Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer these questions thoroughly as possible. if you can please include codifications numbers to it. Svaha Arial Group (hereinafter SAG), a publicly traded company,

Please answer these questions thoroughly as possible. if you can please include codifications numbers to it.

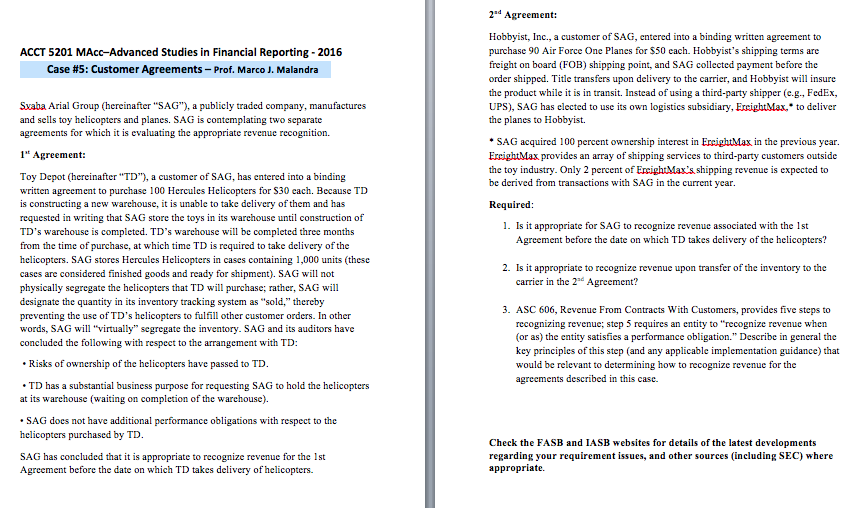

Svaha Arial Group (hereinafter "SAG"), a publicly traded company, manufactures and sells toy helicopters and planes. SAG is contemplating two separate agreements for which it is evaluating the appropriate revenue recognition. Toy Depot (hereinafter "TD"), a customer of SAG, has entered into a binding written agreement to purchase 100 Hercules Helicopters for $30 each. Because TD is constructing a new warehouse, it is unable to take delivery of them and has requested in writing that SAG store the toys in its warehouse until construction of TD's warehouse is completed. TD's warehouse will be completed three months from the time of purchase, at which time TD is required to take delivery of the helicopters. SAG stores Hercules Helicopters in cases containing 1,000 units (these cases are considered finished goods and ready for shipment). SAG will not physically segregate the helicopters that TD will purchase; rather, SAG will designate the quantity in its inventory tracking system as "sold, " thereby preventing the use of TD's helicopters to fulfill other customer orders. In other words, SAG will "Virtually" segregate the inventory. SAG and its auditors have concluded the following with respect to the arrangement with TD: Risks of ownership of the helicopters have passed to TD. TD has a substantial business purpose for requesting SAG to hold the helicopters at its warehouse (waiting on completion of the warehouse). SAG does not have additional performance obligations with respect to the helicopters purchased by TD. SAG has concluded that it is appropriate to recognize revenue for the 1st Agreement before the date on which TD takes delivery of helicopters. Hobbyist, Inc., a customer of SAG, entered into a binding written agreement to purchase 90 Air Force One Planes for $50 each. Hobbyist's shipping terms are freight on board (FOB) shipping point, and SAG collected payment before the order shipped. Title transfers upon delivery to the carrier, and Hobbyist will insure the product while it is in transit. Instead of using a third-party shipper (e.g., FedEx, UPS), SAG has elected to use its own logistics subsidiary, FreightMax, * to deliver the planes to Hobbyist. SAG acquired 100 percent ownership interest in FreightMax in the previous year. FreightMax provides an array of shipping services to third-party customers outside the toy industry. Only 2 percent of FreightMax's shipping revenue is expected to be derived from transactions with SAG in the current year. Is it appropriate for SAG to recognize revenue associated with the 1st Agreement before the date on which TD takes delivery of the helicopters? Is it appropriate to recognize revenue upon transfer of the inventory to the carrier in the 2^nd Agreement? ASC 606, Revenue From Contracts With Customers, provides five steps to recognizing revenue; step 5 requires an entity to "recognize revenue when (or as) the entity satisfies a performance obligation." Describe in general the key principles of this step (and any applicable implementation guidance) that would be relevant to determining how to recognize revenue for the agreements described in this case. Check the FASB and IASB websites for details of the latest developments regarding your requirement issues, and other sources (including SEC) where appropriateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started