Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer these questions, if is correct I will give u a thumb's up, thank you Based on past experience, Maas Corp. (a U.S.-based company)

Please answer these questions, if is correct I will give u a thumb's up, thank you

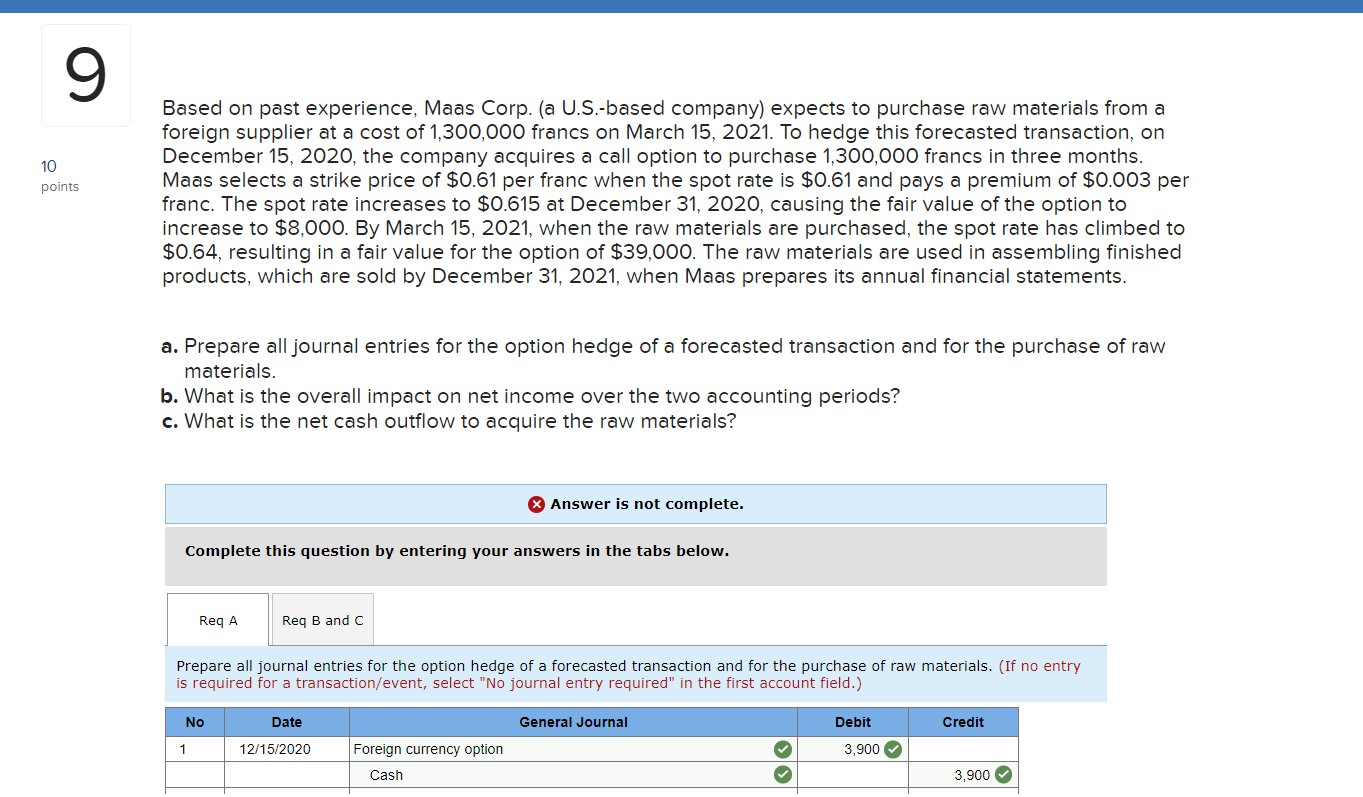

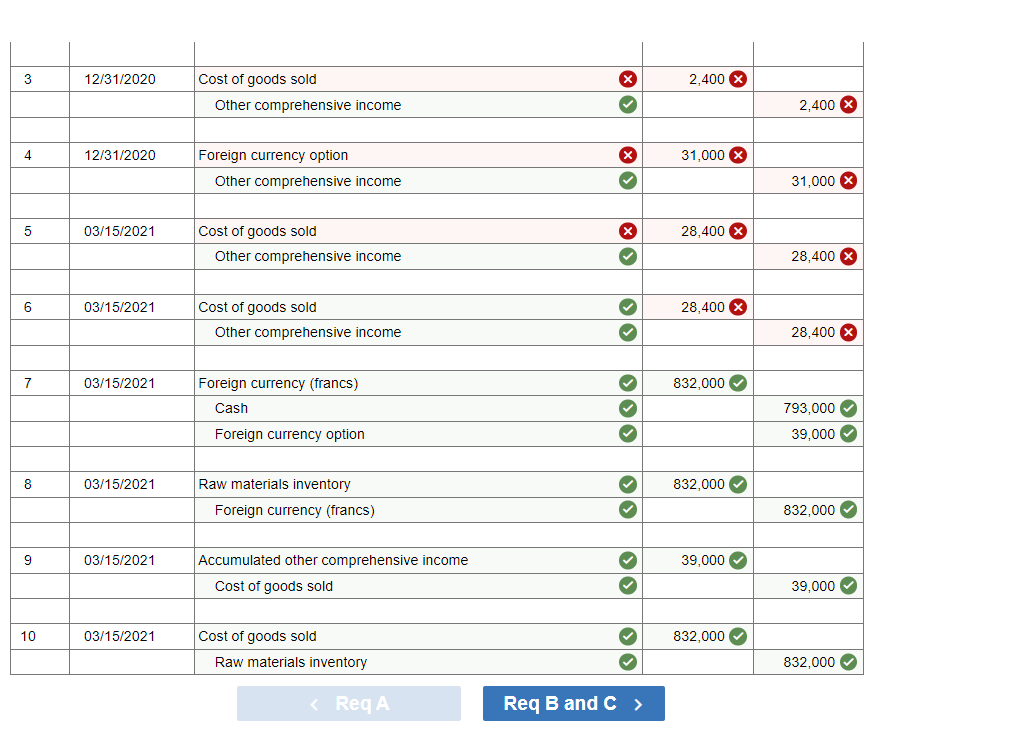

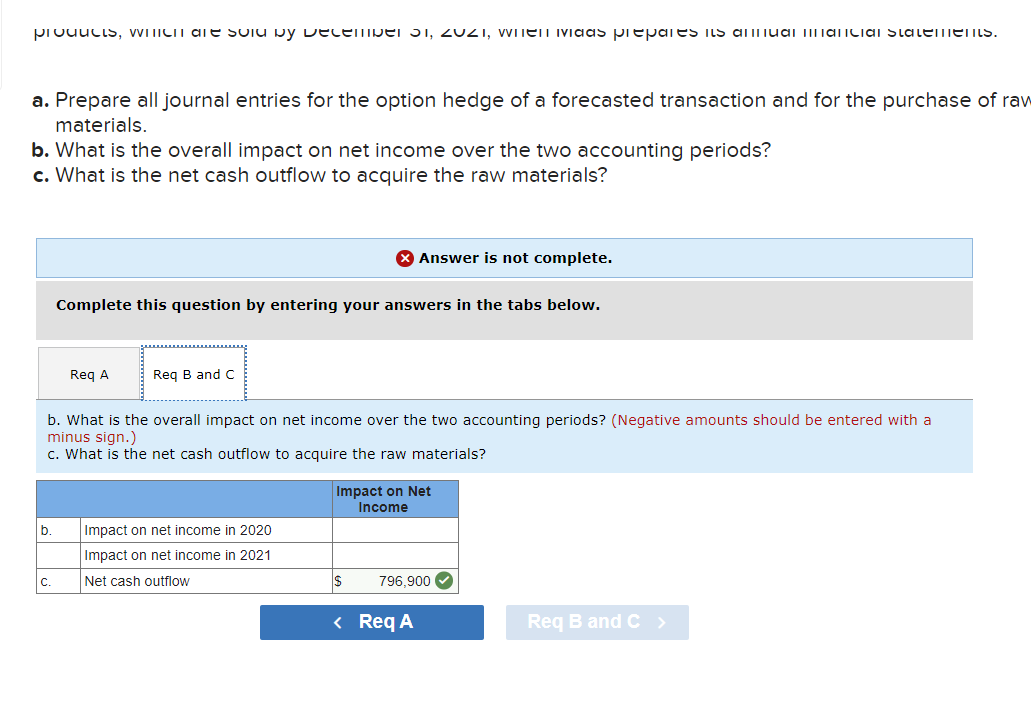

Based on past experience, Maas Corp. (a U.S.-based company) expects to purchase raw materials from a foreign supplier at a cost of 1,300,000 francs on March 15, 2021. To hedge this forecasted transaction, on December 15, 2020, the company acquires a call option to purchase 1,300,000 francs in three months. Maas selects a strike price of $0.61 per franc when the spot rate is $0.61 and pays a premium of $0.003 per franc. The spot rate increases to $0.615 at December 31,2020 , causing the fair value of the option to increase to $8,000. By March 15, 2021, when the raw materials are purchased, the spot rate has climbed to $0.64, resulting in a fair value for the option of $39,000. The raw materials are used in assembling finished products, which are sold by December 31, 2021, when Maas prepares its annual financial statements. a. Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials. b. What is the overall impact on net income over the two accounting periods? c. What is the net cash outflow to acquire the raw materials? Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of raw materials. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) \begin{tabular}{|c|c|c|c|c|c|} \hline 3 & 12/31/2020 & Cost of goods sold & & 2,400 & \\ \hline & & Other comprehensive income & 2 & & 2,400 \\ \hline \multirow[t]{2}{*}{4} & 12/31/2020 & Foreign currency option & & 31,000 & \\ \hline & & Other comprehensive income & 2 & & 31,000 \\ \hline \multirow[t]{2}{*}{5} & 03/15/2021 & Cost of goods sold & & 28,400 & \\ \hline & & Other comprehensive income & 2 & & 28,400 \\ \hline \multirow[t]{2}{*}{6} & 03/15/2021 & Cost of goods sold & 2 & 28,400 & \\ \hline & & Other comprehensive income & 2 & & 28,400 \\ \hline \multirow[t]{3}{*}{7} & 03/15/2021 & Foreign currency (francs) & 2 & 832,000 & \\ \hline & & Cash & 2 & & 793,000 \\ \hline & & Foreign currency option & 2 & & 39,000 \\ \hline \multirow[t]{2}{*}{8} & 03/15/2021 & Raw materials inventory & 2 & 832,000 & \\ \hline & & Foreign currency (francs) & 2 & & 832,000 \\ \hline \multirow[t]{2}{*}{9} & 03/15/2021 & Accumulated other comprehensive income & 2 & 39,000 & \\ \hline & & Cost of goods sold & 2 & & 39,000 \\ \hline \multirow[t]{2}{*}{10} & 03/15/2021 & Cost of goods sold & 2 & 832,000 & \\ \hline & & Raw materials inventory & 2 & & 832,000 \\ \hline \end{tabular} Req B and C > a. Prepare all journal entries for the option hedge of a forecasted transaction and for the purchase of ra materials. b. What is the overall impact on net income over the two accounting periods? c. What is the net cash outflow to acquire the raw materials? Answer is not complete. Complete this question by entering your answers in the tabs below. b. What is the overall impact on net income over the two accounting periods? (Negative amounts should be entered with a minus sign.) c. What is the net cash outflow to acquire the raw materialsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started