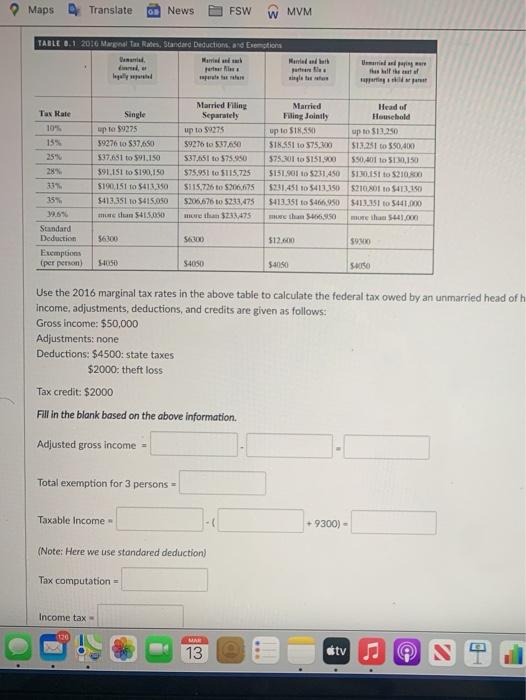

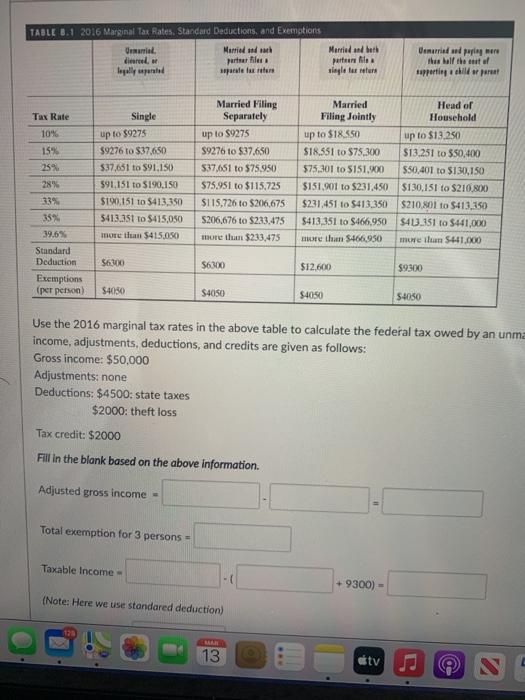

please answer this is extremely hard my life depends on it & graduating... thank u for ur service... greatly appreciated...

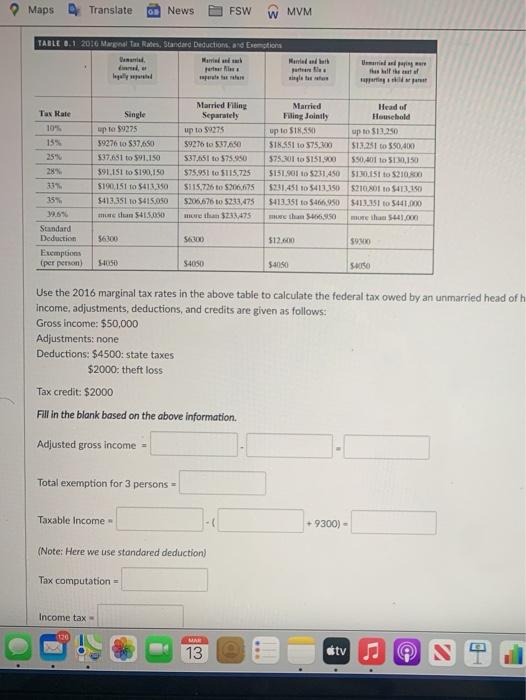

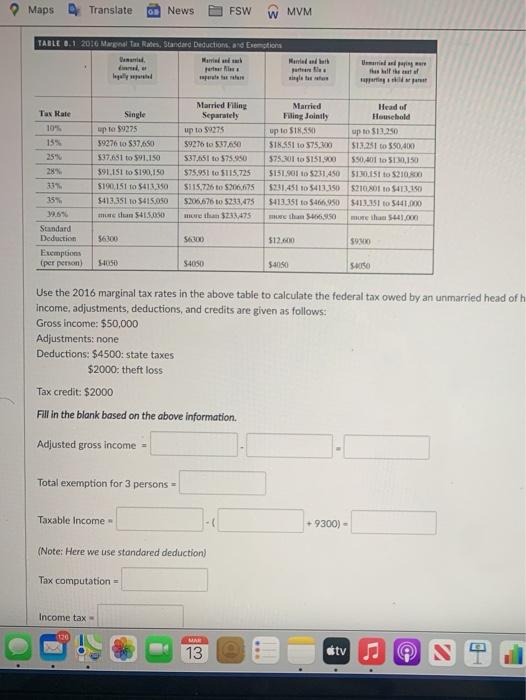

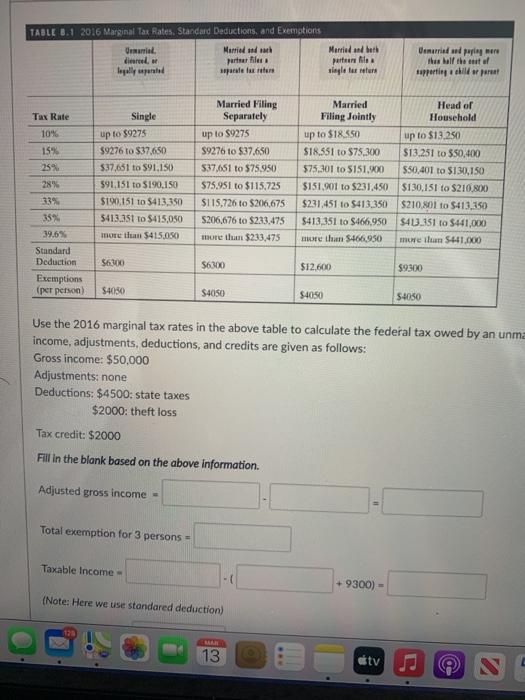

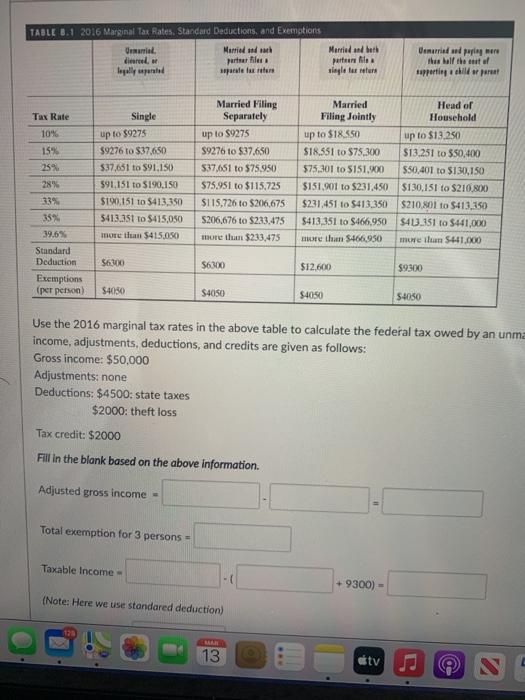

the information needed comes fromcthe chart.

Maps Translate News FSW w MVM TABLE 8.1 2016 Marta Rates, Standard Deduction and Emotions Married Guru Per pune Und Thus the rapporti Tax Rate 10% 155 Single up to $9275 59276 to 537,650 $37,651 to $91.150 391.151 to $190.150 $190, 151 10 5413,350 5413351 To 5415.000 chan S415.00 Married Filling Separately up to 59275 59276 to $17.650 537,851 to 575.950 $75.951 to $115.725 $115,726 to $206,75 $206,676 to 5233,475 more than $233,475 Married Head of Filing Jointly Household up to SIR.550 up to $12250 SIKSSL to 575.00 $13.251 to 350.400 375301 to 5151,200 $50,401 to 3130,150 $15.90 15231.450 51.30.15 to S21XO $231.451 10 5413150 52100 to $413.150 5413.351 to 5466.950 $413.251 to $141.000 e than 30 WOTE ha un 28% 33% 39.99 Standard Deduction Exemptions (per person) 56300 56.300 $12.00 59900 54050 54050 $4050 SO Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unmarried head of h income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information Adjusted gross income Total exemption for 3 persons - Taxable income -( - +9300) - (Note: Here we use standared deduction) Tax computation Income tax 120 MAH 13 etv 7 TABLE 3.1 2016 Marginal Tax Rates. Standard Deductions, and Exemptions Umumi Married and tak diere partner files legally part le for Married and hard partene single lateur Umurid und thes all the tal tappeting dild or parent Tax Rate 10% 15% 259 Single up to $9275 $9276 to $37,650 $37,651 to $91,150 591,151 to $190.150 $190.151 to $413.350 5413.351 to $415,050 more than $415.050 Married Filing Separately up to $9275 S9276 to $37.650 537/651 to $75.950 $75.951 to $115.725 $115,726 to $206.675 $206,676 to $233,475 more than $233,475 Married Head of Filing Jointly Household up to $18350 up to $13.250 $18.551 to $75,300 $13.251 to $50.400 $75,301 to 5151.900 $50,401 to $130,150 $151.901 to $231.450 $130,151 to $210.800 $231,451 to $413.350 $210.801 to $413.350 5413,351 to $466,950 $403.351 to $441,000 more than $466,950 more lun S441.000 28% 33% 35% 39.6% Standard Deduction Exemptions (per person $6300 S6300 $12.600 $9300 $4050 $4050 $4050 S-4050 Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unma income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information Adjusted gross income - Total exemption for 3 persons - Taxable income - +9300) (Note: Here we use standared deduction) 13 tv To Maps Translate News FSW w MVM TABLE 8.1 2016 Marta Rates, Standard Deduction and Emotions Married Guru Per pune Und Thus the rapporti Tax Rate 10% 155 Single up to $9275 59276 to 537,650 $37,651 to $91.150 391.151 to $190.150 $190, 151 10 5413,350 5413351 To 5415.000 chan S415.00 Married Filling Separately up to 59275 59276 to $17.650 537,851 to 575.950 $75.951 to $115.725 $115,726 to $206,75 $206,676 to 5233,475 more than $233,475 Married Head of Filing Jointly Household up to SIR.550 up to $12250 SIKSSL to 575.00 $13.251 to 350.400 375301 to 5151,200 $50,401 to 3130,150 $15.90 15231.450 51.30.15 to S21XO $231.451 10 5413150 52100 to $413.150 5413.351 to 5466.950 $413.251 to $141.000 e than 30 WOTE ha un 28% 33% 39.99 Standard Deduction Exemptions (per person) 56300 56.300 $12.00 59900 54050 54050 $4050 SO Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unmarried head of h income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information Adjusted gross income Total exemption for 3 persons - Taxable income -( - +9300) - (Note: Here we use standared deduction) Tax computation Income tax 120 MAH 13 etv 7 TABLE 3.1 2016 Marginal Tax Rates. Standard Deductions, and Exemptions Umumi Married and tak diere partner files legally part le for Married and hard partene single lateur Umurid und thes all the tal tappeting dild or parent Tax Rate 10% 15% 259 Single up to $9275 $9276 to $37,650 $37,651 to $91,150 591,151 to $190.150 $190.151 to $413.350 5413.351 to $415,050 more than $415.050 Married Filing Separately up to $9275 S9276 to $37.650 537/651 to $75.950 $75.951 to $115.725 $115,726 to $206.675 $206,676 to $233,475 more than $233,475 Married Head of Filing Jointly Household up to $18350 up to $13.250 $18.551 to $75,300 $13.251 to $50.400 $75,301 to 5151.900 $50,401 to $130,150 $151.901 to $231.450 $130,151 to $210.800 $231,451 to $413.350 $210.801 to $413.350 5413,351 to $466,950 $403.351 to $441,000 more than $466,950 more lun S441.000 28% 33% 35% 39.6% Standard Deduction Exemptions (per person $6300 S6300 $12.600 $9300 $4050 $4050 $4050 S-4050 Use the 2016 marginal tax rates in the above table to calculate the federal tax owed by an unma income, adjustments, deductions, and credits are given as follows: Gross income: $50,000 Adjustments: none Deductions: $4500: state taxes $2000: theft loss Tax credit: $2000 Fill in the blank based on the above information Adjusted gross income - Total exemption for 3 persons - Taxable income - +9300) (Note: Here we use standared deduction) 13 tv To