please answer these three questions for me

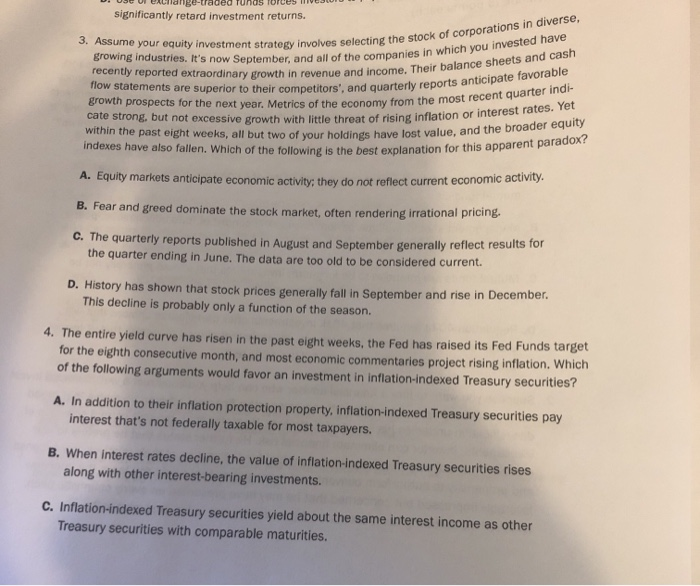

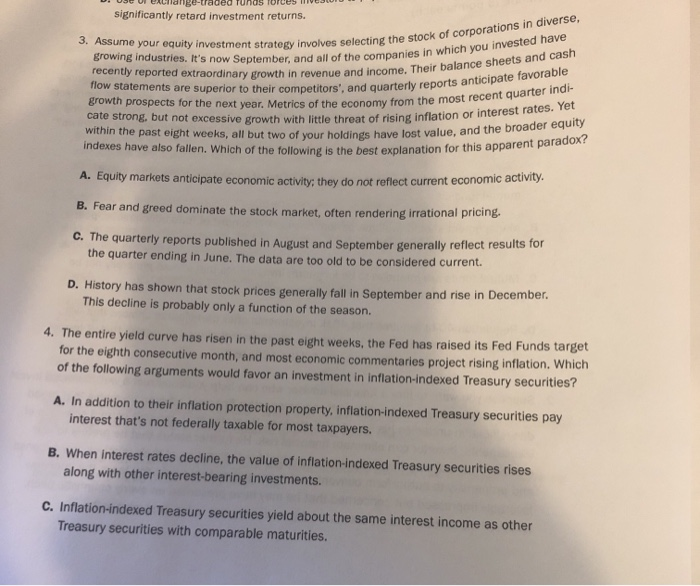

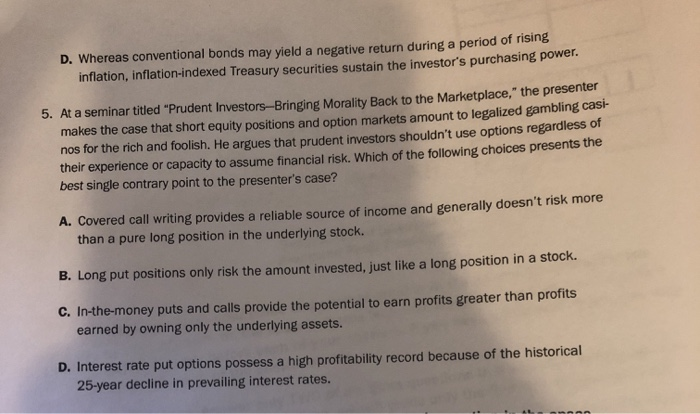

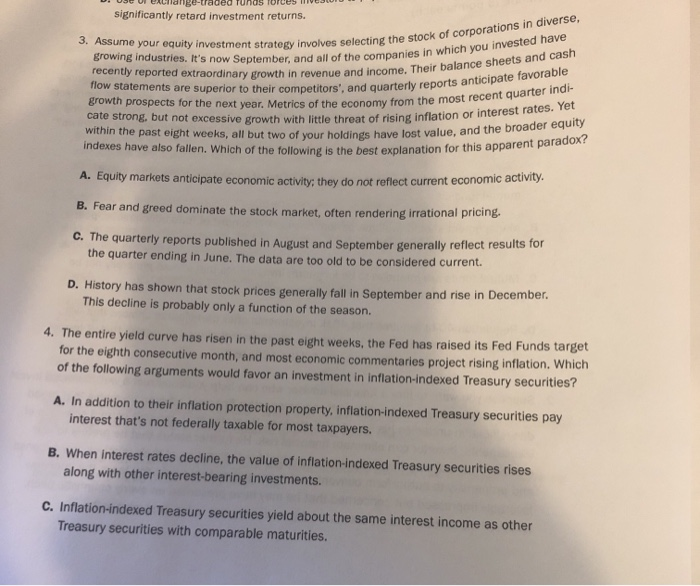

3. Assume your equity investment strategy involves selecting the stock of corporations in diverse, growing industries. It's now September, and all of the companies in which you invested have recently reported extraordinary growth in revenue and income. Their balance sheets and cash growth prospects for the next year. Metrics of the economy from the most recent quarter indi- faded runas forces significantly retard investment returns. within the past eight weeks, all but two of your holdings have lost value, and the broader equity cate strong, but not excessive growth with little threat of rising inflation or interest rates. Yet indexes have also fallen. Which of the following is the best explanation for this apparent paradox? A. Equity markets anticipate economic activity: they do not reflect current economic activity. B. Fear and greed dominate the stock market, often rendering irrational pricing. C. The quarterly reports published in August and September generally reflect results for the quarter ending in June. The data are too old to be considered current. D. History has shown that stock prices generally fall in September and rise in December. This decline is probably only a function of the season. 4. The entire yield curve has risen in the past eight weeks, the Fed has raised its Fed Funds target for the eighth consecutive month, and most economic commentaries project rising inflation. Which of the following arguments would favor an investment in inflation-indexed Treasury securities? A. In addition to their inflation protection property, inflation-indexed Treasury securities pay interest that's not federally taxable for most taxpayers. B. When interest rates decline, the value of inflation-indexed Treasury securities rises along with other interest-bearing investments. C. Inflation-indexed Treasury securities yield about the same interest income as other Treasury securities with comparable maturities. D. Whereas conventional bonds may yield a negative return during a period of rising inflation, inflation-indexed Treasury securities sustain the investor's purchasing power. 5. At a seminar titled "Prudent Investors-Bringing Morality Back to the Marketplace," the presenter makes the case that short equity positions and option markets amount to legalized gambling casi- nos for the rich and foolish. He argues that prudent investors shouldn't use options regardless of their experience or capacity to assume financial risk. Which of the following choices presents the best single contrary point to the presenter's case? A. Covered call writing provides a reliable source of income and generally doesn't risk more than a pure long position in the underlying stock. B. Long put positions only risk the amount invested, just like a long position in a stock. C. In-the-money puts and calls provide the potential to earn profits greater than profits earned by owning only the underlying assets. D. Interest rate put options possess a high profitability record because of the historical 25-year decline in prevailing interest rates. 3. Assume your equity investment strategy involves selecting the stock of corporations in diverse, growing industries. It's now September, and all of the companies in which you invested have recently reported extraordinary growth in revenue and income. Their balance sheets and cash growth prospects for the next year. Metrics of the economy from the most recent quarter indi- faded runas forces significantly retard investment returns. within the past eight weeks, all but two of your holdings have lost value, and the broader equity cate strong, but not excessive growth with little threat of rising inflation or interest rates. Yet indexes have also fallen. Which of the following is the best explanation for this apparent paradox? A. Equity markets anticipate economic activity: they do not reflect current economic activity. B. Fear and greed dominate the stock market, often rendering irrational pricing. C. The quarterly reports published in August and September generally reflect results for the quarter ending in June. The data are too old to be considered current. D. History has shown that stock prices generally fall in September and rise in December. This decline is probably only a function of the season. 4. The entire yield curve has risen in the past eight weeks, the Fed has raised its Fed Funds target for the eighth consecutive month, and most economic commentaries project rising inflation. Which of the following arguments would favor an investment in inflation-indexed Treasury securities? A. In addition to their inflation protection property, inflation-indexed Treasury securities pay interest that's not federally taxable for most taxpayers. B. When interest rates decline, the value of inflation-indexed Treasury securities rises along with other interest-bearing investments. C. Inflation-indexed Treasury securities yield about the same interest income as other Treasury securities with comparable maturities. D. Whereas conventional bonds may yield a negative return during a period of rising inflation, inflation-indexed Treasury securities sustain the investor's purchasing power. 5. At a seminar titled "Prudent Investors-Bringing Morality Back to the Marketplace," the presenter makes the case that short equity positions and option markets amount to legalized gambling casi- nos for the rich and foolish. He argues that prudent investors shouldn't use options regardless of their experience or capacity to assume financial risk. Which of the following choices presents the best single contrary point to the presenter's case? A. Covered call writing provides a reliable source of income and generally doesn't risk more than a pure long position in the underlying stock. B. Long put positions only risk the amount invested, just like a long position in a stock. C. In-the-money puts and calls provide the potential to earn profits greater than profits earned by owning only the underlying assets. D. Interest rate put options possess a high profitability record because of the historical 25-year decline in prevailing interest rates