Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer these. thank you! E. None of the above 7. Which of the following is NOT an assumption of the Miller & Modigliani theorem?

please answer these. thank you!

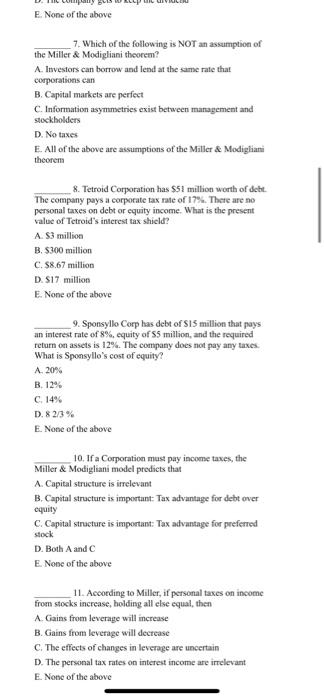

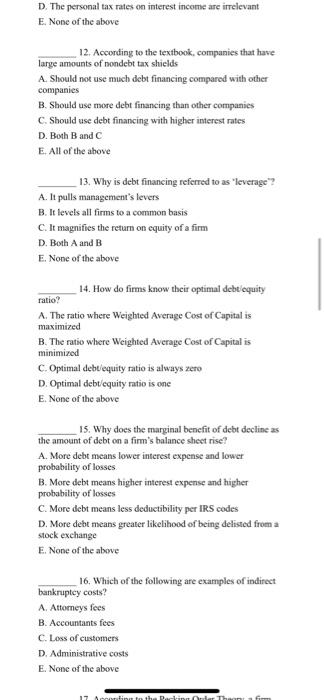

E. None of the above 7. Which of the following is NOT an assumption of the Miller & Modigliani theorem? A. Investors can borrow and lend at the same rate that corporations can B. Capital markets are perfect C. Information asymmetries exist between management and stockholders D. No taxes E. All of the above are assumptions of the Miller & Modigliani theorem 8. Tetroid Corporation has $51 million worth of debt. The company pays a corporate tax rate of 17%. There are no personal taxes on debt or equity income. What is the present value of Tetroid's interest tax shield? A. $3 million B. $300 million C. $8.67 million D. $17 million E. None of the above 9. Sponsyllo Corp has debt of $15 million that pays an interest rate of 8%, equity of $5 million, and the required return on assets is 12%. The company does not pay any taxes. What is Sponsyllo's cost of equity? A. 20% B. 12% 14% D. 82/3% E. None of the above C. 10. If a Corporation must pay income taxes, the Miller & Modigliani model predicts that A. Capital structure is irrelevant B. Capital structure is important: Tax advantage for debt over equity C. Capital structure is important: Tax advantage for preferred stock D. Both A and C E. None of the above 11. According to Miller, if personal taxes on income from stocks increase, holding all else equal, then A. Gains from leverage will increase B. Gains from leverage will decrease C. The effects of changes in leverage are uncertain D. The personal tax rates on interest income are irrelevant E. None of the above D. The personal tax rates on interest income are irrelevant E. None of the above 12. According to the textbook, companies that have large amounts of nondebt tax shields A. Should not use much debt financing compared with other companies B. Should use more debt financing than other companies C. Should use debt financing with higher interest rates D. Both B and C E. All of the above 13. Why is debt financing referred to as "leverage"? A. It pulls management's levers B. It levels all firms to a common basis C. It magnifies the return on equity of a firm D. Both A and B E. None of the above 14. How do firms know their optimal debt equity ratio? A. The ratio where Weighted Average Cost of Capital is maximized B. The ratio where Weighted Average Cost of Capital is minimized C. Optimal debt equity ratio is always zero D. Optimal debt equity ratio is one E. None of the above 15. Why does the marginal benefit of debt decline as the amount of debt on a firm's balance sheet rise? A. More debt means lower interest expense and lower probability of losses B. More debt means higher interest expense and higher probability of losses C. More debt means less deductibility per IRS codes D. More debt means greater likelihood of being delisted from a stock exchange E. None of the above 16. Which of the following are examples of indirect bankruptcy costs? A. Attorneys fees B. Accountants fees C. Loss of customers D. Administrative costs E. None of the above 17 According to the Packing Order Thaona firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started