Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer these question I will give u a like thanks D Jeremy received $50 as a gift and $120 from his a job as

please answer these question I will give u a like thanks

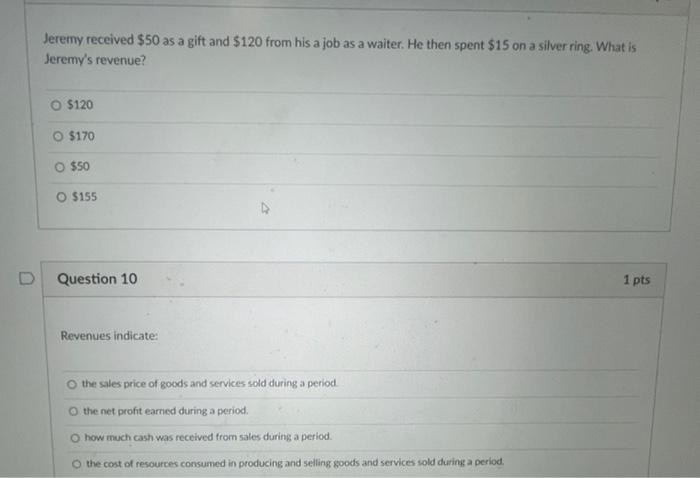

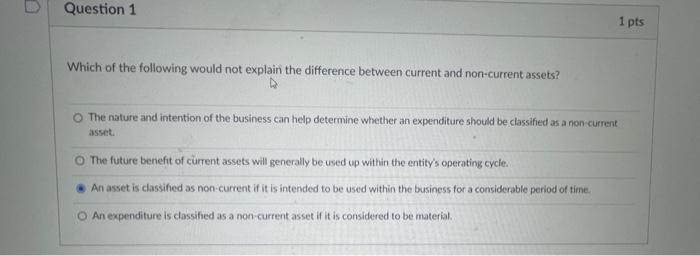

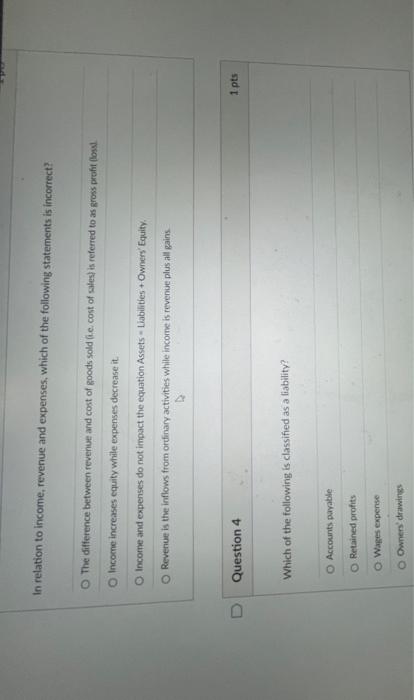

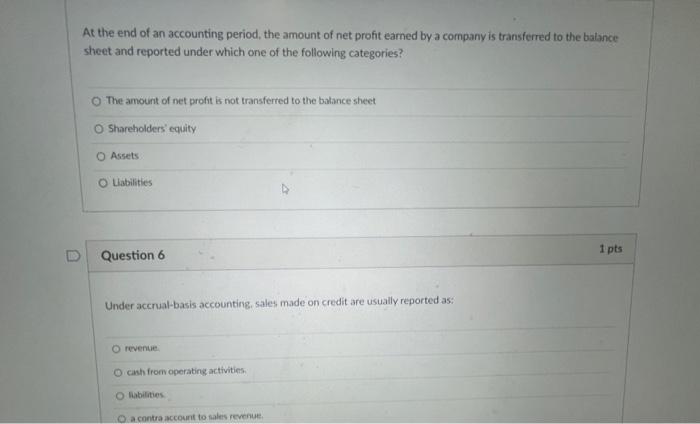

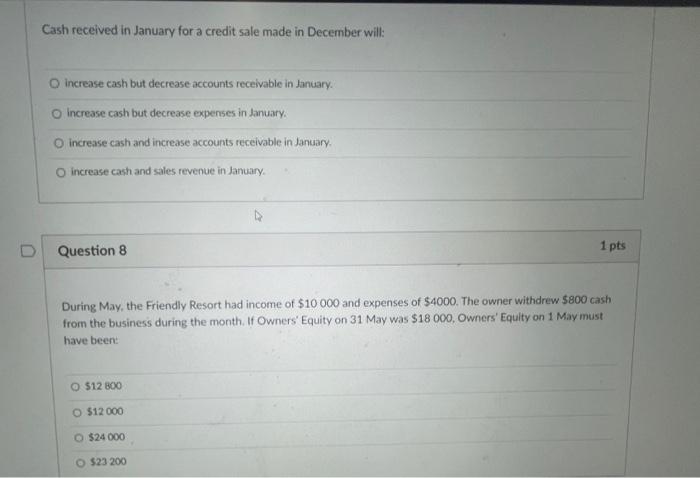

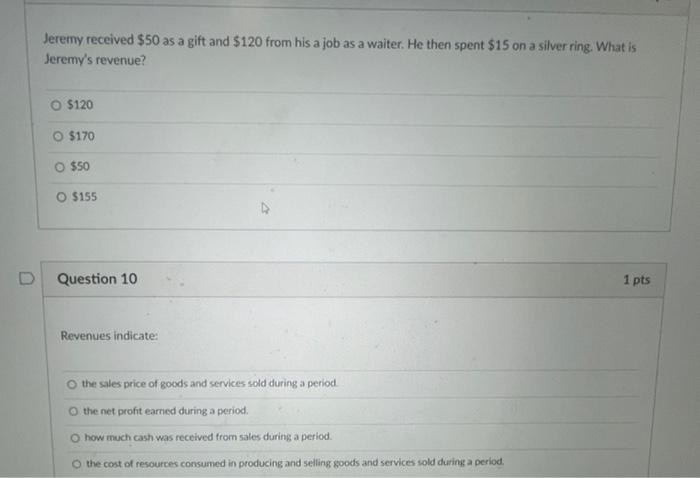

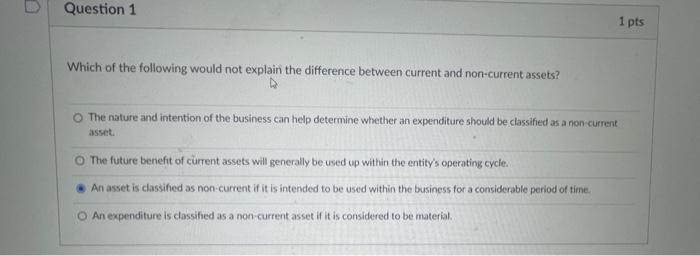

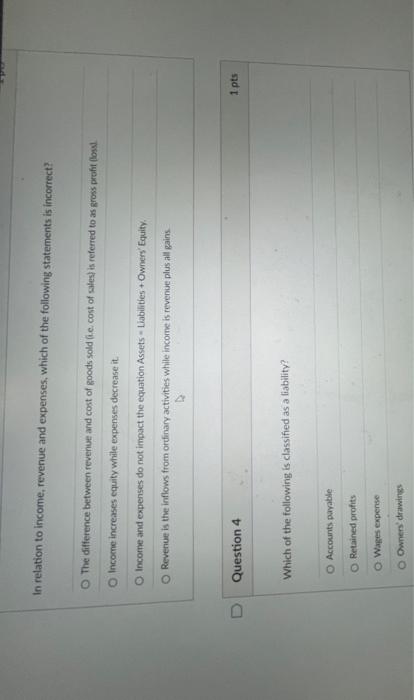

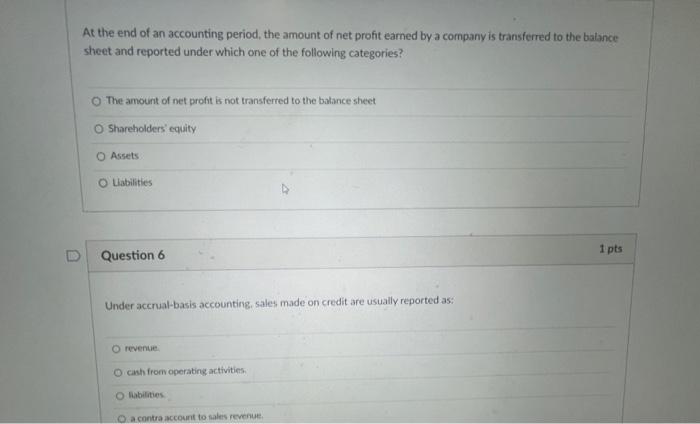

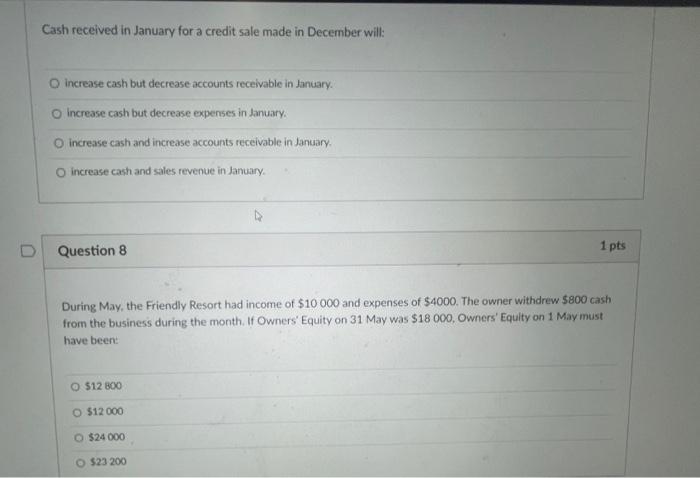

D Jeremy received $50 as a gift and $120 from his a job as a waiter. He then spent $15 on a silver ring. What is Jeremy's revenue? O $120 O $170 O $50 O $155 Question 10. 1 pts Revenues indicate: O the sales price of goods and services sold during a period. O the net profit earned during a period. O how much cash was received from sales during a period. the cost of resources consumed in producing and selling goods and services sold during a period. Question 1 1 pts Which of the following would not explain the difference between current and non-current assets? A O The nature and intention of the business can help determine whether an expenditure should be classified as a non-current asset. The future benefit of current assets will generally be used up within the entity's operating cycle. An asset is classified as non-current if it is intended to be used within the business for a considerable period of time. O An expenditure is classified as a non-current asset if it is considered to be material. D In relation to income, revenue and expenses, which of the following statements is incorrect? O The difference between revenue and cost of goods sold (e. cost of sales) is referred to as gross profit (loss). O Income increases equity while expenses decrease it. O Income and expenses do not impact the equation Assets - Liabilities + Owners' Equity. O Revenue is the inflows from ordinary activities while income is revenue plus all gains Question 4 Which of the following is classified as a liability? O Accounts payable O Retained profits O Wages expense O Owners' drawings 1 pts At the end of an accounting period, the amount of net profit earned by a company is transferred to the balance sheet and reported under which one of the following categories? O The amount of net profit is not transferred to the balance sheet O Shareholders' equity O Assets O Liabilities Question 6 1 pts Under accrual-basis accounting, sales made on credit are usually reported as: O revenue O cash from operating activities. O liabilities O a contra account to sales revenue. D Cash received in January for a credit sale made in December will: O increase cash but decrease accounts receivable in January. O increase cash but decrease expenses in January. O increase cash and increase accounts receivable in January. O increase cash and sales revenue in January. Question 8 1 pts During May, the Friendly Resort had income of $10 000 and expenses of $4000. The owner withdrew $800 cash from the business during the month. If Owners' Equity on 31 May was $18 000, Owners' Equity on 1 May must have been: O $12 800 O $12000 O $24000 O $23 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started