Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer this and fill in the blanks CORRECTLY. On January 1, 2024, the Allegheny Corporation purchased equipment for $156,000. The estimated service life of

Please answer this and fill in the blanks CORRECTLY.

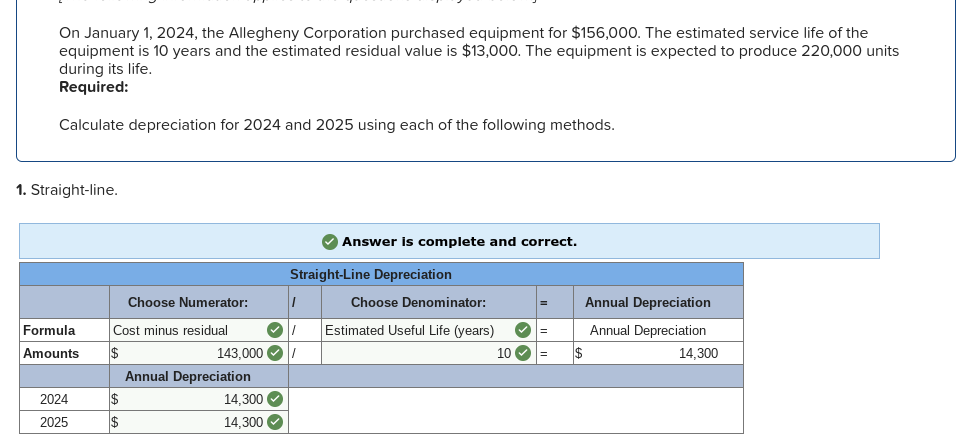

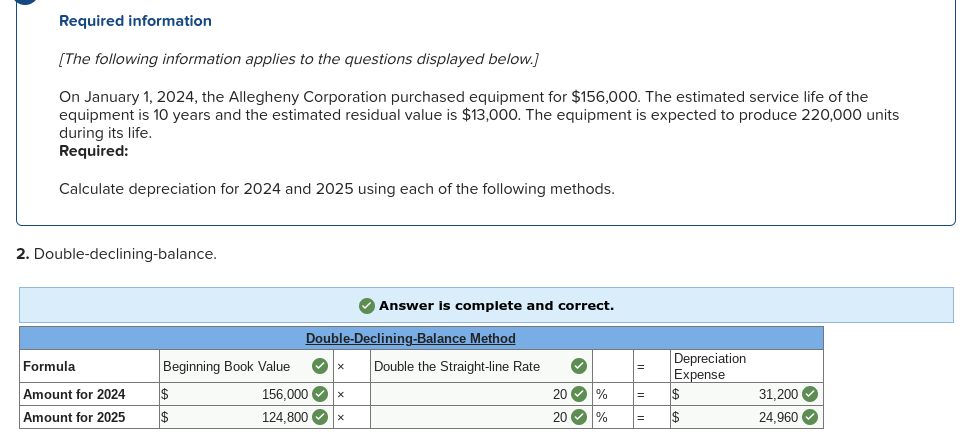

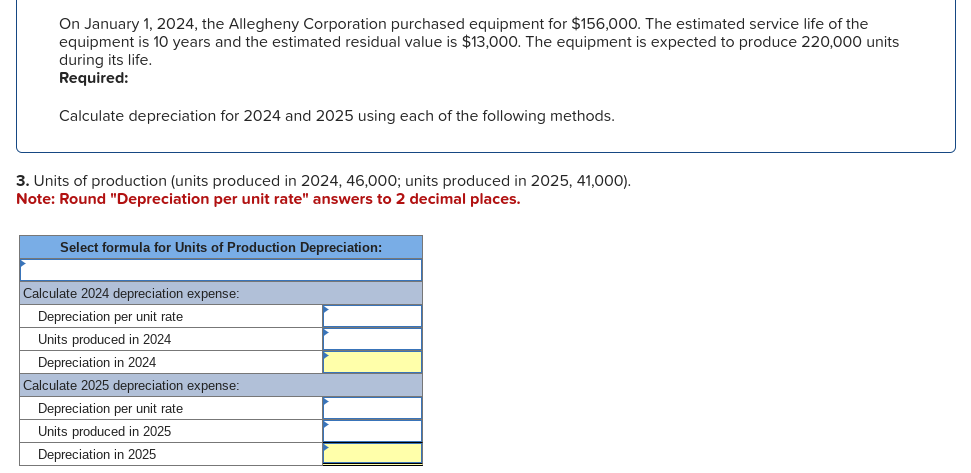

On January 1, 2024, the Allegheny Corporation purchased equipment for $156,000. The estimated service life of the equipment is 10 years and the estimated residual value is $13,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 1. Straight-line. Required information [The following information applies to the questions displayed below.] On January 1, 2024, the Allegheny Corporation purchased equipment for $156,000. The estimated service life of the equipment is 10 years and the estimated residual value is $13,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 2. Double-declining-balance. On January 1, 2024, the Allegheny Corporation purchased equipment for $156,000. The estimated service life of the equipment is 10 years and the estimated residual value is $13,000. The equipment is expected to produce 220,000 units during its life. Required: Calculate depreciation for 2024 and 2025 using each of the following methods. 3. Units of production (units produced in 2024,46,000; units produced in 2025,41,000 ). Note: Round "Depreciation per unit rate" answers to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started