(Please answer these questions from a continuation of the homework assignment that is attached as a picture)

This upload assignment is an extension of the Available for Sale category treatment of investments in Chapter 14 Exercise 52. ASSUME the Company intends to prepare financial statements on 7/1/Yr2 after the sale of 2/8 of the bonds.

1) Adjust the remaining 6/8 of the investment in AFS Bonds to FV assuming the FV is $57,902 at 7/1/Yr2. Provide the journal entry and all supporting computations.

2) What amounts would be reported in the Asset and Stockholder's Equity section of the Balance Sheet (as shown in class) after adjustment on 7/1/Yr2? You must use a proper heading for your partial Balance Sheet. Provide all supporting computations.

2) What amounts AND where would they be reported in the 7/1/Yr 2 Income Statement for both the bonds sold and the remaining bonds? You must use a proper heading for your partial Income Statement. Provide all supporting computations.

Reminder: You must show all supporting computations

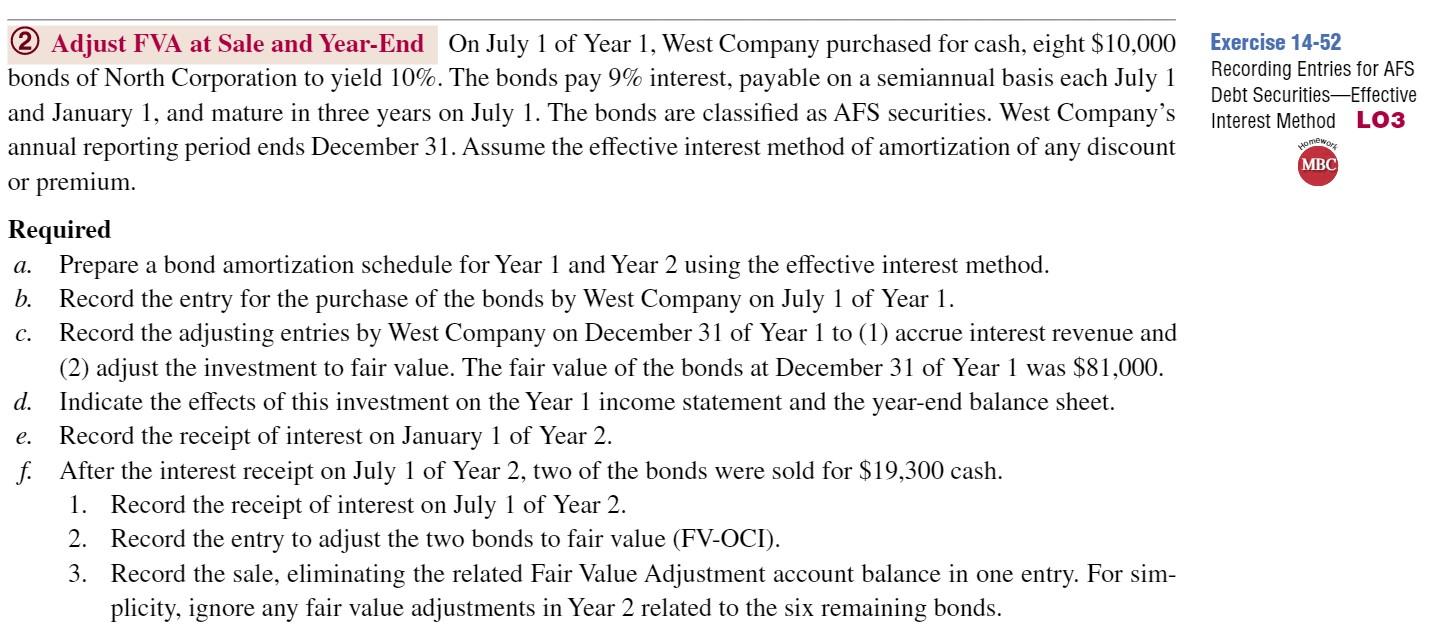

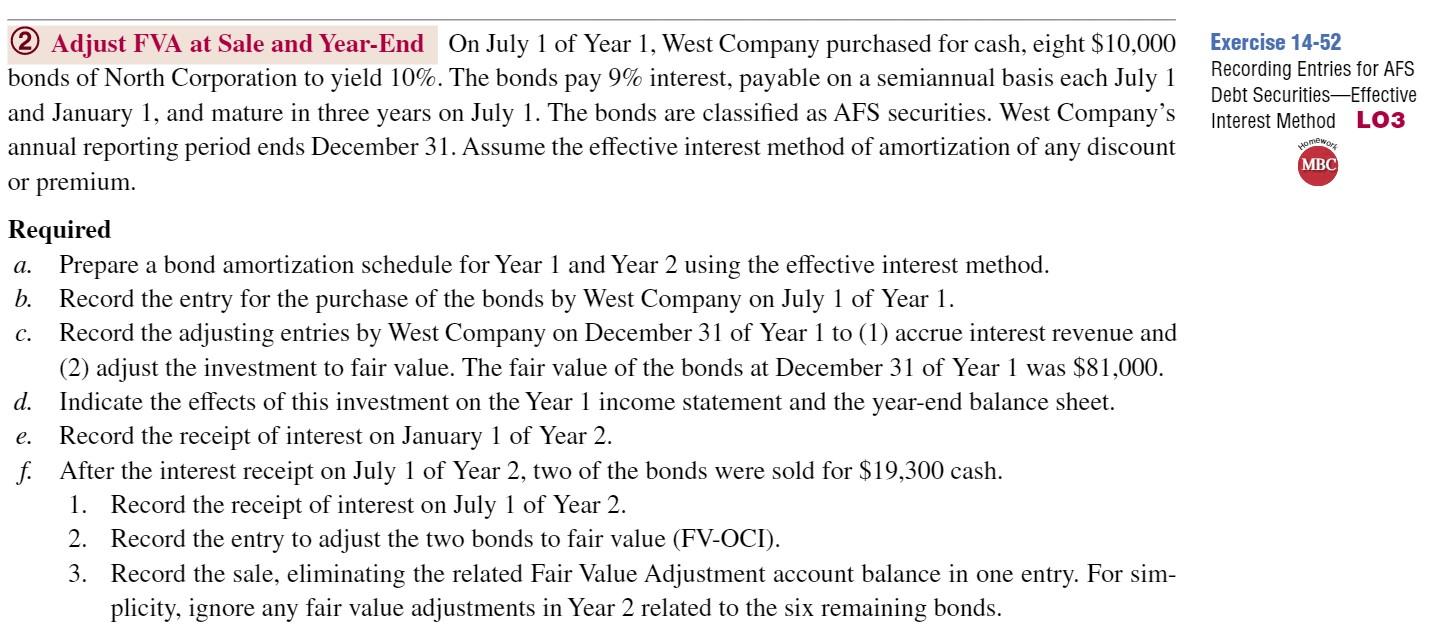

(2) Adjust FVA at Sale and Year-End On July 1 of Year 1, West Company purchased for cash, eight $10,000 Exercise 14-52 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 Recording Entries for AFS and January 1, and mature in three years on July 1. The bonds are classified as AFS securities. West Company's Debt Securities-Effective annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Required a. Prepare a bond amortization schedule for Year 1 and Year 2 using the effective interest method. b. Record the entry for the purchase of the bonds by West Company on July 1 of Year 1 . c. Record the adjusting entries by West Company on December 31 of Year 1 to (1) accrue interest revenue and (2) adjust the investment to fair value. The fair value of the bonds at December 31 of Year 1 was $81,000. d. Indicate the effects of this investment on the Year 1 income statement and the year-end balance sheet. e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $19,300 cash. 1. Record the receipt of interest on July 1 of Year 2. 2. Record the entry to adjust the two bonds to fair value (FV-OCI). 3. Record the sale, eliminating the related Fair Value Adjustment account balance in one entry. For simplicity, ignore any fair value adjustments in Year 2 related to the six remaining bonds. (2) Adjust FVA at Sale and Year-End On July 1 of Year 1, West Company purchased for cash, eight $10,000 Exercise 14-52 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 Recording Entries for AFS and January 1, and mature in three years on July 1. The bonds are classified as AFS securities. West Company's Debt Securities-Effective annual reporting period ends December 31. Assume the effective interest method of amortization of any discount or premium. Required a. Prepare a bond amortization schedule for Year 1 and Year 2 using the effective interest method. b. Record the entry for the purchase of the bonds by West Company on July 1 of Year 1 . c. Record the adjusting entries by West Company on December 31 of Year 1 to (1) accrue interest revenue and (2) adjust the investment to fair value. The fair value of the bonds at December 31 of Year 1 was $81,000. d. Indicate the effects of this investment on the Year 1 income statement and the year-end balance sheet. e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $19,300 cash. 1. Record the receipt of interest on July 1 of Year 2. 2. Record the entry to adjust the two bonds to fair value (FV-OCI). 3. Record the sale, eliminating the related Fair Value Adjustment account balance in one entry. For simplicity, ignore any fair value adjustments in Year 2 related to the six remaining bonds