Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer these and show your work ((:! please make sure its the correct fixed cost and read the paragraph for additional information ((: Kitchen

Please answer these and show your work ((:! please make sure its the correct fixed cost and read the paragraph for additional information ((:

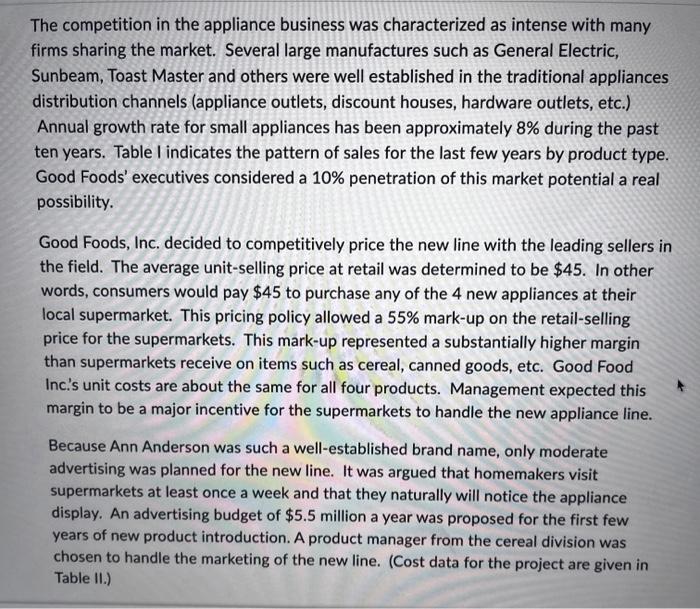

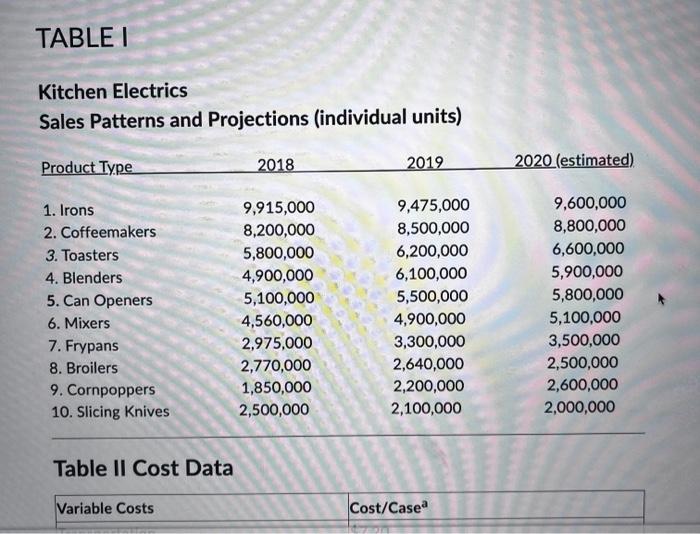

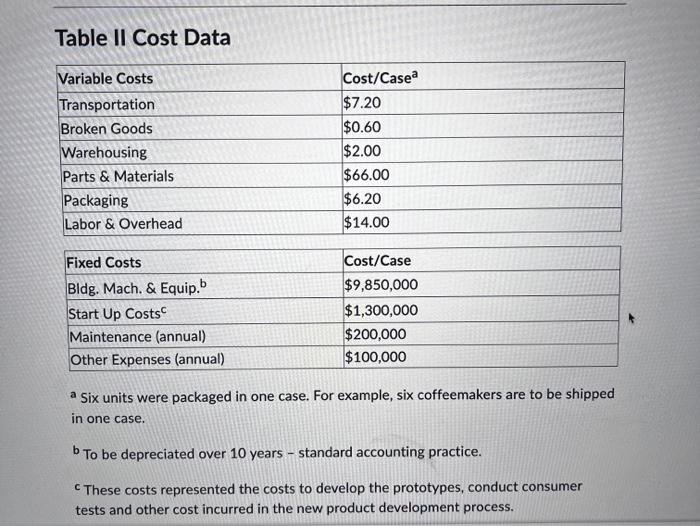

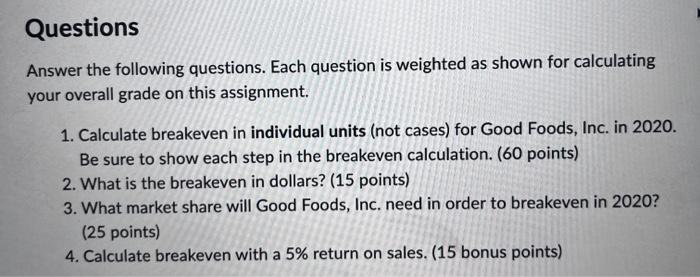

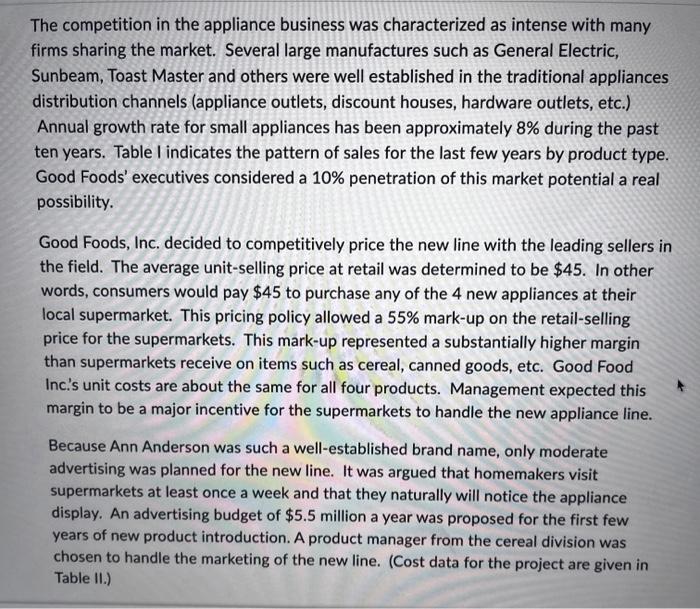

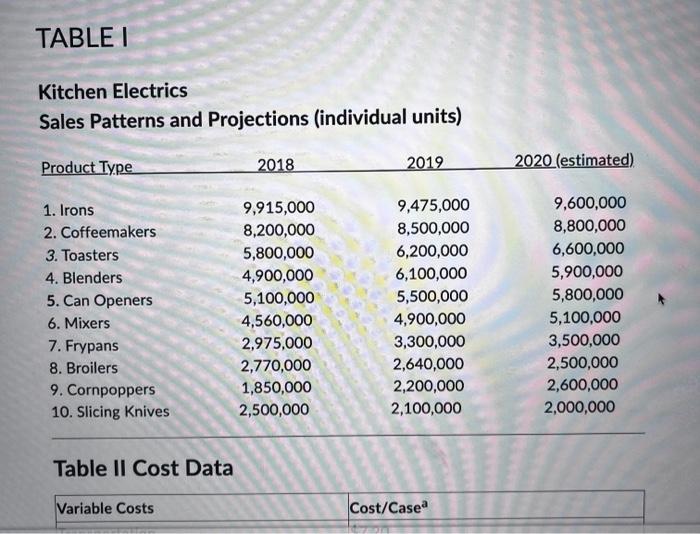

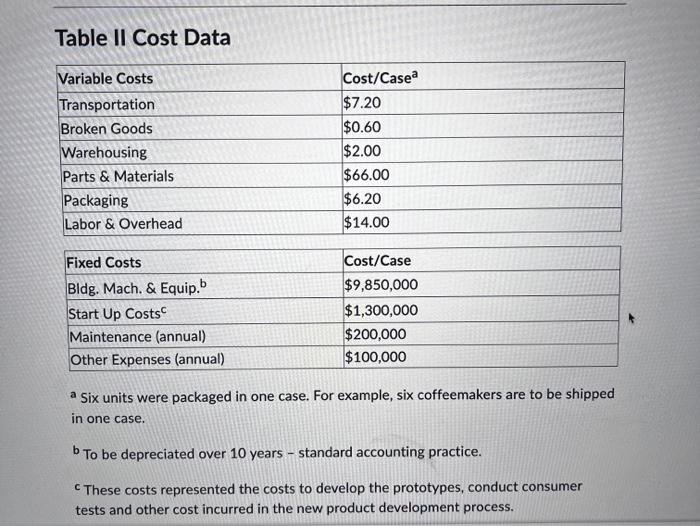

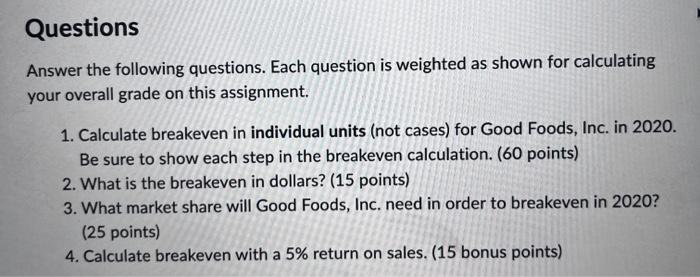

Kitchen Electrics Sales Patterns and Projections (individual units) Table II Cost Data Questions Answer the following questions. Each question is weighted as shown for calculating your overall grade on this assignment. 1. Calculate breakeven in individual units (not cases) for Good Foods, Inc. in 2020. Be sure to show each step in the breakeven calculation. ( 60 points) 2. What is the breakeven in dollars? (15 points) 3. What market share will Good Foods, Inc. need in order to breakeven in 2020 ? (25 points) 4. Calculate breakeven with a 5% return on sales. ( 15 bonus points) Table II Cost Data a Six units were packaged in one case. For example, six coffeemakers are to be shipped in one case. b To be depreciated over 10 years - standard accounting practice. c These costs represented the costs to develop the prototypes, conduct consumer tests and other cost incurred in the new product development process. The competition in the appliance business was characterized as intense with many firms sharing the market. Several large manufactures such as General Electric, Sunbeam, Toast Master and others were well established in the traditional appliances distribution channels (appliance outlets, discount houses, hardware outlets, etc.) Annual growth rate for small appliances has been approximately 8% during the past ten years. Table I indicates the pattern of sales for the last few years by product type. Good Foods' executives considered a 10% penetration of this market potential a real possibility. Good Foods, Inc. decided to competitively price the new line with the leading sellers in the field. The average unit-selling price at retail was determined to be $45. In other words, consumers would pay $45 to purchase any of the 4 new appliances at their local supermarket. This pricing policy allowed a 55% mark-up on the retail-selling price for the supermarkets. This mark-up represented a substantially higher margin than supermarkets receive on items such as cereal, canned goods, etc. Good Food Inc.'s unit costs are about the same for all four products. Management expected this margin to be a major incentive for the supermarkets to handle the new appliance line. Because Ann Anderson was such a well-established brand name, only moderate advertising was planned for the new line. It was argued that homemakers visit supermarkets at least once a week and that they naturally will notice the appliance display. An advertising budget of $5.5 million a year was proposed for the first few years of new product introduction. A product manager from the cereal division was chosen to handle the marketing of the new line. (Cost data for the project are given in Table II.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started