Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer these two questions as soon as possible atdgrap The first question: As a financial analyst, state the types of investments and how they

please answer these two questions as soon as possible

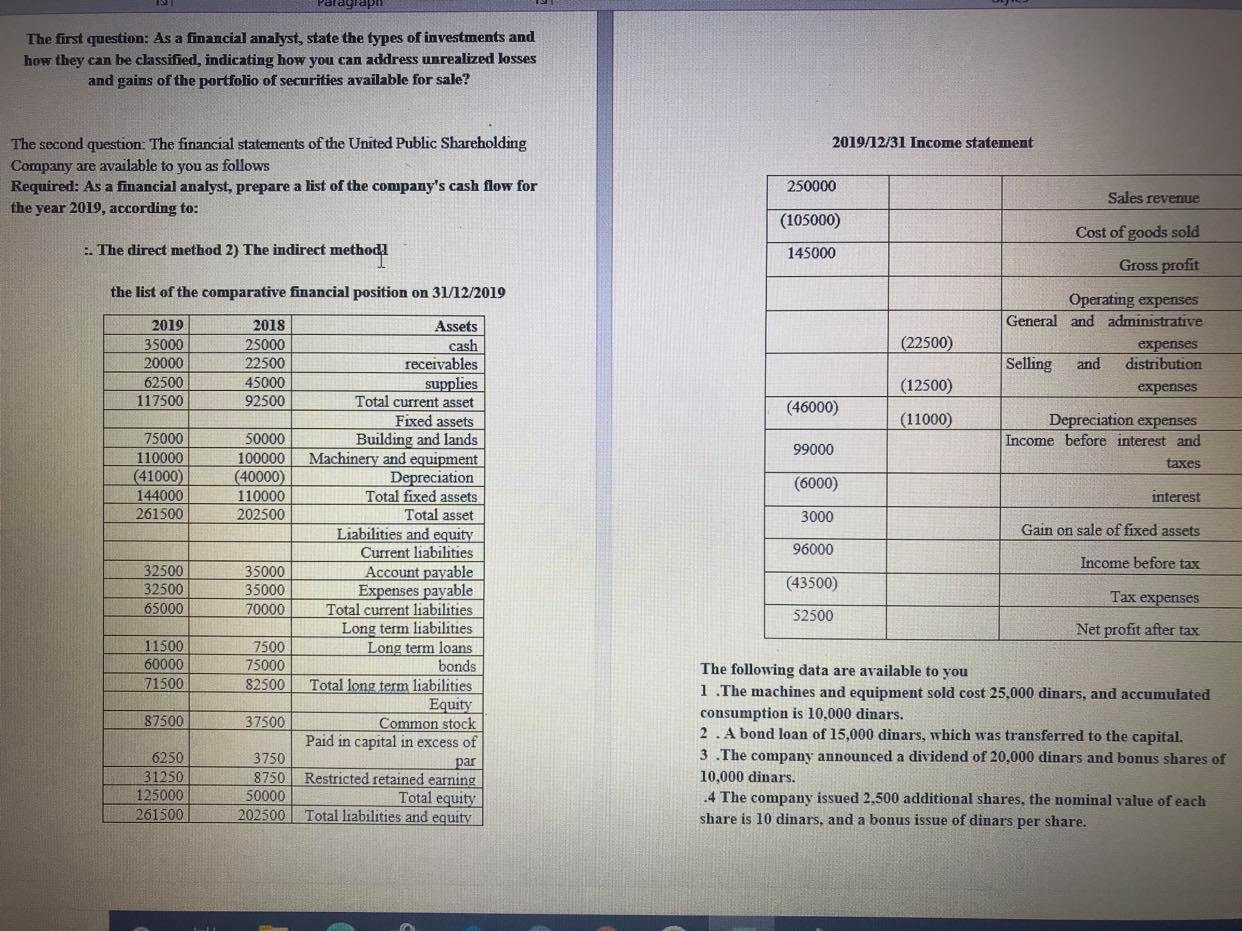

atdgrap The first question: As a financial analyst, state the types of investments and how they can be classified, indicating how you can address unrealized losses and gains of the portfolio of securities available for sale? 2019/12/31 Income statement The second question: The financial statements of the United Public Shareholding Company are available to you as follows Required: As a financial analyst, prepare a list of the company's cash flow for the year 2019, according to: 250000 Sales revenue (105000) . The direct method 2) The indirect method 145000 Cost of goods sold Gross profit the list of the comparative financial position on 31/12/2019 Assets cash (22500) 2019 35000 20000 62500 117500 2018 25000 22500 45000 92500 Operating expenses General and administrative expenses Selling and distribution expenses (12500) (46000) (11000) 99000 Depreciation expenses Income before interest and taxes 75000 110000 (41000) 144000 261500 50000 100000 (40000) 110000 202500 (6000) interest 3000 Gain on sale of fixed assets 96000 Income before tax 32500 32500 65000 35000 35000 70000 receivables supplies Total current asset Fixed assets Building and lands Machinery and equipment Depreciation Total fixed assets Total asset Liabilities and equity Current liabilities Account payable Expenses payable Total current liabilities Long term liabilities Long term loans bonds Total long term liabilities Equity Common stock Paid in capital in excess of par Restricted retained earning Total equity Total liabilities and equity (43500) Tax expenses 52500 Net profit after tax 11500 60000 71500 7500 75000 82500 87500 37500 The following data are available to you 1 The machines and equipment sold cost 25.000 dinars, and accumulated consumption is 10.000 dinars. 2 . A bond loan of 15,000 dinars, which was transferred to the capital. 3. The company announced a dividend of 20.000 dinars and bonus shares of 10,000 dinars. -4 The company issued 2.500 additional shares, the nominal value of each share is 10 dinars, and a bonus issue of dinars per share. 6250 31250 125000 261500 3750 8750 50000 202500 atdgrap The first question: As a financial analyst, state the types of investments and how they can be classified, indicating how you can address unrealized losses and gains of the portfolio of securities available for sale? 2019/12/31 Income statement The second question: The financial statements of the United Public Shareholding Company are available to you as follows Required: As a financial analyst, prepare a list of the company's cash flow for the year 2019, according to: 250000 Sales revenue (105000) . The direct method 2) The indirect method 145000 Cost of goods sold Gross profit the list of the comparative financial position on 31/12/2019 Assets cash (22500) 2019 35000 20000 62500 117500 2018 25000 22500 45000 92500 Operating expenses General and administrative expenses Selling and distribution expenses (12500) (46000) (11000) 99000 Depreciation expenses Income before interest and taxes 75000 110000 (41000) 144000 261500 50000 100000 (40000) 110000 202500 (6000) interest 3000 Gain on sale of fixed assets 96000 Income before tax 32500 32500 65000 35000 35000 70000 receivables supplies Total current asset Fixed assets Building and lands Machinery and equipment Depreciation Total fixed assets Total asset Liabilities and equity Current liabilities Account payable Expenses payable Total current liabilities Long term liabilities Long term loans bonds Total long term liabilities Equity Common stock Paid in capital in excess of par Restricted retained earning Total equity Total liabilities and equity (43500) Tax expenses 52500 Net profit after tax 11500 60000 71500 7500 75000 82500 87500 37500 The following data are available to you 1 The machines and equipment sold cost 25.000 dinars, and accumulated consumption is 10.000 dinars. 2 . A bond loan of 15,000 dinars, which was transferred to the capital. 3. The company announced a dividend of 20.000 dinars and bonus shares of 10,000 dinars. -4 The company issued 2.500 additional shares, the nominal value of each share is 10 dinars, and a bonus issue of dinars per share. 6250 31250 125000 261500 3750 8750 50000 202500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started