D. $ 2,050.00 $ 34.03 $ 365.28 $ 94.81 Nesbitt, M. 1,410.00 23.41 187.73 52.00 63.13 Trent, F. 30.38 296.30 42.00 83.92 1,830.00 3,150.00 Vallot, M 52.29 758.52 302.00 149.26 Totals $ 8,440.00 $ 140.11 $1,607.83 $ 478.00 $ 391.12 $ 0.00 $ 0.00 $ 0.00 $ 0.00 D&D Stockyards' four employees are paid monthly. Each employee donates 5% of gross pay to United Way through payroll deductions. Crimson and Peterson purchase Canada Savings Bonds through monthly payroll deductions of $150 and $200, respectively. Required: Use a El rate of 1.66% and CPP rate of 4.95% to complete the payroll register below for the monthly pay period ended February 29, 2018. Assume the following income tax deduction for the following employees: Crimson $152.50, Long $185.95, Morris $177.40, and Peterson $172.25. (Do not round intermediate values. Round the final answers to 2 decimal places.) Pay Distribution Deductions Canada Saving CPP Bonds Employee Gross Pay El Premium Income Taxes United Way Total Deductions Net Pay Office Salaries Sales Salaries Crimson, L. $ 1,995.00 $ 1,995.00 Long, M. 2,040.00 Morris, P. 2,000.00 2,040.00 2,000.00 2,280.00 $ 6,320.00 Peterson, B. 2,280.00 8,315.00 Totals $ $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 0.00 $ 1,995.00 Lendrum Servicing's four employees are paid every two weeks. Atkins runs the office and the remaining employees are sales representatives. Required: Complete the payroll register below for the biweekly period ended March 16, 2018. (Round the final answers to 2 decimal places.) Deductions Payment Distribution Employee Gross Pay Premium Income Taxes CPP Total Deductions Net Pay United Way $ 82.00 Admin. Salaries Sales Salaries Atkins, D. $ 2,050.00 $ 34.03 $ 365.28 $ 94.81 Nesbitt, M. 1,410.00 23.41 187.73 52.00 63.13 Trent, F. 30.38 296.30 42.00 83.92 1,830.00 3,150.00 Vallot, M 52.29 758.52 302.00 149.26 Totals $ 8,440.00 $ 140.11 $1,607.83 $ 478.00 $ 391.12 $ 0.00 $ 0.00 $ 0.00 $ 0.00