Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this 2 questions which they are connected to each other . thanks Question 1 5 pts In order to save money for a

please answer this 2 questions which they are connected to each other . thanks

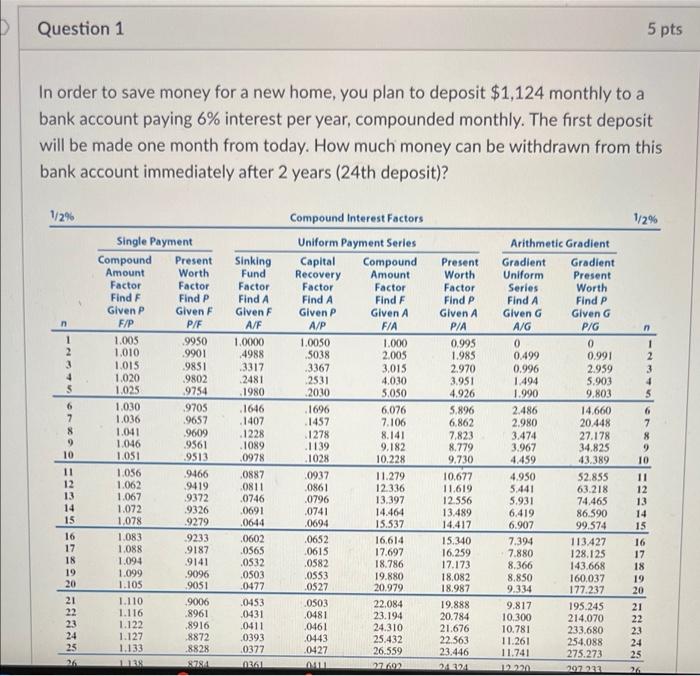

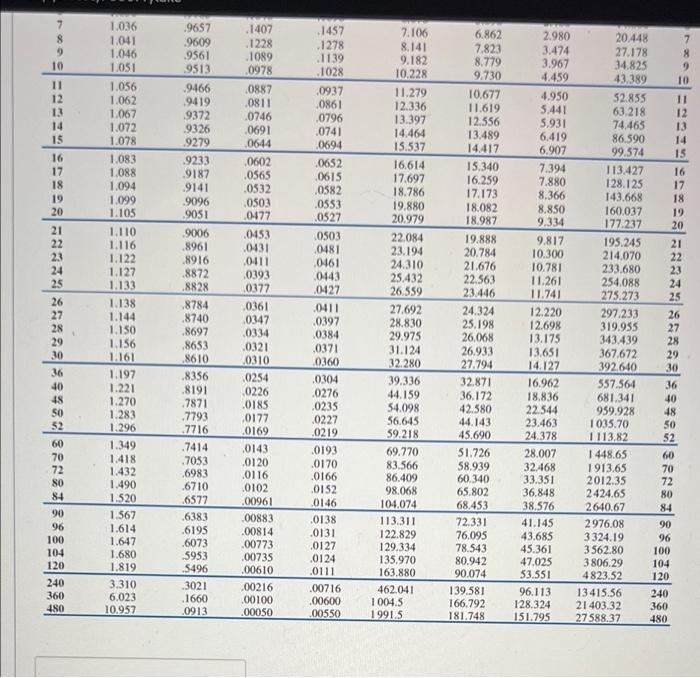

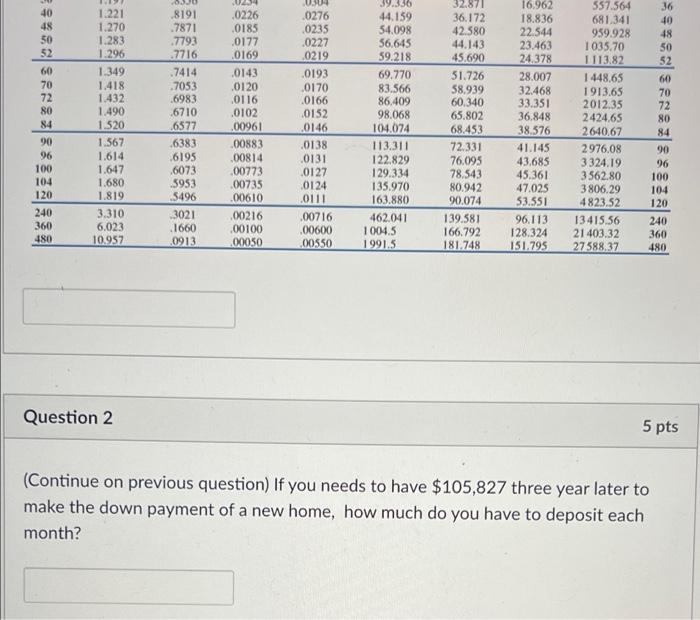

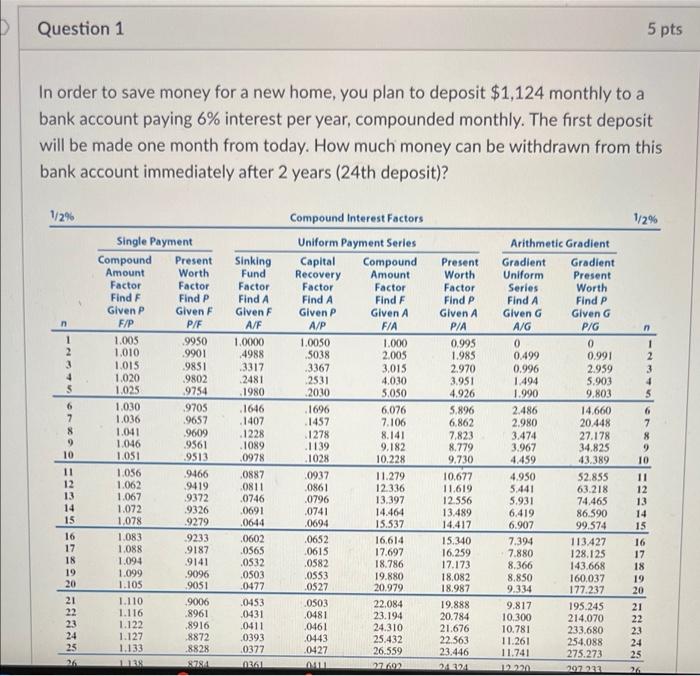

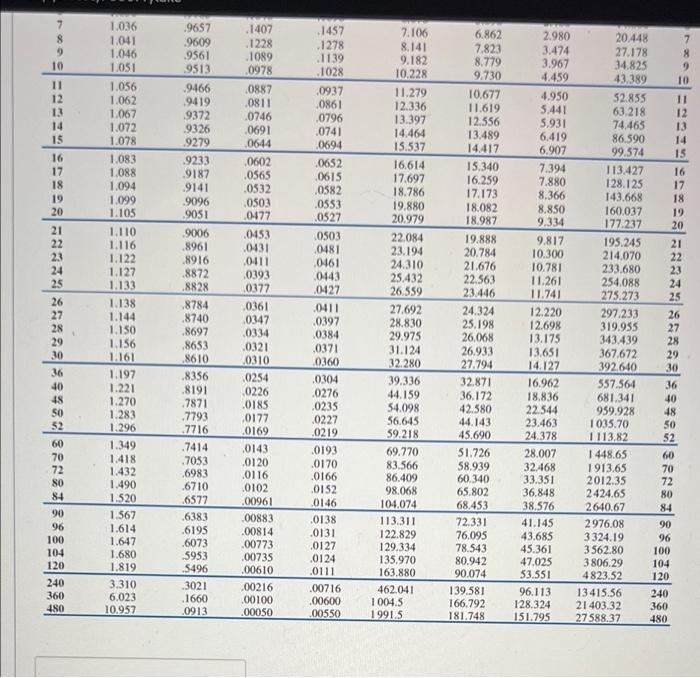

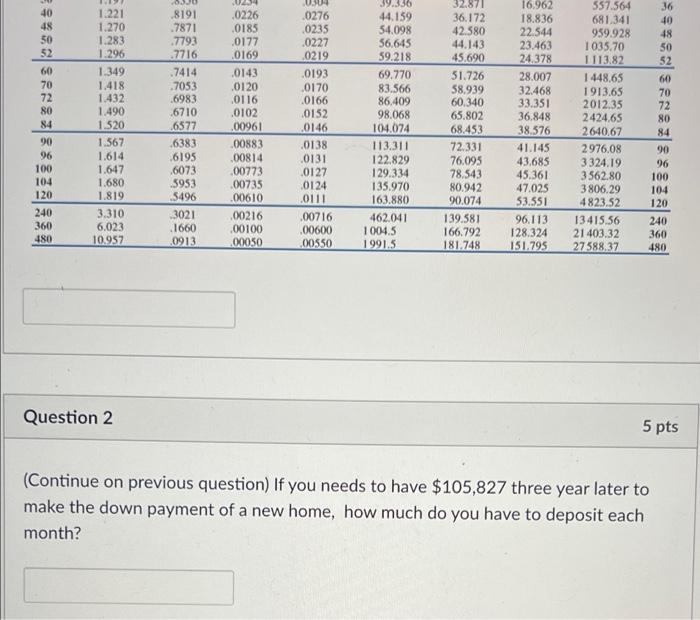

Question 1 5 pts In order to save money for a new home, you plan to deposit $1,124 monthly to a bank account paying 6% interest per year, compounded monthly. The first deposit will be made one month from today. How much money can be withdrawn from this bank account immediately after 2 years (24th deposit)? 12% 1/2% Arithmetic Gradient n 1 2 3 4 $ 1 2 3 5 6 7 6 Single Payment Compound Present Amount Worth Factor Factor Find F Find P Given P Given F F/P P/F 1.005 9950 1.010 9901 1.013 9851 1.020 9802 1.025 9754 1.030 9705 1.036 9657 1.041 .9609 1.046 9561 1.051 9513 1.056 9466 1.062 9419 1.067 9372 1.072 9326 1,078 9279 1.083 9233 1.088 9187 1.094 9141 1.099 .9096 1.105 .9051 1.110 9006 1.116 .8961 1.122 ,8916 1.127 8872 1.133 .8828 1138 8781 10 Compound Interest Factors Uniform Payment Series Capital Compound Recovery Amount Factor Factor Find A Find F Given P Given A A/P F/A 1.0050 1.000 5038 2.005 3367 3,015 2531 4.030 2030 5.050 1696 6,076 1457 7.106 1278 8.141 1139 9.182 1028 10.228 0937 11.279 .0861 12.336 .0796 13.397 .0741 14.464 .0694 15.537 .0652 16.614 .0615 17.697 .0582 18.786 .0553 19.880 0527 20.979 .0503 22.084 .0481 23.194 .0461 24.310 .0443 25.432 0427 26.559 LI 27.602 Sinking Fund Factor Find A Given F A/F 1.0000 4988 3317 2481 .1980 1646 .1407 .1228 1089 0978 .0887 0811 .0746 .0691 .0644 .0602 .0565 ,0532 0503 .0472 .0453 0431 0411 0393 .0377 0361 Present Worth Factor Find P Given A P/A 0.995 1.985 2.970 3.951 4.926 5.896 6,862 7,823 8.779 9.730 10.677 11.619 12.556 13.489 14.417 15.340 16.259 17.173 18.082 18.987 19.888 20.784 21.676 22.563 23.446 2324 Gradient Uniform Series Find A Given G A/G 0 0.499 0.996 1.494 1.990 2.486 2.980 3.474 3.967 4.459 4.950 5.441 5.931 6.419 6.907 7.394 7.880 8.366 8.850 9.334 9.817 10.300 10.781 11.261 11.741 12220 Gradient Present Worth Find P Given G PIG 0 0.991 2.959 5.903 9.803 14.660 20.448 27.178 34.825 43.389 52.855 63.218 74.465 86.590 99.574 113.427 128.125 143.668 160,037 177.237 195.245 214.070 233.680 254.088 275.273 207.222 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 24 7 8 9 10 1407 1228 . 1089 0978 2.980 3.474 3.967 4.459 4.950 5.441 5.931 6.419 6.907 7.394 7.880 8.366 8.850 9.334 11 12 13 14 13 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 36 40 48 50 52 60 70 72 80 84 90 96 100 104 120 240 360 480 1.036 1.041 1.046 1.051 1.056 1.062 1.067 1.072 1.078 1.083 1.088 1.094 1.099 1.105 1.110 1.116 1.122 1.127 1.133 1.138 1.144 1.150 1156 1.161 1.197 1.221 1.270 1.283 1.296 1.349 1.418 1.432 1.490 1.520 1.567 1.614 1.647 1.680 1.819 3.310 6.023 10.957 .9657 9609 9561 9513 9466 .9419 .9372 9326 9279 .9233 9187 9141 9096 9005 .9006 .8961 .8916 .8872 .8828 .8784 .8740 .8697 .8653 .8610 .8356 .8191 7871 .7793 .7716 .7414 .7053 .6983 .6710 .6577 .6383 .6195 .6073 5953 .5496 3021 .1660 .0913 .0887 .0811 .0746 0691 0644 0602 .0565 0532 0503 .0477 .0453 0431 20111 .0393 0377 .0361 .0347 0334 .0321 0310 0254 0226 0185 0177 .0169 0143 .0120 20116 .0102 .00961 .00883 .00814 .00773 .00735 .00610 .00216 .00100 .00050 1457 1278 .1139 1028 .0937 .0861 .0796 .0741 0694 0652 0615 0582 .0553 0527 (0501 0481 .0161 0443 .0427 0411 .0397 .0384 0371 0360 .0304 .0276 .0235 0227 ,0219 .0193 0170 0166 0152 0146 .0138 .0131 .0127 .0124 .0111 .00716 .00600 00550 7.106 8.141 9.182 10.228 11.279 12.336 13.397 14.464 15.537 16,614 17.697 18.786 19.880 20.979 22.084 23.194 24.310 25.432 26.559 27.692 28.830 29.975 31.124 32.280 39.336 44.159 54.098 56.645 59.218 69.770 83.566 86.409 98,068 104.074 113.311 122.829 129.334 135.970 163.880 462.041 1004.5 1991.5 6.862 7.823 8.779 9.730 10.677 11.619 12.556 13.489 14.417 15,340 16.259 17.173 18.082 18.987 19.888 20.784 21.676 22.563 23.446 24.324 25.198 26,068 26.933 27.794 32.871 36.172 42.580 44.143 45.690 51.726 58.939 60.340 65.802 68.453 72.331 76,095 78.543 80.942 90.074 139.581 166.792 181.748 9.817 10.300 10.781 11.261 11.741 12.220 12.698 13.175 13.651 14.127 16.962 18.836 22.544 23.463 24.378 28.007 32.468 33.351 36.848 38.576 41.145 43.685 45.361 47.025 53.551 96.113 128.324 151.795 20.448 27.178 34.825 9 43,389 10 52.855 11 63.218 12 74.465 13 86.590 14 99.574 15 113.427 16 128.125 17 143.668 18 160.037 19 177.237 20 195.245 21 214.070 22 233.680 23 254.088 24 275.273 25 297.233 26 319.955 27 343.439 28 367.672 29 392.640 30 557.564 36 681.341 40 959.928 48 1 035.70 50 1 113,82 52 1 448.65 60 1913.65 70 2012.35 72 2424.65 80 2640.67 84 2976.08 90 3324.19 96 3562.80 100 3806.29 104 4823.52 120 13415.56 240 21 403.32 360 27588.37 480 UZ 36 40 48 50 52 60 70 72 80 40 48 50 52 60 70 72 80 84 90 96 100 104 120 240 360 480 1.221 1.270 1.283 1.296 1.349 1.418 1.432 1.490 1.520 1.567 1.614 1.647 1.680 1.819 3.310 6.023 10.957 .8191 7871 .7793 .7716 .7414 ..7053 .6983 6710 .6577 6383 6195 .6073 .5953 5496 3021 1660 0913 0226 .0185 0177 0169 .0143 0120 .0116 .0102 .00961 .00883 .00814 .00773 .00735 .00610 .00216 .00100 .00050 . .0276 0235 0227 0219 0193 0170 20166 .0152 .0146 .0138 20131 0127 0124 .0111 .00716 .00600 00550 39.336 44.159 54.098 56,645 59.218 69.770 83.566 86.409 98.068 104.074 113.311 122.829 129.334 135.970 163.880 462.041 1004.5 1991.5 32.871 36.172 42.580 44.143 45.690 51.726 58.939 60.340 65.802 68.453 72.331 76.095 78,543 80.942 90,074 139.581 166.792 181.748 16.962 18.836 22.544 23.463 24.378 28.007 32.468 33.351 36.848 38.576 41.145 43.685 45.361 47.025 53.551 96.113 128.324 151.795 557.564 681.341 959.928 1 035.70 1113.82 1 448,65 1913.65 2012.35 2424,65 2640.67 2976.08 3324.19 3562.80 3806.29 4823.52 13415.56 21 403.32 27588,37 84 90 96 100 104 120 240 360 480 Question 2 5 pts (Continue on previous question) If you needs to have $105,827 three year later to make the down payment of a new home, how much do you have to deposit each month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started