Answered step by step

Verified Expert Solution

Question

1 Approved Answer

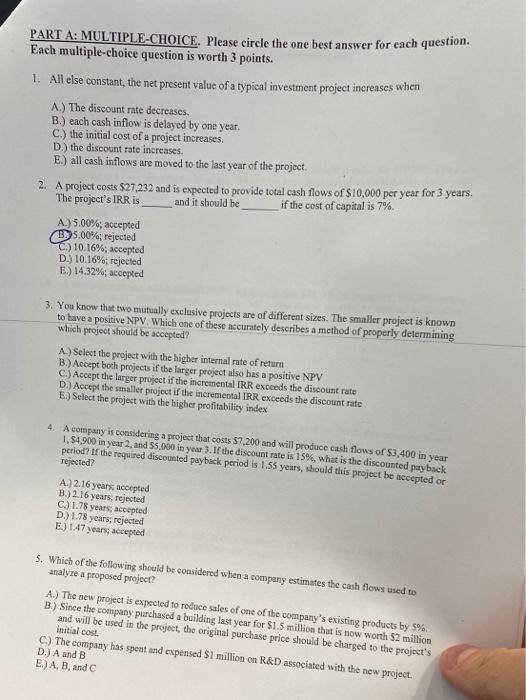

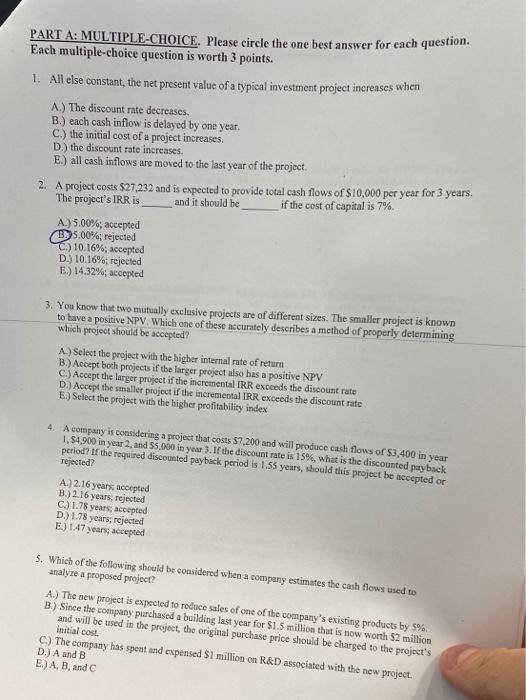

please answer this multiple question PART A: MULTIPLE-CHOICE. Please circle the one best answer for each question. Each multiple-choice question is worth 3 points. 1.

please answer this multiple question

PART A: MULTIPLE-CHOICE. Please circle the one best answer for each question. Each multiple-choice question is worth 3 points. 1. All else constant, the net present value of a typical investment project increases when A.) The discount rate decreases B.) each cash inflow is delayed by one year. C.) the initial cost of a project increases. D.) the discount rate increases. E.) all cash inflows are moved to the last year of the project 2. A project costs $27,232 and is expected to provide total cash flows of $10,000 per year for 3 years. The project's IRR is if the cost of capital is 7% A.)5.00%, accepted B 5.00%, rejected C.) 10.16%, accepted D.) 10.16% rejected E.) 14.32%; accepted and it should be 3. You know that two mutually exclusive projects are of different sizes. The smaller project is known to have a positive NPV. Which one of these accurately describes a method of properly determining which project should be accepted? A.) Select the project with the higher internal rate of return B.) Accept both projects if the larger project also has a positive NPV C.) Accept the larger project if the incremental IRR exceeds the discount rate D.) Accept the smaller project if the incremental IRR exceeds the discount rate E.) Select the project with the higher profitability index 4. A company is considering a project that costs 57,200 and will produce cash flows of $3,400 in year 1.54.900 in year 2, and 55,000 in year 3. If the discount rate is 15%, what is the discounted payback period? If the required discounted payback period is 1.55 years, should this project be accepted or Tejected? A.) 2.16 years, accepted B.) 2.16 years, rejected C.) 1.78 years, accepted D.) 1.78 years, rejected E) 1.47 years, accepted 5. Which of the following should be considered when a company estimates the cash flows used to analyze a proposed project A.) The new project is expected to reduce sales of one of the company's existing products by 5% B.) Since the company purchased a building last year for $1.5 million that is now worth $2 million and will be used in the project, the original purchase price should be charged to the project's initial cost. C.) The company has spent and expensed $1 million on R&D associated with the new project. D.) A and B E.) A, B, and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started