Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer this is all 1 question Accounting for Financial Management: Financial Statements The focus on financial statements in finance is how managers and investors

please answer this is all 1 question

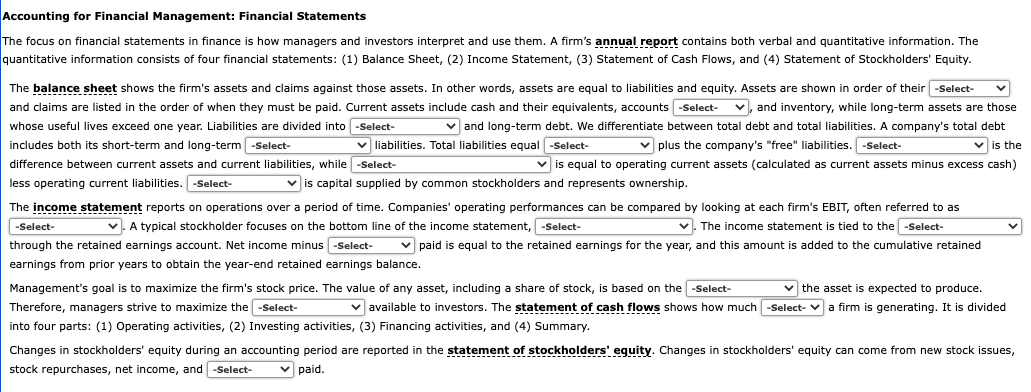

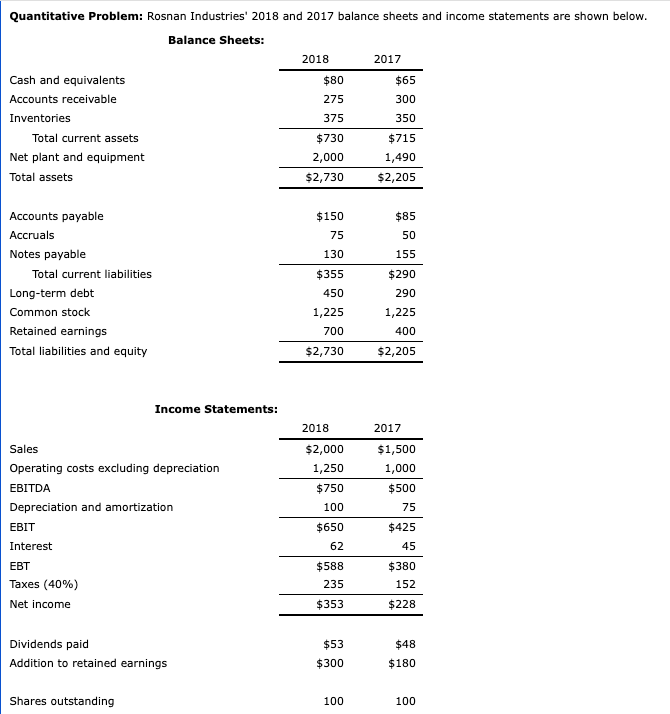

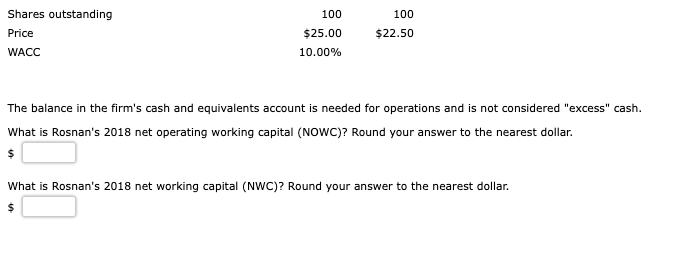

Accounting for Financial Management: Financial Statements The focus on financial statements in finance is how managers and investors interpret and use them. A firm's annual report contains both verbal and quantitative information. The quantitative information consists of four financial statements: (1) Balance Sheet, (2) Income Statement, (3) Statement of Cash Flows, and (4) Statement of Stockholders' Equity. The balance sheet shows the firm's assets and claims against those assets. In other words, assets are equal to liabilities and equity. Assets are shown in order of their and claims are listed in the order of when they must be paid. Current assets include cash and their equivalents, accounts whose useful lives exceed one year. Liabilities are divided into and long-term debt. We differentiate between total debt and total liabilities. A company's total debt includes both its short-term and long-term liabilities. Total liabilities equal plus the company's "free" liabilities. is the difference between current assets and current liabilities, while is equal to operating current assets (calculated as current assets minus excess cash) less operating current liabilities. is capital supplied by common stockholders and represents ownership. The income statement reports on operations over a period of time. Companies' operating performances can be compared by looking at each firm's EBIT, often referred to as A typical stockholder focuses on the bottom line of the income statement, . The income statement is tied to the through the retained earnings account. Net income minus paid is equal to the retained earnings for the year, and this amount is added to the cumulative retained earnings from prior years to obtain the year-end retained earnings balance. Management's goal is to maximize the firm's stock price. The value of any asset, including a share of stock, is based on the the asset is expected to produce. Therefore, managers strive to maximize the available to investors. The statement of cash flows shows how much a firm is generating. It is divided into four parts: (1) Operating activities, (2) Investing activities, (3) Financing activities, and (4) Summary. Changes in stockholders' equity during an accounting period are reported in the statement of stockholders' eguity. Changes in stockholders' equity can come from new stock issues, stock repurchases, net income, and paid. Quantitative Problem: Rosnan Industries' 2018 and 2017 balance sheets and income statements are shown below. The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess" cash. What is Rosnan's 2018 net operating working capital (NOWC)? Round your answer to the nearest dollar. $ What is Rosnan's 2018 net working capital (NWC)? Round your answer to the nearest dollar. $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started